In today’s digital world, if you’re not offering your customers a variety of convenient payment options, you’re going to lose a huge customer base. Alternative Payment Methods (APMs) allow people to make purchases without relying on cash or any major credit card network. For e-commerce merchants, integrating alternative payment methods has become essential.

And you’ll be surprised to know that, in 2023, 30% of point-of-sale transactions globally were made using digital wallets, more than any other payment type. This is a clear sign of how fast alternative payment methods are gaining traction.

That being said, no single APM dominates the market, as preferences differ based on location and demographics. In this guide, you’ll learn about 7 different types of alternative payment methods and why incorporating APMs into your payment strategy is essential for the success of your business.

Table of Contents

What Are Alternative Payment Methods?

Alternative Payment Methods (APMs) are payment solutions that do not involve cash or traditional credit card networks like Visa or Mastercard. APMs encompass a variety of options, such as e-wallets, prepaid cards, bank transfers, cryptocurrencies, and Buy Now Pay Later (BNPL) services.

These methods are widely used in emerging markets and are gaining popularity globally due to their convenience, accessibility, and security.

In 2023, mobile wallets made up about half of all online payment transactions, making them the most popular payment method for e-commerce globally.

Global E-Commerce Payment Method Market Share (2023 & 2027 Forecast)

Source: Statista

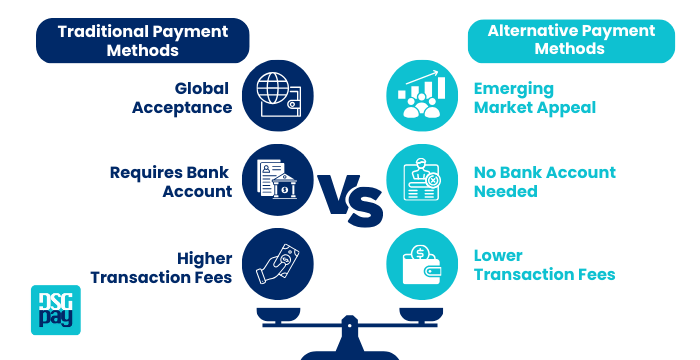

Traditional Payment Methods VS Alternative Payment Methods

Traditional Payment Methods

These are the most widely used payment options, especially in USA, UK, and Canada. They include:

- Credit Cards: Visa and Mastercard

- Debit Cards: Visa Debit

- Bank Transfers: SWIFT, ACH, SEPA

- Cash on Delivery (COD): Paying in cash upon delivery

Pros:

- Global acceptance

- Trusted and reliable

Cons:

- Higher transaction fees

- Requires a bank account or credit history

- Slower processing times

While they’re essential for a lot of businesses, they can be less accessible in emerging markets.

Alternative Payment Methods (APMs)

Alternative Payment Methods (APMs) are gaining ground, especially where credit cards aren’t as common with options like mobile wallets, digital payments, cryptocurrencies, and BNPL (Buy Now Pay Later).

Pros:

- Lower transaction fees

- Faster payments

- Better access for unbanked customers

Cons:

- Not accepted everywhere

- Some require internet access

For instance, Alipay and WeChat Pay lead in China, Paytm and UPI are popular in India, and M-Pesa is widely used in Kenya.

These alternative payment methods are tailored to local needs and cater to both tech-savvy and unbanked customers, making them a great choice for businesses looking to expand and keep up with modern payment trends.

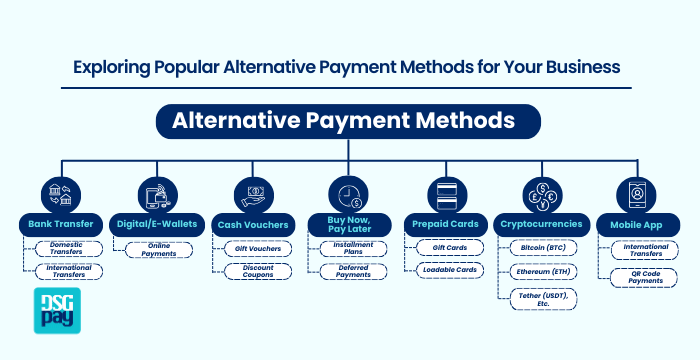

7 Different Types of Alternative Payment Methods

Let’s take a look at what are the most popular alternate payment methods available.

