Looking to transfer money from India abroad without paying high fees and additional charges? Services like Wise, PayPal, and Western Union are leading the way. But are they really the cheapest options out there?

In this article, we’ll uncover cheaper alternative providers that might save you more and break down the key rules for transferring money from India to abroad, helping you plan your transfers wisely, avoid hidden costs, and get the best value for your money.

Table of Contents

Common Methods for Transferring Money from India to Abroad

Before you send money from India abroad, it’s a good idea to understand the different digital payment methods. Each one comes with its own speed, fees, and best use cases, so comparing them carefully can help you find the cheapest way to transfer money from India to abroad

Here is a detailed guide on the types of digital financial services available in India:

- Wire Transfer (SWIFT Transfer via Internet Banking): Wire transfers use the SWIFT network to send money directly from an Indian bank account to a foreign bank account. It is the most common method for high-value international remittances, offering security and global reach.

- Online Money Transfer Services (e.g., Wise, Remitly, Western Union): Authorised digital platforms allow users to transfer money internationally with lower fees and faster speeds compared to banks. They are ideal for personal remittances, education fees, and small business payments abroad.

- International Credit Card Payments: Indian credit cards that support international transactions can be used to pay directly for services abroad, such as hotel bookings, tuition fees, and subscriptions. It’s an instant and convenient option, but it incurs foreign transaction fees.

- Unified Payments Interface (UPI) for International Merchant Payments: UPI has expanded internationally for merchant payments in countries like Singapore and the UAE. Users can scan UPI QR codes abroad to pay local merchants directly from Indian bank accounts, though person-to-person transfers are not yet available.

- Foreign Currency Demand Draft (FCDD): Banks issue physical foreign currency demand drafts payable to overseas recipients, typically used for university applications, immigration fees, or official payments where hard copies are required. It is a slower but formal payment method.

Top Payment Services for Transferring Money from India to Abroad

With many different options available out there, we don’t want you to spend hours trying to figure out which is the best payment services provider for your business. So here is a quick look at the top 10 digital payment services in India in 2024:

Disclaimer: Please note that the information provided is subject to change and may vary based on individual agreements with the service providers. Always refer to the latest terms and conditions provided by each provider for accurate details.

Understanding the Rules for Sending Money Abroad from India

Before transferring money from India abroad, it’s important to understand key regulations like the Liberalised Remittance Scheme(LRS) and Tax Collected at Source (TCS) to plan your transactions compliant and cost-effective with regulatory requirements.

What Is The Liberalised Remittance Scheme (LRS)?

The Liberalised Remittance Scheme(LRS) is a part of the Foreign Exchange Management Act (FEMA) 1999. If you are a Resident Indian and seeking to transfer money from India to abroad, you are permitted to transfer up to $250,000 per financial year.

If you don’t comply with LRS rules, you may face a penalty of up to three times the amount involved, if it can be determined, or INR 200,000 (2 lakh) if the amount cannot be determined, along with an additional INR 5,000 per day for continued violations. In serious cases, legal actions such as court proceedings or asset seizure may follow. That’s exactly why you need to understand the rules.

The Purposes of Transfers Under LRS

- Travel: Travel expenses/travel insurance

- Studies abroad: Education institute, publish an article/journal, work from overseas.

- Family support: Send money to your family or married couples.

- Donations or gifts: Money sent as a gift to your family and friends abroad.

- Transfer to your own account: Deposit money into your bank account abroad.

- Others: Investment in equity markets, mutual funds or venture capital.

Requirements or Prohibition under LRS

- Lottery tickets and government lotteries cannot be purchased.

- Buying Foreign Currency Convertible Bonds (FCCBs) issued by Indian companies in the international secondary market.

- Direct or indirect transfers to individuals and entities identified as high-risk for terrorist crimes or countries designated as non-cooperating countries and territories by the Financial Action Task Force (FATF).

- Gifts from a resident to another resident in foreign currency to request credit on that resident’s foreign currency account held abroad under the LRS.

What is Tax Collected at Source (TCS)?

