Do you plan to work, study, or retire in Thailand for a long period? Or perhaps you’re searching for a convenient way to open a bank account in Thailand as a foreigner? Look no further!

With the right preparation, setting up a bank account in Thailand is a straightforward process that’s easier than most people imagine.

In this guide, we’ll explain everything you need to know about how to open a bank account in Thailand as a foreigner, addressing common challenges and requirements for each bank. We’ll also include helpful tips to make the process seamless.

Let’s dive in!

Table of Contents

Can I Open a Bank Account in Thailand as a Foreigner?

Yes, you can. To open a bank account in Thailand as a foreigner, the type of visa you have, your purpose for opening the account, and the bank you choose will influence the entire process.

Additionally, some banks are known to be more foreigner-friendly than others, making it crucial for you to select one of the best banks in Thailand.

However, opening a bank account may be challenging for tourists, because most banks in Thailand prefer long-term residents or those with work permits.

How Can I Open a Bank Account in Thailand as a Foreigner?

1. Choose a Suitable Bank

The first step to opening a banking account in Thailand is selecting a bank that suits the needs of your stay. Whether you need a traditional bank account for your business, studies, or retirement plans, finding the right bank also means considering its relevant features.

When it comes to choosing a bank, most foreigners go for banks with a wide customer base and those with a long banking history.

However, there are several banks in Thailand that offer diverse banking options for foreigners.

Here is a list of some of the popular banks in Thailand:

- Bangkok Bank (BBL): Established in 1944, Bangkok Bank is one of the largest and leading commercial banks in Thailand, with various branches and subsidiaries in the United States, the United Kingdom, and other countries in and outside Asia. They offer comprehensive corporate, retail, and international banking services.

- Kasikorn Bank (KBank): Formerly known as Thai Farmers Bank in 1945, this prominent rebranded in 1987 to provide innovative banking solutions to local and international clients all around Asia. They offer a wide range of financial options to individual and corporate clients.

- Siam Commercial Bank (SCB): Founded in 1904, Siam Commercial Bank is one of the oldest and largest commercial banks in Thailand. With over a century of banking experience, they offer diverse corporate and individual banking services to their customers.

- Krung Thai Bank (KTB): Majorly owned by the Thai government, KTB is an established bank in Thailand. It offers tailored services for foreigners and has a strong presence in rural areas, making it a convenient option for expats staying outside the city.

- Bank of Ayudhya (BAY): Founded in 1945 and also known as Krungsri, Bank of Ayudhya is one of Thailand’s major commercial banks. It offers a wide range of retail and corporate banking services for local and international customers.

With the following established, let’s take a comprehensive look at the bank’s key features and coverage. This will help you make a more informed decision and choose a bank that fits your needs.

| Bank | Customer Base | Key Features | Account Types | Requirements* |

| Bangkok Bank (BBL) | 17 Million+ (7,600+ ATMs & 1,000+ branches) | • Global Network: Only Thai bank with major branches in London & NYC. • Investment Focus: Access to “Bualuang iBanking” for international trade. • Expat Specialisation: High success rate for non-work permit holders. | • Savings • Current • Fixed • Foreign Currency (FCD) | • Passport (6 months validity) • Proof of Address • Non-Tourist Visa |

| Kasikorn Bank (KBank) | 23.9 Million+ (8,400+ ATMs & 740+ branches) | • Digital Leader: Award-winning K PLUS app with AI-driven spending insights. • Lifestyle Perks: “K-Point” rewards usable at major Thai malls and shops. • Seamless Payment: Best-in-class cross-border QR payments across SE Asia. | • Savings • Fixed • Current Deposit • Foreign Currency (FCD) | • Passport • Non-immigrant visa • Proof of Thai residency |

| Siam Commercial Bank (SCB) | 17 Million + (10,000+ ATMs & 640+ branches) | • AI Advisory: “SCB WEALTH” provides AI-powered investment advice via the app. • Elite Services: Offers premium “SCB First” lounges for high-balance expats. • Virtual Ready: Launching virtual banking in partnership with KakaoBank. | • Savings • Current • Fixed • Foreign Currency (FCD) | • Passport • Work Permit (where necessary) |