1. Bank Transfer

Bank transfers are one of the most common and reliable methods for cashless transactions, especially for recurring payments like subscriptions or utilities. With this method, customers simply provide their bank account details and approve the transaction, which is then deducted directly from their account and credited to the business.

Many banks now offer mobile apps, making it even easier for customers to pay bills or make purchases with just a few clicks on their phones. This convenience has made bank transfers a popular choice for seamless and secure transactions.

2. Digital/E-Wallets

A digital wallet is an app that stores payment details, gift cards, IDs, and more, letting you pay without cash or cards. It works on phones and computers, using tech like QR codes or NFC for quick payments. Popular examples include Apple Pay and PayPal, with some even supporting cryptocurrency.

These wallets are super convenient and secure, cutting down the need for physical wallets. But they rely on internet access and may not work everywhere. Plus, keeping your device protected is a must to avoid risks like theft or hacking.

3. Cash Vouchers

Cash vouchers are like gift cards that let you shop or get services without using cash or cards. They’re often given by stores or businesses and can be used to buy stuff at specific places. You can get them as physical cards or digital codes, and they usually come with a set amount of money loaded onto them.

While cash vouchers offer flexibility, they may have limitations, such as expiration dates or restrictions on where they can be used. They also don’t always offer the same consumer protection as credit or debit cards, so it’s important to check the terms before using them for larger purchases.

4. Buy Now, Pay Later

Buy Now, Pay Later (BNPL) is one of the most popular alternative payment methods that lets you shop now and spread the cost over time, usually with no interest. You pay a small upfront amount, and the rest is paid off in manageable instalments over a few weeks or months. It’s a handy way to make purchases without paying everything upfront.

However, while BNPL can be a convenient option, it’s not without its risks. If you miss a payment, you could face late fees, and it might hurt your credit score. It’s especially popular for things like clothes, travel, and groceries, but always read the fine print. Make sure you can comfortably afford the payments to avoid getting into financial trouble down the line.

5. Prepaid Cards

A prepaid debit card is like a gift card that you load with money. You can use it to buy things, both in stores and online, just like a regular debit card. You don’t need a bank account to use it, but once the money is spent, you need to reload it.

Prepaid cards can be handy for sticking to a budget or for people who don’t have a bank account, but be careful – they often come with fees, like charges for using ATMs or monthly maintenance fees.

While prepaid cards are useful, they won’t help you build credit since they don’t report to credit agencies. They can also expire or have limits on how much you can add to them, so it’s important to know the details before you choose one. Just make sure to check for any fees or restrictions to avoid surprises.

6. Cryptocurrencies

Cryptocurrency is a digital form of money that lets you send and receive payments without using banks. It works through a network of computers, and transactions are recorded on a public ledger called a blockchain. You store your cryptocurrency in a digital wallet, and it can be used to buy things or traded for profit, though not all businesses accept it yet.

As one of the lesser-used alternative payment methods, cryptocurrencies allow you to make transactions directly between people, cutting out traditional banks. You can buy crypto on platforms, store it in wallets, and use it for purchases or investments. While it’s still growing, more places are starting to accept it as a way to pay, making it an increasingly popular choice for payments.

7. Mobile App

Mobile payment apps allow users to make secure payments directly from their smartphones. These apps often integrate various features, such as QR code payments, in-app purchases, and international money transfers, offering a convenient and fast way to handle transactions.

Popular examples include Wise and Revolut. While these apps are highly user-friendly and versatile, their functionality depends on internet access and may require linking to a bank account or card. They’re an excellent option for businesses looking to offer seamless and tech-savvy payment solutions.

Why Should You Have APMs for Your Business?

There are several reasons why SMEs and large businesses today are integrating alternative payment methods into their payment structure.

Let’s take a look at some of the benefits alternative payment methods provide:

- Reach New Customers: In many emerging markets, people don’t have access to credit cards or traditional banking. APMs help you connect with these customers and grow your business in untapped regions.

- Better Shopping Experience: Alternative payment methods let customers pick how they want to pay, making checkout faster and more convenient. Happy customers are more likely to stick around.