Tax Collected at Source(TCS) is applied to overseas money transfers to help track international flows, prevent money laundering, and curb tax evasion. In 2025, the minimum threshold for TCS under RBI’s Liberalised Remittance Scheme (LRS) was raised from INR 700,000 (₹7 lakh) to INR 1,000,000 (₹10 lakh) per financial year.

| Annual Transfer Amount | TCS Collection Status |

| ≤ INR 1,000,000 (₹10 lakh) | The full amount can be transferred without TCS |

| > INR 1,000,000 (₹10 lakh) | TCS applies and will be collected on any amount exceeding ₹10 lakh. |

Applicable TCS Rates on Outward Remittances from India

As a Resident Indian, before initiating an outward remittance, make sure to check the applicable TCS rates under the LRS for different purposes. Here’s a handy table showing the updated TCS rates, effective from April 2025 onwards.

| Purpose of Outward Remittance | TCS Rate |

| Education loan through a financial institution | 0% |

| Education expenses not covered by a bank loan | 5% for any amount above INR 1,000,000 (₹10 lakh) |

| Medical expenses abroad | 5% for any amount above INR 1,000,000 (₹10 lakh) |

| Buying an overseas tour package | 5% for an amount up to INR 1,000,000 (₹10 lakh); 20% for any amount above INR 1,000,000 (₹10 lakh) |

| Other purposes | 20% for any amount above INR 1,000,000 (₹10 lakh) |

Tips to Save Taxes When Transferring Money from India Abroad

- Plan Your Remittance Schedule: Try to keep your total outward remittance under INR 1,000,000 (₹10 lakh) per financial year. If your transfer amount is close to the threshold, consider postponing part of the remittance to the next financial year.

- Check the purpose code for your transfer: Transfers for purposes like medical treatment or education may attract a lower TCS rate compared to other types of remittances. Always check which purpose code applies to your transfer.

- Consider an education loan: If you are a student, using an education loan can significantly reduce your TCS rate to 0%. It’s a smart way to manage your finances while studying abroad.

- File Your Taxes Properly: Just because TCS has been deducted doesn’t mean you lose that money. If your actual tax liability is lower, you can claim a refund. Make sure your Tax Credit Statement (Form 27D) matches your Form 26AS when you file your ITR, and you’ll be all set!

How to Transfer Money from India to Abroad

- Choose a Licensed Online Money Transfer Provider: Select a trusted online money transfer service authorised under RBI regulations, such as Wise, Remitly, or Western Union

- Open an Account and Complete KYC: You need a savings account (Resident/NRE/NRO) and full KYC verification with documents such as Aadhaar, PAN, passport, and visa (if required)

- Documentation Requirements: Fill out the digital A2 form declaring the purpose of your remittance. Select the correct purpose code and upload any necessary supporting documents as per the PSP’s guidelines.

- Fund Your Digital Wallet or Payment Account: After your KYC and documentation are complete, you can top up your digital account or wallet using Indian Rupees (INR) via debit card or direct bank transfer. Once your wallet is funded, you can immediately initiate the international money transfer. The service provider will automatically handle currency conversion at real-time exchange rates.

- Execute the Transfer: Provide the recipient’s bank account number, along with SWIFT/BIC code or IBAN (depending on the destination country). Confirm the destination country and receiving currency to ensure the transfer is processed correctly. If transferring to a mobile wallet instead of a bank account, a wallet ID or mobile number may be required instead of SWIFT/BIC codes.

- Track Your Transfer: After completing the transfer, you will receive tracking details. Banks usually provide a SWIFT number, while apps offer real-time updates. Transfers typically take one to three days through banks and a few hours to two days through online platforms.

- Manage Tax Reporting: Ensure that the TCS deducted is correctly recorded in your Form 26as. Keep all digital receipts and transaction summaries for future tax filing and compliance purposes.

Things to Consider When Choosing a Money Transfer Method

Selecting the right digital payment service depends on your specific needs, transaction patterns, and preferences.

Here’s a guide to help you make the best choice:

- Purpose of Remittance: What are you transferring money for? Services like Western Union and Wise are ideal for personal remittances, while platforms like traditional banks may be better suited for business or investment transfers under LRS guidelines.

- Transfer Fees and Exchange Rates: Always calculate the full cost of your transfer, not just the upfront fees. Compare exchange rates and check for hidden charges such as currency conversion markups or account maintenance fees.

- Transfer Speed: How urgently do you need the money to arrive? For fast transfers (same day or next day), choose services like DSGPay, Wise, or Remitly. For non-urgent transfers, bank wire transfers may be acceptable.

- Security and Regulatory Compliance: Use platforms licensed by reputable financial authorities. Look for strong security features like two-factor authentication (2FA), encryption, and fraud detection systems to safeguard your funds and comply with FEMA and LRS rules.

- Supported Currencies and Locations: Ensure the service can send money to your target country and support the required currency. Services with multi-currency virtual accounts like DSGPay offer more flexibility for international transfers.

- User Experience and Customer Support: Pick a platform that provides an easy-to-use interface, fast onboarding, and responsive customer support. Reliable service is essential when dealing with international transactions and TCS-related queries.

- Recipient Location: Does the service operate in the country you’re sending money to? Ensure the platform supports transfers to your desired location to avoid unnecessary complications.

