Local payment methods in Australia are growing and diversifying with the rise of online shopping in Australia. Technological developments are shaping the future of payments. They’re contributing to the rapid adoption of digital payments in Australia.

According to the Reserve Bank of Australia’s 2022 Consumer Payments Survey, around only 13% of payments were made with cash in 2022.

Customers and businesses are opting for online, convenient, and secure payment methods in Australia. Some payment methods are gaining popularity in Australia due to their ability to conduct contactless transactions and enhance the checkout experience.

This blog will give you an overview of the popular payment methods in Australia.

Table of Contents

Debit and Credit Cards

Three-quarters of payments in 2022 were made with cards, as per the RBA Consumer Payments Survey 2022.

Consumers continue to shift from cash to online payment methods in Australia. Debit cards and credit cards are gaining preference due to convenience, especially contactless card payments.

Credit and debit cards being secure and fully encrypted is another selling point.

A large number of businesses now accept card payments, which has led to innovations like mobile payment apps and digital wallets. Since these payment solutions are also gaining popularity in Australia, you can find more about them below.

Digital Wallets or E-wallets

Digital wallets or e-wallets are some of the popular online payment methods in Australia.

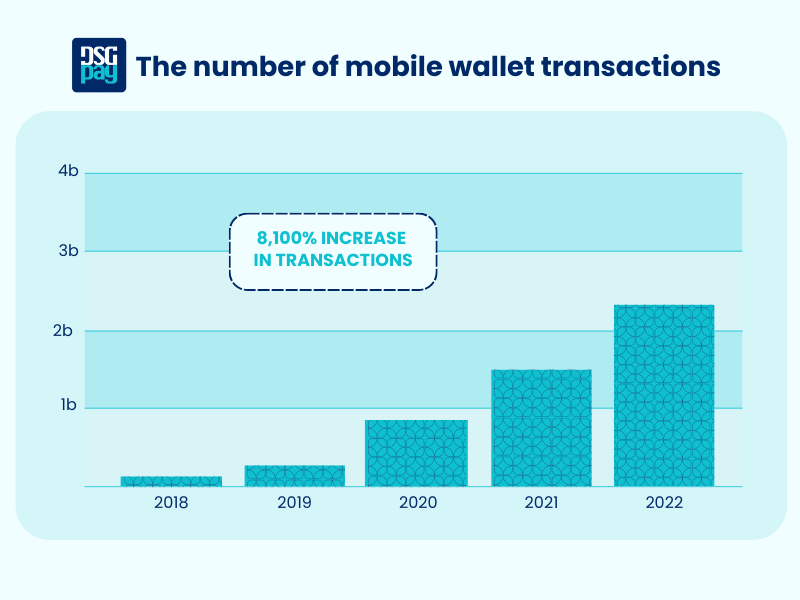

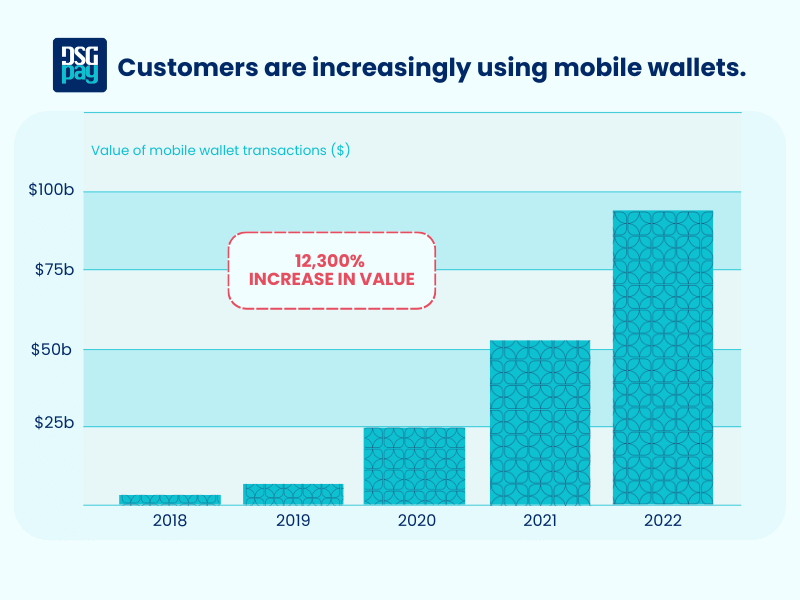

The Australian Banking Association reported that the value of mobile wallet transactions witnessed a 12,400% increase between 2018 and 2022—from $746 million in 2018 to $93 billion in 2022. The number of mobile wallet transactions saw an 8,200% increase during the same period.

