Whether you’re a non-resident living in the United States or someone abroad with financial ties to the US, it’s a crucial asset. Having a US bank account can simplify your financial management, reduce currency exchange costs, and streamline payments and transfers.

If you’re unsure of where to start opening a US bank account for non-residents due to the regulations and requirements involved, this article will guide you through the process.

For those seeking something beyond traditional banking, a DSGPay USD account is the perfect alternative, simply contact us to get started today

Table of Contents

Can a Foreigner Open a Bank Account in the US?

Yes, foreigners are welcome to open bank accounts in the US. Whether you’re temporarily residing in the country, studying as an international student, or managing business operations from abroad.

However, the process may vary depending on your residency status, the type of account you wish to open, and the bank you choose.

How to Open a US Bank Account as a Foreigner

Opening a US bank account as a non-resident involves several steps, but with the right preparation, it’s a smooth process. Let’s take a look at the essential steps, making the process simple and stress-free.

1. Research US Banks for Non-Residents

Not all banks in the US allow foreigners to open accounts without a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Look for banks with international banking programs or those known for accommodating non-residents, such as:

2. Compare Types of Bank Accounts in the USA Before Deciding

When selecting a bank account in the USA, it’s essential to understand the various options available to ensure they align with your financial needs. Here’s an overview of common account types:

- Checking Accounts: Designed for daily transactions, these accounts offer easy access to funds through checks, debit cards, and online banking. They typically do not earn interest.

- Savings Accounts: Intended for storing money over time, savings accounts accrue interest on the balance. They may have limitations on the number of withdrawals per month.

- Certificates of Deposit (CDs): These are time deposits where funds are locked in for a specified period, ranging from a few months to several years, in exchange for a fixed interest rate. Early withdrawal often incurs penalties.

- Money Market Accounts: Combining features of checking and savings accounts, money market accounts offer higher interest rates and may provide limited check-writing capabilities. They often require higher minimum balances.

- Business Accounts: Tailored for business owners, these accounts help manage business finances separately from personal funds, offering features like merchant services and payroll processing.

- Individual Retirement Accounts (IRAs): Designed for retirement savings, IRAs offer tax advantages and come in various forms, such as Traditional and Roth IRAs, each with specific tax implications.

- Brokerage Accounts: These accounts allow individuals to invest in securities like stocks, bonds, and mutual funds, facilitating the buying and selling of investments.

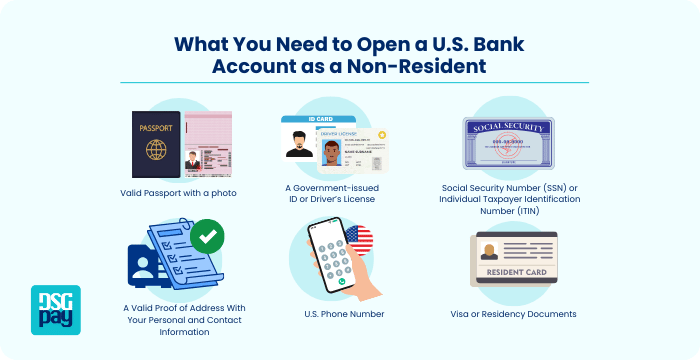

3. What Documents Are Needed for Opening a Bank Account

Each bank has its own requirements, but you’ll generally need the following documents:

- Valid Passport: This serves as your primary identification.

- Visa or Immigration Documents: Proof of your legal status in the US (e.g., student visa, work visa).

- Proof of US Address: This can be a utility bill, lease agreement, or letter from your university (if you’re a student).

- Proof of Foreign Address: Some banks require documentation of your permanent address in your home country.

- Taxpayer Identification Number (Optional): While an SSN or ITIN isn’t always required, having one can simplify the process.

- Bank Reference Letter (Optional): A letter from your bank in your home country may help demonstrate your financial reliability.

- US Phone Number: Some banks require a US-based phone number for account verification and communication purposes.

4. Visit a Local Bank Branch

For most banks, you’ll need to visit a branch in person to open your account. Here’s what to expect:

- Speak with a Banker: Explain your situation as a non-resident and specify the type of account you want to open.

- Submit Your Documents: Provide the required identification and address proof.

- Make an Initial Deposit: Most banks require an initial deposit, which can range from $25 to $100, depending on the account type.

5. Tips for a Successful Application

- Prepare All Documents in Advance: Ensure you have original and, if required, certified copies of your documents.