| Krung Thai Bank (KTB) | 40 million + (7,200+ ATM & 900+ bank branches) | • Gov-Linked: Integrated with “Paotang” for government bonds and taxes. • Rural Access: The largest physical presence in smaller provinces. • Stability: Backed by the Ministry of Finance for maximum security. | • Savings • Current • Time Deposit • Payroll • Foreign Currency Deposit | • Passport • Non-Immigration Visa • Proof of Residence (TM30) |

| Bank of Ayudhya (BAY) | 10 Million + (5,600+ ATMs & 560+ branches) | • MUFG Partnership: Connects you to Japan and a global financial network. • Regional Expert: Best for expats doing business across the ASEAN region. • Simple Banking: Highly rated for “Make Life Simple” English support. | • Savings • Current • Fixed • Foreign Currency (FCD) | • Passport • Non-Immigration Visa • Proof of Residence |

Important note: Requirements may vary by the type of account and policy updates.

Additionally, some banks will require additional documents. These can include:

- A Certificate of Residence from your embassy or an international organisation (often required in place of a work permit).

- A formal letter from your employer or educational institution.

- Proof of a SWIFT account from your home country.

- A recommendation letter from a trustworthy individual or a local guarantor.

These banks generally offer debit cards upon opening an account, and some even provide credit card options once you establish a good banking history in Thailand.

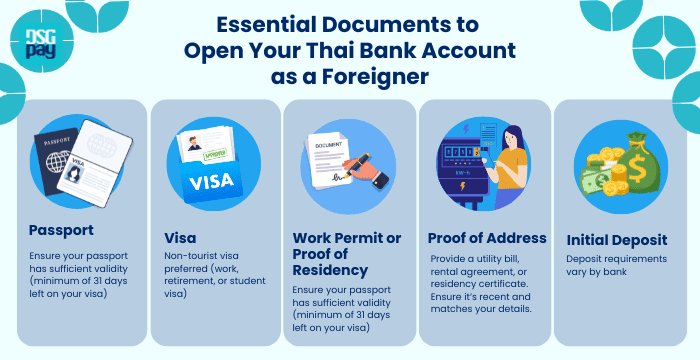

2. Gather Required Documents

To open a bank account in Thailand as a foreigner, you’ll need the following:

- Passport: An original passport with at least 6 months of validity is required. Banks conduct a digital face scan for biometric verification at the branch.

- Valid Long-Term Visa: A Non-Immigrant visa is the standard requirement, such as Work (Type B), Retirement (Type O), or Student (Type ED). Tourist visas and visa exemptions are generally not accepted for new account applications.

- Work Permit or Proof of Residency: These documents help establish your legitimacy as a resident or worker in Thailand. They are usually required for accounts offering credit cards or higher deposit limits.

- Proof of Address: This could be a utility bill, rental agreement, or a residency certificate obtained from the local immigration office or embassy. Ensure the document is recent and matches your personal details.

- Initial Deposit: The minimum deposit typically ranges from 500 to 2,000 THB for a basic savings account, depending on the specific institution.

- Thai Mobile Number: A local SIM card registered in the applicant’s name is required to activate mobile banking applications and receive secure OTPs.

3. Visit the Bank Branch

While digital transformation in Thailand is rapid, opening a bank account in Thailand for the first time still requires a physical visit to a branch for mandatory Identity Verification.

What to Expect at the Bank Branch

- Identity Verification: Banks now utilise advanced biometric technology, including high-resolution face scanning, to ensure maximum security. This biometric data is stored securely and used to verify your identity for future high-value mobile transactions.

- Digital Setup: Once your identity is verified, bank staff will assist you in installing and activating the official mobile banking app immediately. It is essential to ensure the app is fully functional and that you can log in before leaving the branch.

- Debit Card & Passbook: You will typically receive a physical passbook (bank book) and a debit card linked to international networks such as Visa or Mastercard. These tools are essential for both global and local transactions, including ATM withdrawals and point-of-sale payments.

💡 Pro-Tips for a Successful Visit

- Choose a Central Branch: For the best experience, visit a branch in a major shopping mall or a central business district (CBD). Staff at these locations are often more experienced in assisting foreigners with the documentation required to open a bank account in Thailand.

- Check Operating Hours: While standalone branches usually close at 3:30 PM or 4:30 PM, branches located within shopping malls are often open until 7:00 PM or 8:00 PM and operate on weekends.

- Verify Your Registered Name: Ensure that the name registered for your Thai Mobile Number exactly matches the name on your passport. This is critical for the seamless activation of mobile banking apps.