- Save on Fees: APMs often have lower transaction costs than credit cards, which means more savings for your business over time.

- Boost Sales: Offering multiple payment options can attract more shoppers and make it easier for them to complete their purchases, increasing your sales.

- Stronger Security: Alternative payment methods like e-wallets and cryptocurrencies use cutting-edge encryption to keep transactions safe and customer data protected.

How to Choose the Right Alternative Payment Methods for Your Business

Choosing the right alternative payment methods depends on various factors, including your target market, the nature of your products, and the regions you operate in. Here are some tips to guide your decision:

- Understand Your Customer Base: Research which payment methods are most popular in the regions where you operate.

- Consider Payment Fees: Different APMs come with different transaction costs. Ensure the payment method you choose offers a good balance between cost and convenience.

- Security Features: Opt for payment solutions that offer robust security measures to protect your business and customers from fraud.

- Ease of Integration: Look for APM providers that can be easily integrated into your existing payment infrastructure without major technical hurdles.

Introducing DSGPay as Another Alternative Payment Method

DSGPay is a modern Alternative Payment Method (APM) designed to help businesses collect payments efficiently, especially from customers in Asia and beyond. Instead of relying on traditional credit and debit cards, DSGPay offers local payment solutions that make transactions faster, more secure, and easier for both merchants and customers.

Additionally, it integrates smoothly with e-commerce platforms, making payment processes efficient for businesses. DSGPay supports reliable international payments with competitive exchange rates, making it an ideal choice for companies aiming to expand globally while reducing transaction costs.

How to Connect DSGPay to Your Online Store

Connecting DSGPay to your online store is simple and can be done in a few ways:

- API Collections: If you’re tech-savvy, you can use DSGPay’s API to connect the payment system directly to your site. This lets you accept payments in real time from customers worldwide.

- Embedded Widget: For those who don’t want to get into coding, DSGPay provides a widget that you can add to your store. It works right out of the box and helps you collect payments without extra hassle.

- Mobile App: If you’re always on the go, DSGPay has a mobile app where you can manage payments and collections directly from your phone, so you never miss a transaction.

Why DSGPay is a Great Choice as an Alternative Payment Method

If you’re looking for a flexible, secure, and efficient way to collect payments, especially from customers in Asia, DSGPay offers some compelling benefits as an alternative payment method (APM).

Here’s Why DSGPay Stands Out:

- Local Payment Methods: DSGPay supports a range of local payment solutions across different countries, including QR codes in Hong Kong, mobile payments in Australia, and virtual accounts in South Korea. This means your customers can pay in the way they’re most comfortable with, which can help improve conversion rates.

- Open Banking: Open banking allows customers to pay directly through their bank accounts, which makes the payment process easier and faster. There’s no need to enter credit card details, reducing checkout friction and increasing the chances of successful transactions.

- Faster Payments: Unlike traditional methods that can take several days to process, DSGPay offers quicker settlement times, payments can reach your account in just 1-2 working days. This makes managing cash flow much smoother.

- Reduced Fraud Risk: DSGPay uses secure, bank-level protection such as two-factor authentication (2FA) to ensure that payments come from legitimate customers. This reduces the risk of fraud and chargebacks compared to traditional card payments.

- Mobile-Ready: DSGPay’s open banking and push payment technologies are mobile-friendly, making it easier for customers to pay on their phones. As more shoppers use mobile devices for purchases, this flexibility is key to providing a seamless user experience.

- Multi-Currency Support: With DSGPay, you can manage payments in 30 different currencies, which makes it easier to do business internationally without worrying about fluctuating exchange rates or hidden fees.

- Easy Integration: Whether you’re using APIs for a custom solution or their ready-to-use embedded widget, DSGPay can seamlessly connect to your e-commerce store.

- Secure and Reliable: DSGPay’s strong security measures ensure that your customers’ payments are protected. You can also rely on DSGPay’s track record, with years of experience and global reach, providing a trustworthy service for your business.

In summary, DSGPay isn’t just another payment provider, it offers a flexible, secure, and easy-to-integrate solution that helps your business grow, especially in Asia. Whether you’re dealing with local or international customers, DSGPay makes accepting payments easier, faster, and safer.