This popularity can be attributed to the convenience of digital wallets.

Features of Digital Wallets as Payment Methods in Australia:

- You can add several debit and credit cards to your digital wallet.

- Digital wallets also let you store event tickets and membership cards.

- They can be used for e-commerce purchases with an embedded link and in-person payments with the tap of your phone using NFC technology.

- They’re fully encrypted with passwords, making them a secure payment option for businesses and consumers.

Apple Pay, Google Pay, Samsung Wallet, and PayPal are a few popular e-wallet payment services.

Buy Now Pay Later (BNPL)

Buy Now Pay Later (BNPL) is a payment method in Australia that’s quickly growing in popularity. BNPL allows you to make a purchase immediately and spread out the cost over a fixed period. Klarna, Afterpay, Zip, and PayPal Pay in 4 are some of the BNPL providers in Australia.

Features of the BNPL Payment Method:

- Low or no-interest repayment instalments, usually on a weekly or monthly basis.

- You might not face any fees or be subject to a hard credit check.

- BNPL gives you the ability to make purchases that you might not have been able to make otherwise by spreading the payment into smaller amounts.

- BNPL payment method can be integrated into the checkout process, making it convenient to make online purchases.

How Does BNPL Work?

Signing up for BNPL and using it as payment is usually a straightforward process.

- Choose a BNPL provider and sign up with them.

- Once you’re approved, you’ll be asked to either link your debit or credit card to the account.

- In the account, you’ll get a view of your account limit and repayment schedule. You’ll be able to manage and adjust the repayments from here.

- When making an online purchase, all you need to do is select the Buy Now Pay Later option as your preferred payment method and enter the required details.

- You can also opt for BNPL in-store, if available.

- Once the purchase is made, your repayments will automatically be deducted from your nominated card in instalments.

Not all customers will go for this payment method, but a business with a large Gen Z and millennial customer base might find it to be a popular payment method.

BPAY

BPAY is an easy way to pay bills in Australia. It’s a secure electronic bill payment system available to customers with bank cards from major Australian banks.

BPAY can be used to make bill payments online, via mobile, or over phone banking, to companies that accept this payment method.

Features of BPAY

- Gives you the convenience of making payments 24/7 from anywhere.

- You can use your preferred banking platform for BPAY.

- BPAY can be for one-off payments or you can even set up recurring payments.

- Unique BPAY and biller codes make it easier to keep track of the payments.

Uses of BPAY

Over 55,000 businesses offer the BPAY bill payment solution. It can be used for a wide variety of transactions and bill payments, including:

- Personal bill payments such as utilities, credit cards, and others.

- Income tax, and other tax payments.

- Business billing where customers can be offered an additional payment option of using BPAY.

- Batch payments for businesses processing multiple transactions at once.

Peer-to-peer (P2P) Payment Platforms

P2P payment platforms refer to online payment services like PayPal and Venmo. They allow you to send and receive money quickly via the accounts registered on your mobile phones. These accounts are usually linked to a bank account or card.

The payment platforms prioritise encryption and authentication to prevent fraud and secure the customers’ accounts.

POLi Payments

POLi Payments was once a popular choice for online transactions in Australia, known for its convenience and integration with various Australian banks. However, as of 30 September 2023, POLi Payments has officially discontinued its operations in Australia. This move leaves a gap for businesses and consumers seeking a reliable payment solution.

Why DSGPay is the Perfect Alternative Payment Method in Australia

DSGPay is at the forefront of embedded finance. We integrate financial products into various platforms to offer consumers and businesses a convenient, personalised, and seamless e-commerce experience. This can help you boost customer engagement, expand your business’s reach, and leverage data to optimise your offerings.

Universal Banking Support

DSGPay connects seamlessly with all major Australian banks through PayID, ensuring broad network coverage.

Fast Transactions

Experience real-time payment processing with DSGPay, eliminating delays and improving transaction efficiency.

Settlement

Benefit from same-day settlement with DSGPay, enhancing cash flow and operational efficiency.

Cost-Effective

DSGPay offers a cost-effective solution with competitive pricing, providing excellent value for businesses.

At DSGPay, we also offer secure and reliable payment solutions, such as local payment technologies, open banking, QR codes, dynamic virtual accounts, and more, for e-commerce businesses.

Contact us to get customised solutions and transform your business.