- Ask About Daily Limits: When setting up your account, ask the staff to help you adjust your daily transfer and withdrawal limits on the app to suit your personal or business needs.

4. Start Banking

Once your application is approved, your account will typically be activated within a few hours to a few business days. To open a bank account in Thailand successfully, you must ensure all digital services are linked correctly before leaving the branch.

Account Activation & Access

- Instant Access: Upon activation, you will receive your account number, a physical passbook, and a debit card for immediate use.

- Digital Ecosystem: You can link your account to various payment platforms and utilise mobile banking for daily transactions.

- Fee Structure: It is important to note that traditional banks may apply fees for certain services, such as:

- ATM withdrawals made at non-designated machines.

- Local and international fund transfers.

- Annual debit card maintenance fees.

With your account active, you can immediately utilise features such as PromptPay QR payments, bill payments, and international transfers directly from your smartphone.

Traditional Banks vs. Modern Banks: Which is Suitable for Foreigners in Thailand?

To open a bank account in Thailand as a foreigner, you do not necessarily have to use the traditional banking system. However, this may prove to be a great alternative when you’re looking for:

- Established Trust and Reliability: A traditional bank offers an undisputable level of security and accountability. They are also a popular option in various countries.

- Personalised Customer Service: Thai banks offer face-to-face customer interaction where customers can discuss their concerns physically with staff. With varying numbers of physical branches, traditional banks provide personalised services to their clients.

- Stability: Traditional banks offer stable services, with Thai banks going as far back as a century ago.

However, you might be getting a lot more with modern banking solutions. They offer a range of advantages, especially for foreigners who need flexibility and efficiency in managing their finances. Here are some key benefits:

- Convenience: Unlike traditional banks, you can open a fully functional account from anywhere in the world without the need to visit a physical branch.

- Low Fees: Online payment providers often charge lower transaction and maintenance fees compared to traditional banks.

- Flexibility: A modern payment provider is an ideal option for digital nomads and frequent travellers for guaranteed access to funds regardless of location.

- User-Friendly Platforms: Most online providers invest in intuitive apps and websites, making it easy for you to manage your account, track expenses, and set financial goals.

Tips on How to Open a Bank Account in Thailand as a Foreigner

Here are a few tips to help you navigate your financial landscape in Thailand:

- Choose a suitable bank by researching account features such as ATM availability, international transfer fees, mobile banking options, and the type of account available.

- Compare banking features and read reviews from other users for a better experience.

- Take a friend or interpreter along when visiting a Thai bank branch. You can also use an online translation tool to prepare key phrases or questions beforehand. You can skip this if you’re well-versed in the Thai language.

- Many Thai banks open between 10:30 am and 4:00 pm. As such, visit during off-peak hours, typically early in the morning or just after lunch breaks. Take note of Thai bank holidays, weekends, and limited-hours service for account openings.

- Prepare to make a first deposit as soon as you open your bank account. Some banks in Thailand do not accept accounts without an initial deposit.

- Consider online banking options if you prioritise convenience, lower fees, and global access.

Concluding Thoughts on How to Open a Bank Account in Thailand as a Foreigner

To open a bank account in Thailand as a foreigner, start off by carefully selecting a bank that matches your financial needs, gathering all the required documents, visiting your bank branch, and activating your account.

From this guide, you’ll see that opening a bank account in Thailand as a foreigner is fairly easy. You only need the right documents and information. If your document is incomplete, consider using an alternative such as a letter from an employer, a recommendation letter, a certificate from an embassy or international organisation, and many more. You can also ask staff at the bank branch for more information on the required documents.

Seamless Cross-Border Money Transfers with DSGPay

Opening a traditional bank account in Thailand can take time, especially for foreigners who do not yet meet all local residency or visa requirements.

Whether you need to receive funds from abroad, such as salary, business income, or family support, or send money back to your home country, having an efficient cross-border solution can make everyday finances much easier.

DSGPay is a regulated payment service provider that offers virtual accounts, allowing you to manage international payments or multiple currencies.

With DSGPay, you can:

- Send and receive money in 30+ currencies.

- Use named virtual accounts to receive overseas payments.

- Hold and convert multiple currencies in one platform.

- Manage cross-border transfers digitally with transparent fees.

This makes DSGPay a practical option for expats, students, retirees, freelancers, and international business owners who need a flexible way to send and receive money while living in Thailand.