With the growing familiarity and comfort surrounding QR codes, more companies are adopting the QR payment system as a preferred payment method. The shift towards contactless payments, accelerated by the COVID-19 pandemic, has significantly boosted the popularity of QR payments over traditional methods, a trend poised to continue in the coming years. Currently, QR codes account for 4% of global consumer transactions, a figure projected to rise with a compound annual growth rate (CAGR) of 16.1% by 2030.

In this guide, we’re exploring everything you need to know about implementing a QR payment system for your business, from its benefits to reviewing some of the best QR payment services available today.

Table of Contents

What is QR payment?

QR codes, or ‘Quick Response codes,’ allow smartphones to instantly trigger actions like payments, links, or menus with a quick scan. Easily scannable from any screen or paper, QR codes are resilient, secure, and versatile.

QR codes are instantly recognizable by their unique, square shape, which consists of a grid of black and white squares arranged within a larger square frame. This structure isn’t just for aesthetics; it’s a carefully designed format that allows QR codes to be highly efficient and reliable. The three large squares located in the top left, top right, and bottom left corners serve as alignment markers, helping devices quickly identify and orient the code, even from unusual angles. The remaining squares contain the encoded information, stored in a way that can be read swiftly by any camera-enabled device.

Originally designed for Japan’s automotive industry in the 1990s, QR codes now play a major role in global payments, supporting contactless transactions across different regions. Nations such as China, Singapore, and India have integrated QR payments into popular apps like Alipay, and WeChat, and unified QR codes, making them a fast, adaptable payment solution worldwide.

How Does the QR Payment System Work?

QR code payments provide a quick, contactless way for customers to make purchases using just their smartphones. This method is particularly beneficial for businesses, as it requires minimal setup and streamlines the transaction process for both sides.

To set up a QR payment system effectively, the first step is to decide how the QR code will integrate into your payment flow. This involves choosing the action you want the QR code to initiate, whether it’s to authorize a specific payment amount, open a secure payment page in the customer’s browser, or prompt them to send funds via their mobile payment app.

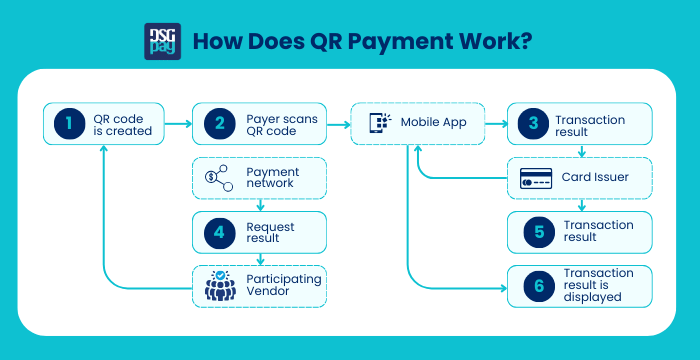

Once you’ve defined the role of the QR code in your payment process, the next step is to create it using a specialized tool, embedding all the necessary transaction details. Here’s a step-by-step look at how QR code payments work.

- QR Code Creation: The process begins with the merchant generating a unique QR code for each transaction. This code contains critical payment details, such as the amount, merchant information, and other transaction data. The QR code can be displayed digitally on a screen, printed on a receipt, or presented on a physical sign at the point of sale.

- Customer Scans the QR Code: To make a payment, the customer opens their preferred mobile payment app, such as their banking app, PayPal, or popular regional apps like Alipay or WeChat Pay, and scans the QR code. This action automatically pulls up the transaction details embedded in the code, initiating the payment process.

- Transaction Request: Once the customer confirms the transaction in the app, a transaction request is sent through the payment network. This request routes the payment data to the card issuer or financial institution for authorization, ensuring a secure transfer of funds.

- Payment Network Processing: The payment network verifies the transaction by checking the details with the card issuer or bank. This step includes confirming that the customer has sufficient funds or credit to complete the purchase, along with applying security checks to prevent fraud or unauthorized transactions.

- Transaction Result: After verification, the network sends the transaction result back through the QR payment system. If the payment is approved, a confirmation is sent to both the customer’s app and the merchant’s system in real-time, enabling both parties to proceed without delay.