FAQs

Is it safe to use online money transfer platforms instead of banks?

Yes, it’s safe as long as you use trusted and regulated platforms. Licensed services authorised under RBI regulations are required to follow strict compliance standards, including KYC, anti-money laundering, and encryption protocols to protect your transactions.

How much money can I transfer from India to abroad under LRS?

As per RBI’s Liberalised Remittance Scheme (LRS) rules, resident Indians can remit up to USD 250,000 per financial year for permissible purposes like education, travel, family support, and investments.

Do I have to pay taxes when transferring money from India to abroad?

Yes, if your total outward remittance during a financial year exceeds INR 1,000,000 (₹10 lakh), Tax Collected at Source (TCS) will apply. A 5% TCS rate is applied to education and medical remittances exceeding INR 1,000,000 (₹10 lakh), while a 20% rate applies to remittances made for other purposes like travel, investment, or personal expenses.

If I am an NRI and I transfer money abroad from my NRE or NRO account, do I have to pay TCS?

No, TCS is not applicable for NRIs transferring money from NRE or NRO accounts. TCS under the LRS scheme only applies to resident Indians.

If I am paying for my child’s education abroad, will I have to pay TCS?

Yes, if the amount transferred exceeds INR 1,000,000 (₹10 lakh) in a financial year, a 5% TCS will apply on the excess amount. However, this only applies when paying directly to a foreign educational institution that has no presence in India.

If I transfer less than INR 1,000,000 (₹10 lakh) abroad for family support or gifts, do I still have to pay TCS?

No, if your total outward remittance during a financial year is below INR 1,000,000 (₹10 lakh), you will not be required to pay TCS.

If I use an online money transfer service instead of a bank, do I still need to provide documents like the A2 form?

Yes, regardless of whether you use a bank or an online transfer service, you must declare the purpose of your transfer by completing an A2 form or its digital equivalent as per RBI regulations.

Final Thoughts on the Cheapest Ways to Transfer Money from India to Abroad

In 2025, sending money from India to overseas destinations has become faster, easier, and more cost-effective thanks to the rise of digital payment platforms. Whether you are transferring funds for education, travel, investments, or family support, choosing a licensed and secure service provider is essential. It is important to comply with the Liberalised Remittance Scheme (LRS) and understand the applicable TCS regulations.

Today, many payment service providers offer seamless international transfers with better exchange rates, lower fees, and faster processing times compared to traditional banks. With careful planning, thoughtful comparison of service options, and staying aligned with regulatory guidelines, you can ensure that your international remittances are smooth, safe, and cost-efficient in an increasingly digital world.

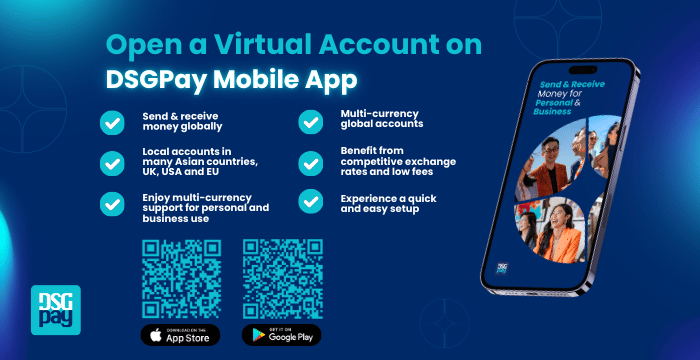

Choose DSGPay as an Alternative Solution to Transfer Money

Whether you are an Indian Resident or a Non-Indian Resident and seeking to send money received from India to another country where you live, DSGPay makes it easy and secure. We’ve got the perfect solutions for you to transfer money from India to abroad.

Here are the effective solutions for transferring money from India to abroad:

- 30+ Multi-Currency Virtual Accounts: We provide global and local named virtual accounts, including USD, EUR, GBP, and INR and offer flexibility for both personal and business transactions for seamless payments and cross-border transactions.

- Competitive Exchange Rates: With some of the most competitive exchange rates in the market, DSGPay ensures that users get maximum value for their money, which is ideal for workers and small businesses managing international payments.

- Cross-Border Collections & Payouts: Receive payments from global customers, marketplaces, and platforms, and settle funds in your preferred currency.

- Fast and Secure Transfers: With DSGPay, you can send and receive funds with real-time processing.

- Regulatory Compliance: Fully licensed and regulated in jurisdictions like Hong Kong and Australia, offering peace of mind for all transactions.

Ready to transfer money from India to abroad? Experience fast, secure, and affordable remittances with DSGPay!