One of Southeast Asia’s largest economies is witnessing a significant transformation with the advent of digital financial services in Indonesia. This trend is not only reshaping the financial sector but also has crucial implications for Indonesia’s broader economic landscape.

The Emergence of Digital Financial Services in Indonesia

The rise of digital financial services in Indonesia has been facilitated by high mobile penetration and supportive governmental policies. Indonesia, with over 270 million people, boasts a massive digital user base that serves as fertile ground for the proliferation of these services. Key players driving this digital revolution include well-established platforms like GoPay, OVO, LinkAja, and Dana, along with innovative fintech start-ups introducing a wider variety of financial services to the public.

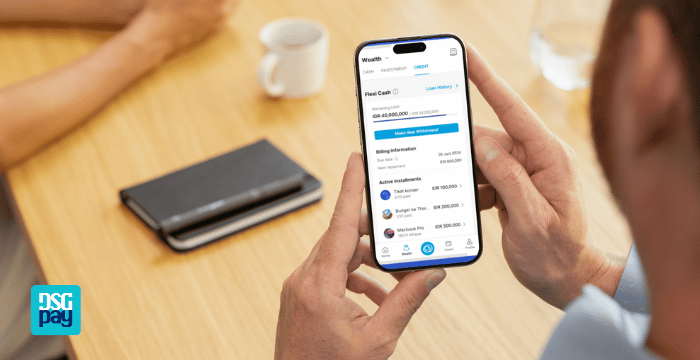

These services cover a spectrum of financial needs, including e-wallets, digital banking, peer-to-peer (P2P) lending, and investment platforms. The digital shift is supported by regulatory frameworks such as those from Bank Indonesia (BI) and the Financial Services Authority (OJK), which aim to promote safe and inclusive financial technology.

Role of Digital Financial Services in Expanding Financial Inclusion in Indonesia

For Indonesia, with its dispersed island geography and significant unbanked population, digital financial services play a crucial role in expanding financial inclusion. These services are bridging the financial divide, providing accessible and affordable financial services to those previously without.

Case study such as Jenius, a digital bank launched by Bank BTPN, provides straightforward access to banking services, including the ability to open accounts, save, and obtain credit through mobile devices. These innovations are helping finance companies in Indonesia bring essential services to people who had previously been excluded from the traditional banking system.

Economic Impact of Digital Financial Services in Indonesia

Digital financial services are significantly influencing the dynamics of Indonesia’s economy. They support small and medium enterprises by streamlining transactions and facilitating access to credit, bolstering entrepreneurial growth. Furthermore, digital finance services have a substantial impact on remittances, both domestic and international. These services reduce transfer fees, expedite transactions, and help families receive funds more efficiently. On a macroeconomic scale, this accelerates cash flow and contributes to GDP growth by improving financial fluidity and increasing consumer spending.

Digital Financial Services and the Transformation of Indonesia’s Financial Sector

The rise of digital financial services has prompted traditional financial institutions to evolve and embrace digital transformation. Concurrently, the fintech landscape in Indonesia is growing rapidly, with start-ups introducing disruptive solutions.

Challenges and Risks for Digital Financial Services in Indonesia

Despite promising advancements, digital financial services also need to improve. Cybersecurity and data privacy are pressing concerns that need to be addressed as more individuals and businesses adopt digital financial services. Regulatory hurdles also exist, with the need for policy adaptations to foster growth while ensuring consumer protection.

The Future of Digital Financial Services in Indonesia

Looking ahead, digital financial services in Indonesia are set for dynamic growth, driven by evolving consumer demands, technological advancements, and regulatory support. The integration of artificial intelligence (AI) and blockchain technology will likely bring even more secure, efficient, and transparent services. As fintech solutions become more embedded in daily life, partnerships between tech companies, finance companies in Indonesia, and government agencies will be critical to navigating this new era.

Conclusion

The rise of digital financial services in Indonesia represents a significant shift in the country’s financial and economic landscape. As we navigate this digital transformation, it’s crucial to seize opportunities while addressing the challenges to ensure that all segments of society can realise the benefits of digital finance.

As the digital financial landscape in Indonesia continues to evolve, your business needs a trusted partner like DSGPay to navigate this shift successfully. We’re here to assist you in shaping Indonesia’s digital future – contact us today to learn how.