Getting banking in Thailand as a foreigner, whether you are a tourist, an expat, or a resident, can be both convenient and beneficial. However, choosing the best bank in Thailand that aligns with your needs can be challenging.

In this article, we’ve compiled a list of the best banks in Thailand available for foreigners to help you understand each bank’s offerings and find the one that best suits your specific needs. Whether you’re looking for comprehensive services, excellent customer support, or competitive rates, this guide will help you navigate your options and make an informed decision.

Overview of Topics

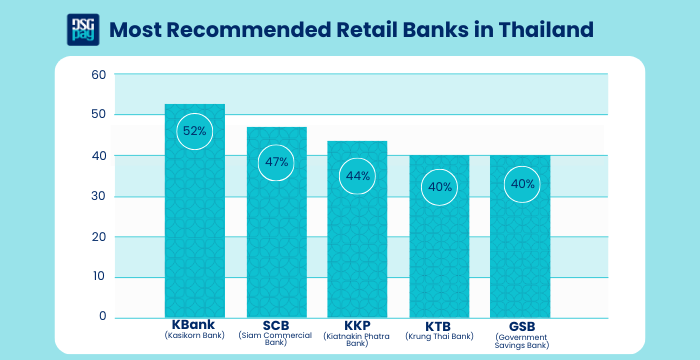

Best Bank in Thailand by Customer Recommendation

In the 2023 BankQuality Survey, Kasikornbank (KBank) was voted the Most Recommended and Most Selected Main Retail Bank in Thailand, solidifying its position as one of the best banks in Thailand. With a BankQuality Score (BQS) of 52%, KBank’s recognition is driven by strong consumer confidence and its commitment to sustainability solutions.

KBank, which serves 21.3 million customers and has seen a 9.3% year-on-year growth, also excelled in omnichannel customer service, leading the rankings for mobile, internet, branch, and phone banking. Its consistent performance across various channels further cements its status as the best bank in Thailand for many consumers.

Siam Commercial Bank (SCB), another top contender for the best bank in Thailand, ranked second overall. SCB dominated in product categories such as international remittance, time deposits, and personal loans, earning praise for its speed, security, and effectiveness in managing customer finances.

Source: TABInsights

Overview of the Thai Banking System

The Thai banking system has several types of financial institutions: commercial banks, government banks, and foreign banks. Commercial banks dominate the market, providing a wide range of services to both locals and foreigners.

Commercial banks in Thailand are well-regulated and offer a variety of financial products, from savings accounts to investment services, making them a reliable choice for expats. Government banks, while typically serving local needs, also offer certain services that can benefit foreigners, particularly in terms of stability and reliability.

Disclaimer (2024): This information is based on research from reliable sources, including industry reports and official websites of the banks in Thailand. For the most current details, please consult directly with the banks. This content is not financial advice.

Source: Thansettakij Note: As of March 31, 2024, assets and liabilities from the top 5 Thai banks were reported to SET.

10 Popular Banks in Thailand

1. Bangkok Bank (BBL)

Bangkok Bank is one of the largest and most well-established banks in Thailand. It offers a variety of services specifically designed for foreigners, making it easy to manage your finances. The bank’s extensive branch network and user-friendly services make it a popular choice. Whether you need to transfer money internationally or manage your savings, Bangkok Bank has you covered. The bank also provides multi-currency accounts, which can be particularly useful for expats who need to deal with multiple currencies regularly.

2. Kasikorn Bank (KBANK)

Kasikorn Bank, also known as KBank, is known for its excellent customer service and innovative banking solutions. It offers a range of products tailored to the needs of expats, including easy-to-open accounts and many online banking services. With a vast network of branches and ATMs, Kasikorn Bank ensures that banking is convenient for all its customers. The bank also offers a mobile banking app that allows you to perform various transactions on the go, making it a perfect choice for tech-savvy expats.

3. Siam Commercial Bank (SCB)

Siam Commercial Bank (SCB) is another top contender, offering a variety of services to expats. SCB is known for its comprehensive international services. The bank provides multiple account types suitable for different financial needs, ensuring flexibility and convenience. Additionally, SCB offers excellent investment services and financial advice, which can be very beneficial for expats looking to invest in Thailand.

4. Krung Thai Bank (KTB)

Krung Thai Bank has tailored services aimed at foreigners. The bank offers various account options and features designed to meet the unique needs of expats. With an emphasis on customer satisfaction, Krung Thai Bank ensures that its services are both accessible and user-friendly. The bank also has a strong presence in rural areas, making it a great option for expats living outside of major cities.

5. Bank of Ayudhya (Krung Sri Bank)

Bank of Ayudhya, also known as Krung Sri Bank, is well-regarded for its expat-friendly policies and excellent customer service. The bank provides various banking solutions, from savings accounts to international transfers, ensuring your financial needs are met. Krung Sri Bank’s commitment to making banking easy for expats is evident in its wide array of services. The bank also offers various insurance products, providing added security for expats.

