The Fintech Revolution in Vietnam is reshaping the nation’s financial landscape, bringing unparalleled opportunities for financial inclusion and economic growth. This vibrant Southeast Asian country, known for its dynamic culture and rapid development, is witnessing a technological transformation that is revolutionizing how people access financial services.

This article takes you on a journey through Vietnam’s evolving fintech landscape, revealing the role of digital financial services in advancing financial inclusion.

The Rise of the Fintech Revolution in Vietnam

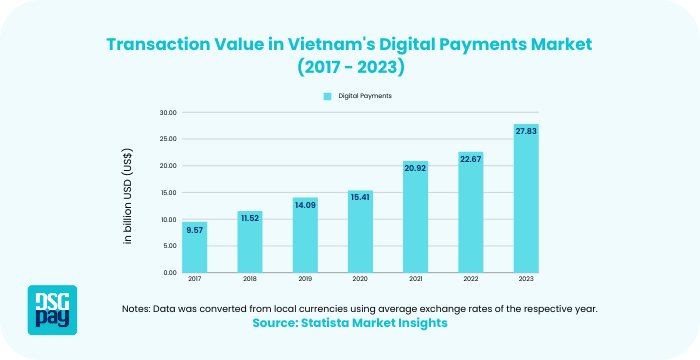

The fintech revolution in Vietnam has grown exponentially in recent years, driven by increasing internet and smartphone penetration, a supportive regulatory environment, and rising awareness of digital services. This growth has given rise to innovative fintech solutions, ranging from digital payments and peer-to-peer lending to Insurtech and robo-advisory services. The country has become a fertile ground for startups and established financial institutions to collaborate and create cutting-edge services that meet the needs of an increasingly digital-savvy population.

How Fintech Enhances Financial Inclusion

A key driver behind Vietnam’s fintech revolution is its impact on financial inclusion. Despite its rapid development, a significant proportion of Vietnam’s population remains unbanked or underbanked. Fintech solutions bridge this gap by making financial services more accessible.

Digital wallets, mobile banking apps, and online lending platforms empower individuals who previously had limited access to banking services. These technologies allow people to save, invest, and borrow money conveniently, bringing them into the fold of the formal financial system.

Driving Economic Growth with Fintech

The expansion of digital financial services is not just transforming individual access to financial services, it is also driving economic progress. The fintech revolution in Vietnam is empowering small and medium enterprises (SMEs) by providing them access to credit and other financial services, enabling these businesses to thrive and contribute significantly to Vietnam’s economy. With the fintech revolution in Vietnam, entrepreneurs and small business owners now have the financial tools they need to expand. This financial empowerment directly contributes to job creation, innovation, and overall economic resilience.

In addition, fintech is revolutionizing cross-border remittances, a significant income source for many Vietnamese families. By offering faster, cheaper, and more transparent money transfer solutions, these platforms are empowering individuals and small businesses alike, further fueling economic activity and fostering stronger connections with global markets

Overcoming Challenges for a Brighter Fintech Future

Despite the promising growth, the fintech revolution in Vietnam faces several challenges, including regulatory hurdles, cybersecurity concerns, and limited digital literacy among the older population. Addressing these challenges is essential for the sustained growth of the fintech revolution in Vietnam. Regulators and fintech companies must collaborate to create policies that foster innovation while ensuring security. Initiatives aimed at improving digital literacy are crucial to ensure that all segments of the population can participate in and benefit from Vietnam’s fintech revolution.

The Future of Fintech in Vietnam

The future looks bright for the fintech revolution in Vietnam, with the continued growth of digital financial services promising to enhance financial inclusion further. The fintech revolution in Vietnam is set to introduce more innovative solutions tailored to the unique needs of the Vietnamese population. By leveraging new technologies such as blockchain, artificial intelligence, and machine learning, the fintech sector will likely overcome existing challenges and pave the way for more widespread financial inclusion.

Conclusion

The rise of the fintech revolution in Vietnam is a testament to the power of digital transformation in promoting financial inclusion and driving economic growth. As the country continues to embrace digital financial services, the journey towards a more inclusive financial sector is just beginning.

Unlock Financial Opportunities with DSGPay

Take advantage of Vietnam’s digital financial evolution. Contact us to learn more about how you can take advantage of these developments:

- Multi-Currency Virtual Accounts: Access over 30 currencies, including VND, for seamless global transactions.

- Competitive Exchange Rates: Save on every transaction with low-cost currency conversions.

- Effortless API Integration: Quick and easy setup to streamline your business operations.

- Real-Time Payment Notifications: Stay updated on incoming and outgoing payments instantly.

- 7-Day Availability: DSGPay is operational every day, ensuring constant support.