- Transaction Display: The final confirmation of the payment is displayed to both the customer and the merchant. This last step closes the transaction loop, allowing the merchant to complete the sale by issuing a receipt or providing goods or services. Meanwhile, the customer receives a notification or confirmation message that their payment was successful.

QR Code Payments Benefits

True to its name, the “Quick Response” code offers a fast and convenient way to handle payments, making it a powerful upgrade from traditional card swiping and PIN entry.

By adopting QR code payments, businesses and consumers can both enjoy multiple benefits that go beyond just speed in today’s digital landscape.

Here’s why QR code payments are becoming a preferred choice for so many:

Are QR Code Payments Safe?

QR code payments are generally safe, thanks to several layers of built-in security features. Here are some key points that make QR code payments secure:

- Data Encryption: QR codes can be encrypted to protect sensitive transaction information, ensuring that any data encoded within the QR code is accessible only to authorized users.

- Two-Factor Authentication: QR code payments often require additional authentication steps through the user’s mobile device, such as PIN entry, fingerprint scanning, or face recognition, adding an extra layer of protection.

- Tokenization: Many QR code payment systems use tokenization, which replaces sensitive information (like card numbers) with unique, random tokens. This means that even if data is intercepted, it cannot be used for fraudulent transactions.

- Dynamic QR Codes: For added security, some businesses use dynamic QR codes that change with each transaction. Unlike static QR codes, which can be copied or misused, dynamic codes are unique to each payment, reducing the risk of tampering.

- Secure Payment Apps: QR code payments are typically made through secure mobile payment apps or banking apps, which are designed with security protocols like encryption, fraud detection, and real-time monitoring to protect users from unauthorized activity.

- Limited Data Storage: QR codes contain only essential transaction details and do not store sensitive information, such as a customer’s account balance or PIN. This limits the risk of exposure even if the code is scanned by someone else.

Best QR Code Payment Apps

With a range of QR code payment apps available, each offering unique features and benefits. You have the flexibility to choose a solution that best fits your operational needs and customer preferences. Let’s explore some of the best options for QR code payment apps:

Streamline Your Business Payment with DSGPay’s QR Code Payment System

After understanding the key aspects of implementing a QR payment system, the importance of a smooth, flexible solution for improving efficiency and customer engagement becomes clear.

If you’re looking to simplify payment collections and expand your business reach, DSGPay offers local QR code payment technologies in Hong Kong and Australia. These solutions enable seamless, secure transactions tailored to diverse markets, supporting businesses worldwide in delivering a reliable, customer-friendly payment experience.

Key Features of DSGPay’s QR Code Payment System:

- Instant Payment Acceptance: With DSGPay’s QR code payment system, businesses can instantly accept customers’ payments, reducing wait times and streamlining the checkout process. This feature ensures that transactions are completed quickly, keeping the flow of business uninterrupted, especially in high-traffic environments.

- Real-Time Payment Notifications: Stay informed with real-time payment notifications that instantly alert you when a transaction is successful. This feature provides both you and your customers with immediate confirmation, improving transparency and enhancing customer trust in your payment process.

- Effortless QR Code Sharing: DSGPay makes it easy to generate and share QR codes with customers across various channels, whether in-store, online, or through mobile platforms. This flexibility allows customers to pay from wherever they are, making your business more accessible and convenient.

- Enhanced User Experience: DSGPay’s QR code system is designed to offer a smooth, intuitive user experience that minimizes friction at checkout. Customers can simply scan, pay, and receive instant confirmation, creating a hassle-free payment process that leaves a positive impression.

- Comprehensive Security: Security is a top priority, and DSGPay’s QR payment system incorporates advanced encryption and secure authentication methods to protect each transaction. This ensures both the business and the customer have peace of mind with every payment.

- Global Reach with Local Adaptability: DSGPay’s QR payment solutions are tailored to meet the needs of different regions. Whether it’s QR code payments in Hong Kong, dynamic virtual accounts in South Korea, or mobile-based collections in Australia, DSGPay adapts to the specific preferences and technologies of each market, making cross-border payments easier than ever.