- Call the Bank Ahead of Time: Confirm the requirements for non-residents with the specific branch you plan to visit.

- Start with International-Friendly Banks: Banks like HSBC and Citibank often have experience dealing with non-residents.

- Be Patient: The process may take longer than opening an account as a US resident, especially if additional verifications are required.

How to Open an Online US Bank Account?

For foreigners unable to visit a branch in person, opening a US bank account for non-residents online is a convenient alternative. Several banks and fintech platforms cater to international clients by offering digital account setup. Here’s how to proceed:

1. Research Online US Account Options

- Wise (formerly TransferWise): Offers multi-currency accounts with a focus on low fees for international transfers.

- Revolut: A digital banking platform providing USD accounts and debit cards.

- HSBC Expat: Specializes in remote account opening for expats and international clients.

- DSGPay: Provides multi-currency virtual accounts, including USD, tailored for businesses and individuals engaged in cross-border transactions.

2. Complete the Online Application

Once you’ve selected a bank or platform, follow these steps:

- Visit their official website or download their mobile app.

- Fill out the application form with your personal details.

- Upload scanned copies of your documents.

- Verify your identity through a video call or other verification methods if required.

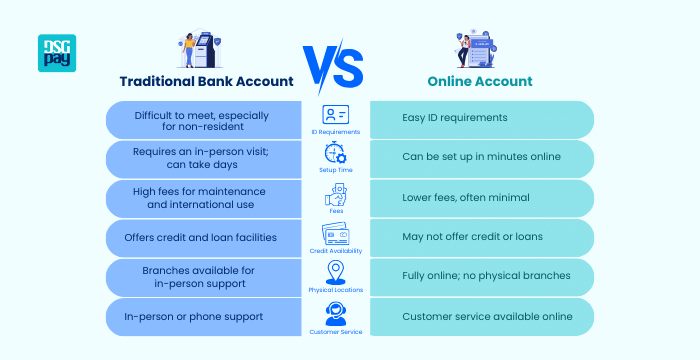

Why Online Accounts Are the Smart Alternative to Traditional Banking

Opting for an online account instead of a traditional bank account offers several advantages, especially for non-residents managing international finances. Here’s why an online account might be the better choice:

1. Convenience

- No need to visit a branch in person, which can be challenging for non-residents.

- Accounts can be opened and managed entirely online from anywhere in the world.

- 24/7 access through mobile apps and web platforms.

2. Lower Fees

- Many online banks and platforms offer lower account maintenance fees.

- Reduced charges for international transfers compared to traditional banks.

- Competitive exchange rates for multi-currency transactions.

3. Faster Setup

- Traditional banks often require extensive documentation and an in-person visit.

- Online accounts typically have a streamlined application process with fewer barriers.

4. Multi-Currency Support

- Platforms like Wise, Revolut, and DSGPay offer multi-currency accounts.

- Ideal for managing funds in different currencies without the hassle of opening multiple accounts.

5. Enhanced Features

- Tools like virtual cards, real-time payments, and seamless integrations with payment platforms.

- Advanced financial analytics and tracking to manage budgets effectively.

6. Accessibility for Non-Residents

- Many online platforms cater specifically to non-residents who may struggle to meet the requirements of traditional banks.

- They often don’t require a US address or Social Security Number (SSN).

When to Choose a Traditional Bank?

While online accounts offer numerous benefits, traditional banks may still be preferable if:

- You require in-person assistance for complex financial services.

- You need access to physical branches for cash deposits or withdrawals.

- You’re looking for specific services like mortgages or business loans that online accounts may not provide.

Final Thoughts on Opening a US Bank Account for Non-Residents

Opening a US bank account as a non-resident can be a straightforward process with the right preparation. Whether you choose a traditional bank or opt for a modern online account, the key is understanding your financial needs and selecting the best platform for your situation.

- Traditional Banks: Ideal for individuals requiring physical branch access, in-person assistance, or specialized financial services like loans or mortgages.

- Online Platforms: A smart choice for non-residents seeking convenience, lower fees, and advanced multi-currency features, especially for international transactions.

Why DSGPay is the Ideal Solution

For those looking to simplify cross-border transactions, DSGPay offers a reliable alternative to traditional banks. With features like:

- Multi-currency virtual accounts, including USD.

- Competitive exchange rates and real-time payment options.

- A hassle-free application process tailored for non-residents.

DSGPay bridges the gap between online convenience and robust financial management, making it the perfect solution for individuals and businesses alike.