6. Government Savings Bank (GSB)

The Government Savings Bank offers various services catering to both locals and foreigners. While it may not have the same level of international services as some commercial banks, it provides reliable and accessible banking options. For those looking for a straightforward and secure banking experience, the Government Savings Bank is a solid choice. This bank is particularly known for its savings products and government-backed securities, making it a stable option for those looking to save securely.

7. TMBThanachart Bank (TTB)

TMBThanachart Bank, commonly referred to as TTB, was formed from the merger of TMB Bank and Thanachart Bank, creating one of Thailand’s largest banking institutions. TTB offers a variety of banking products tailored to meet the needs of both locals and expatriates. With a focus on digital banking, TTB provides convenient online and mobile banking services, making it easy for expats to manage their finances from anywhere. The bank also offers competitive interest rates on savings and fixed deposit accounts, as well as a range of loan products, including personal, home, and auto loans. TTB’s commitment to innovation and customer service makes it an attractive option for foreigners seeking a modern banking experience in Thailand.

8. United Overseas Bank (UOB)

United Overseas Bank (UOB) is a Singapore-based bank with a strong presence in Thailand, offering a range of banking services designed for both individuals and businesses. UOB is known for its personalized banking solutions and excellent customer service, making it a popular choice among expats. The bank provides a variety of account options, including multi-currency accounts, which are particularly beneficial for those dealing with international transactions. UOB also offers investment and wealth management services, catering to the financial needs of expatriates looking to grow their assets. With a focus on providing secure and reliable banking services, UOB is a solid choice for expats in Thailand.

9. CIMB Thai Bank

CIMB Thai Bank is a member of the CIMB Group, one of the largest banking groups in Southeast Asia. The bank offers a wide range of financial products and services, including savings accounts, fixed deposits, and various loan options, all tailored to meet the needs of both locals and expatriates. CIMB Thai Bank is particularly known for its competitive rates on personal loans and its commitment to providing transparent and straightforward banking solutions. The bank also offers digital banking services, allowing expats to manage their finances easily through online and mobile platforms. With a strong emphasis on customer service and financial accessibility, CIMB Thai Bank is a great option for foreigners looking for a reliable banking partner in Thailand.

10. Kiatnakin Phatra Bank

Kiatnakin Phatra Bank is known for its specialized financial services that cater to both individuals and businesses in Thailand. The bank offers a range of products, including savings accounts, fixed deposits, and investment options, making it a strong choice for those looking for tailored financial solutions. Kiatnakin Phatra Bank is particularly recognized for its wealth management and investment banking services, which are designed to help clients grow and manage their assets effectively. With a focus on providing personalized service and expert financial advice, Kiatnakin Phatra Bank is an excellent option for expats and locals alike who seek a more customized banking experience.

Online and Mobile Banking Services

Online and mobile banking services are necessary today, especially for expats needing to manage their finances remotely. Many Thai banks offer digital banking platforms that make banking convenient and secure. Bangkok Bank, Kasikorn Bank, and Siam Commercial Bank are known for their excellent online and mobile banking services. These platforms allow you to perform various banking activities, from checking account balances to transferring money internationally. Security features such as two-factor authentication and biometric login ensure safe transactions. Additionally, these mobile apps provide real-time updates and notifications, helping you stay on top of your finances no matter where you are, in addition to a QR payment code payment system.

Currency Exchange and International Transfers

One of the services that expats often require is currency exchange and international money transfers. Thai banks provide competitive rates and reliable services for these needs. In particular, Bangkok Bank and Kasikorn Bank offer excellent currency exchange rates and low fees for international transfers. Using a local bank for your currency exchange and international transfers can save money and provide peace of mind. Additionally, many banks offer dedicated services for expats, ensuring that you receive the best support for your international financial transactions.

Additional Considerations for Expats

When choosing a bank in Thailand, there are several factors to consider.

- Branch and ATM Network: Ensure the bank has a wide network of branches and ATMs.

- Customer Service: Look for banks that offer good customer service.

- Services for Foreigners: Check if the bank has services specifically tailored to foreigners.

- Reputation: Consider the bank’s reputation in the market.

- Ease of Communication: Evaluate the availability of English-speaking staff and multilingual customer support.

Common Requirements to Open a Bank Account:

- Valid Passport: A must-have document for identification.

- Work Permit: Many banks require a valid work permit to open an account.

- Proof of Residence: Provide documentation that proves your residence in Thailand.

Efficient Cross-Border Money Transfers with DSGPay

Now that you’ve learned about the different banks in Thailand, we’d like to introduce DSGPay as a great alternative for handling cross-border money transfers.

For expats who need a reliable and cost-effective solution for cross-border transactions, DSGPay offers a compelling alternative to traditional banking. Tailored specifically for those who manage finances across multiple countries, DSGPay provides specialized accounts that make international money transfers easy and affordable.

With competitive exchange rates and low fees, DSGPay ensures that your money goes further, whether sending funds home, receiving money from abroad, paying for services abroad, or managing various currencies.

The platform’s user-friendly interface allows you to handle all your transactions conveniently online or via mobile, making it an excellent choice for expats seeking a straightforward and efficient way to manage their cross-border finances.