Are you a business owner looking to increase revenue and improve customer experience by integrating payment solutions for your mobile app?

This guide explores the most popular payment solutions for mobile apps, as well as important considerations when choosing payment solutions for your app, such as security, compatibility, cost, and payment partner reputation. We’ll also provide a step-by-step guide to integrating payment solutions for your mobile app, from setting up a merchant account to launching the integration.

Don’t miss out on the benefits of in-app payments. Read on to learn how to streamline your mobile payment process and stay ahead of the competition.

Exploring Different Types: Integrating Payment Solutions for Mobile Apps

When it comes to integrating payment solutions for mobile apps, businesses must consider several options to ensure seamless transactions. Here are some of the most popular types of payment solutions for mobile apps:

Bank Transfers

Some businesses prefer direct bank transfers. Bank transfers are often safer than other payments, as they require authentication and do not involve storing card details. It typically comes with lower fees, making it a cost-effective payment option. It can also be processed easily and quickly.

Mobile Wallets

Mobile wallets, such as Apple Pay and Google Pay, have become increasingly popular in recent years. This payment solution allows users to store their credit card and other payment information in a secure digital wallet within the app, allowing for quick and easy purchases.

Credit and Debit Card Processing

Credit and debit card processing are the popular payment solutions for mobile apps. This option allows customers to make purchases using their card information, which is securely stored within the app. This type of payment solution is easy to set up and offers a seamless checkout experience for users.

But Now, Pay Later (BNPL)

BNPL allow customers to split payments into interest-free installments. This payment option has gained traction in e-commerce and mobile apps offering high-ticket products. By offering BNPL, businesses can attract more customers who may not have the immediate funds but are willing to pay over time.

Carrier Billing

Carrier billing is the payment method that allows customers to charge purchases directly to their mobile phone bill. Instead of entering card details or banking information, users complete their purchases with a simple confirmation via SMS or carrier approval. It is widely used for digital content, mobile apps, subscriptions, and gaming.

Considerations for Choosing Payment Solutions for Your Mobile App

When selecting payment solutions for your mobile app, there are several factors to consider to ensure that the integration is seamless and practical:

1. Security and Fraud Prevention Measures

One of the most crucial factors to consider is security and fraud prevention measures. You want to make sure that your users’ financial information is protected and that any transactions made through your app are secure.

2. Compatibility with Mobile Platforms

You need to ensure that the payment solutions you choose are compatible with the operating system and technology of your mobile app. This will ensure that the payment process is smooth and hassle-free for your users.

3. Cost and Fees

Cost and fees are also essential factors to consider. Different payment solutions may come with different fees, which can impact your bottom line. You need to balance the costs of implementing the payment solutions with the benefits they bring to your business.

4. Choosing the Right Payment Partner

It is also essential to select the right payment partner for your business. The payment provider you choose should have a good reputation, robust customer support, and experience in working with businesses similar to yours. A reliable and trustworthy payment partner can help you navigate any issues that may arise and ensure that your payment solutions are always up-to-date and effective.

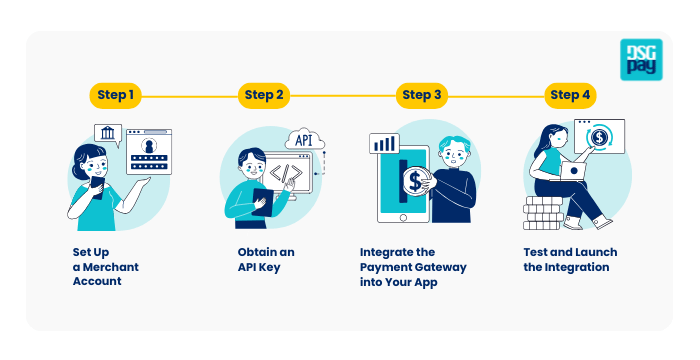

4 Steps to a Successful Payment Solution Integration Process

Integrating payment solutions for mobile apps can seem like a daunting task, but it can be a straightforward process if you follow the proper steps.

Here’s a step-by-step guide to integrating payment solutions for your mobile app:

Step 1: Set Up a Merchant Account

First, you’ll need to set up a merchant account with a payment service provider. This will allow you to accept payments and receive funds directly. Make sure to choose a provider that meets your business needs, including the type of payment methods you want to accept, transaction fees, and customer support.

Step 2: Obtain an API Key

After setting up a merchant account, you’ll need to obtain an API key, which is a code that allows your app to communicate with the payment gateway. The API key will be unique to your merchant account and will be used to authenticate your transactions.

Step 3: Integrate the Payment Gateway into Your App

Next, you’ll need to integrate the payment gateway into your mobile app. This involves writing code to connect your app to the payment gateway using the API key. You can either hire a developer to do this for you or use plugins provided by the payment service provider.

Step 4: Test and Launch the Integration

Once you’ve integrated the payment gateway into your app, it’s time to test and launch the integration. Make sure to test the payment process thoroughly, including successful and failed transactions. You should also ensure that your app meets all the security and compliance standards set by the payment service provider.

Conclusion

Integrating payment solutions for mobile apps can provide numerous benefits, including increased revenue, improved customer experience, and enhanced security. However, it is important to carefully consider the different payment solution options available and select a reliable and secure payment partner. By following best practices for integration and testing, businesses can ensure a smooth and successful implementation of in-app payments. With the increasing trend towards mobile payments, integrating payment solutions for mobile apps is a smart investment for businesses looking to stay competitive in today’s market.

DSGPay: Your Reliable Partner for Payment Solutions for Mobile Apps

With our expertise and experience in the payment industry, we can guide you through the process and ensure a seamless integration that meets your business needs.

Whether you’re an SME, a large enterprise, or an app developer, DSGPay ensures a smooth and efficient payment experience with:

- Multi-Currency Support: Process payments in over 30 currencies, allowing your business to cater to a global customer base.

- Seamless API Integration: Our APIs ensure quick and hassle-free integration with your mobile app.

- Enhanced Security: Cutting-edge encryption and fraud detection measures ensure every transaction remains protected.

- Dedicated Assistance: Our expert support team provides guidance throughout the integration journey, ensuring a seamless experience.

If you’re interested in integrating a secure and hassle-free payment solution into your mobile app, get in touch with us at DSGPay today. We’ll provide you with all the information you need.