The adoption of open banking in Hong Kong, the world’s freest economy and special administrative region of China offers immense benefits and endless possibilities. Because of this, the Hong Kong Monetary Authority rallied a group of 28 banks to facilitate the adoption of open-banking models in 2023, according to Digital Finance Media.

Several banks in Hong Kong have built their APIs to embrace open banking technology. However, the challenge is that the HKMA did not set a standard for APIs, protocols for customer consent, and data quality. Also, the HKMA did not outline an eligibility criterion for fintech.

This article will cover the growth of open banking in Hong Kong and its benefits to the financial sector and economy.

Table of Contents

A Brief Overview of Open Banking in Hong Kong

Open banking involves the sharing of customer data between banks and third-party service providers such as FinTech firms with the help of APIs for real-time communication. Data transfer in open banking typically requires customer consent.

Contrary to other countries’ markets where open banking is being used, open banking ideally supports Fintechs by allowing them to access customer data held by banks to develop services. However, it is different in Hong Kong as the Interbank Account Data Sharing (IADS) indicates that Hong Kong intends to begin adopting open banking technology without the participation of FinTech companies.

Open API

One of the most crucial components of open banking is APIs. So, let’s discuss about it. Application programming interface (API) is an electronic programming model for fostering the sharing of information and performing instructions across diverse computer systems.

Open APIs indicate APIs that allow third-party service providers to gain access to a company’s systems. In the context of the financial sector, open APIs enable banks or financial institutions to make their data and internal IT systems accessible to third-party service providers or fellow banking institutions in a transparent and documented manner.

For instance, an example of the implementation of open API involves information concerning various bank’s services and products being made available on the same website or application to make it easier for users to compare and plan their finances. In addition, new third-party service providers may also use the same information to provide new products and enhanced customer experience.

By leveraging technology such as APIs (application programming interfaces), financial institutions can provide users with an easy route to access all of their financial information. With this being said, open banking in Hong Kong can transform how people deal with banks and other third-party service providers.

Growth of Open Banking in Hong Kong

The rise of open banking in Hong Kong can be traced to 2017 when the Hong Kong Monetary Authority formulated its open API framework. The launch of the open API framework was part of the seven initiatives broadcasted by the HKMA to usher Hong Kong into the era of open banking.

In 2018, HKMA published the Open API Framework with a four-phased plan for banks to prepare APIs for sharing account data, customer onboarding, product specs, and transacting payments.

Here’s an overview of the four phases of open API for the Hong Kong banking industry, as stipulated by the Hong Kong Monetary Authority:

The open API Framework adopts a risk-based principle and a four-phased plan, as mentioned earlier, to serve different open API functions and suggest dominant international security and safety standards for smooth and speedy implementation.

The framework also outlined well-detailed guidelines on how banks will onboard and partner with third-party service providers to ensure customer protection. The HKMA hopes that the Framework will serve as a crucial guideline for banks in Hong Kong to adopt APIs to foster innovation while cutting down on the risks associated with open banking technology.

A recent HSBC survey reveals that almost 60% of Hong Kong respondents are ready to embrace open banking and will give constant access to banks to access their financial data. This reflects the positive growth and adoption of open banking in Hong Kong.

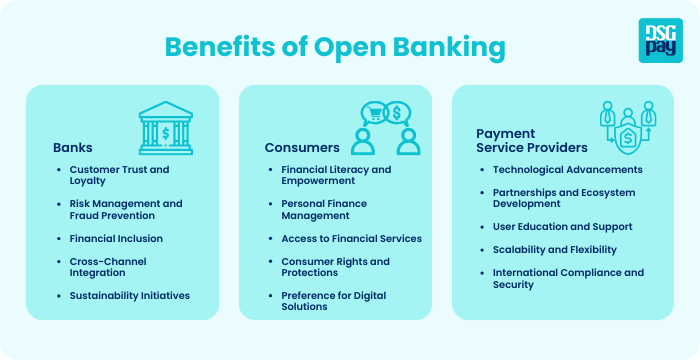

Benefits of Open Banking in Hong Kong

Open banking in Hong Kong offers several benefits to traders and online businesses. It changes how businesses process payments, manage financial information and connect with customers. It helps to reduce payment costs, reinforce payment approval, and limit the occurrence of charges. It also speeds up payment delivery time.

1. Convenience

With open banking, customers can easily pay for services and items from the comfort of their homes without the hassles of going to a financial institution’s physical location. In addition, they can easily access their financial information from one place.

2. Speed

By enabling real-time or near-instantaneous payments and transfers, open banking makes local and cross-border transactions faster and more efficient.

3. Security

Since online merchants can easily verify customers’ information through open banking secure APIs, open banking enhances security by reducing the risk of fraud and helps financial institutions safeguard sensitive customer financial information. In addition, the risk of chargebacks and errors is greatly minimized with open banking.

4. Financial Management

With the support of open banking, individuals and businesses are offered tools and insights that can help them track and manage their finances properly and more efficiently. Having the ability to access their finances in one place helps them to monitor their expenses, savings and loans. This can help them put plans in place for the future.

DSGPay: Leading Financial Service Provider in Hong Kong

Open banking in Hong Kong is a ground-breaking technology with the potential to transform the banking and e-commerce industry. While the benefits are numerous, there is still a long way to go. With the Hong Kong Monetary Authority putting all hands on deck to facilitate the development and adoption of open banking in Hong Kong, it’s only a matter of time before it is fully embraced by businesses and individuals.

DSGPay is a top-notch payment service provider in Asia and Hong Kong. Having adopted industry-leading and state-of-the-art API technology, DSGPay is streamlining payment collection and payouts across the world. With comprehensive coverage for a broad range of industries such as payment providers, fintech, E-commerce and online gaming, DSGPay complies with international standards and is fully licensed by the Hong Kong government.