Bank account transfers are an integral part of personal and business finance, allowing people to send money to friends, family, or businesses seamlessly. With the rise of digital banking, transferring funds has become faster and more accessible, but the process still carries nuances that users need to understand.

This article will do a deep dive into everything you need to know about bank account transfers, including tips, tricks, and common pitfalls to avoid when you are about to send or receive cash.

Table of Contents

Types of Bank Account Transfers

Bank account transfers come in different forms depending on the purpose, speed, and the systems involved.

Let’s explore the most common types:

1. Internal Transfers

Internal transfers occur within the same bank, moving funds between accounts owned by the same individual or different account holders within the bank. They’re usually instant and free.

2. Interbank Transfers

These involve sending money from one bank to another. Common systems for interbank transfers include:

- ACH (Automated Clearing House): Used mainly in the U.S., ACH transfers are cost-effective but take a day or two.

- Wire Transfers: Faster than ACH but usually come with higher fees. Wire transfers are best for urgent and large transactions.

- Real-Time Payments (RTP): A newer system offering immediate interbank transfers, often available 24/7.

3. International Transfers

Sending money across borders often involves:

- SWIFT Network: Common for global transactions, SWIFT allows banks worldwide to communicate securely. Fees can be high, and processing times may range from 1–5 business days.

- Specialized Money Transfer Services: Companies like Wise or PayPal can be faster and cheaper for certain international transfers.

Key Factors to Consider Before Making a Transfer

| Factors | Description |

|---|---|

| Fees and Charges | Bank account transfers aren’t always free. Fees can vary depending on: • The type of transfer (e.g., wire vs. ACH) • Whether it’s domestic or international • The bank or service provider Tip: Look for banks or platforms offering fee waivers or lower charges for regular customers. |

| Transfer Speed | Not all transfers are instant. ACH transfers may take 1–3 business days, while wire transfers and RTPs are faster. International transfers may take even longer due to currency conversions and intermediary banks. |

| Exchange Rates | For international transfers, be mindful of exchange rates. Banks and services often charge a markup on the exchange rate, so compare rates before committing. |

| Limits | Banks and services often impose limits on how much you can transfer daily or monthly. Verify these limits to avoid inconveniences. |

| Security | Use secure networks and avoid sharing sensitive information like your banking credentials over email or unsecured platforms. |

How to Make a Bank Transfer?

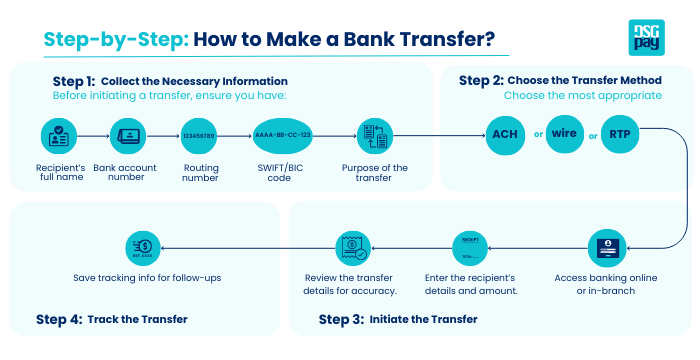

Initiating a bank transfer is generally a straightforward process, but the specific steps may vary depending on the platform or bank being used.

Typically, the process begins with logging into your online banking portal or mobile app. Once logged in, navigate to the “Transfers” or “Payments” section and select the type of transfer you want to initiate; such as ACH, wire transfer, or Real-Time Payment (RTP). Next, you’ll need to provide key details, including the recipient’s name, bank account number, routing number, and, in some cases, their address or SWIFT/BIC code for international transfers.

Step 1: Collect the Necessary Information

Before initiating a transfer, ensure you have:

- Recipient’s full name

- Bank account number

- Routing number (for U.S. banks)

- SWIFT/BIC code (for international transfers)

- Purpose of the transfer (required for some international transactions)

Step 2: Choose the Transfer Method

Choose the most appropriate transfer type, ACH, wire, or RTP, by evaluating the urgency of the transaction and the associated costs.

ACH transfers are generally the most cost-effective option for non-urgent transactions, often taking 1-3 business days to process, making them ideal for routine payments or transfers with flexible timelines.

Wire transfers, while more expensive, are best suited for high-value, time-sensitive transactions, as they typically provide same-day processing and robust tracking capabilities.

Step 3: Initiate the Transfer

- Log in to your online banking platform or visit your local branch.

- Enter the recipient’s details and amount.

- Review the transfer details for accuracy.

- Confirm the transaction.

Step 4: Track the Transfer

Most banks provide tracking IDs or reference numbers to help you follow the progress of your transfer. Save this information in case of delays or disputes.

Common Issues and How to Avoid Them

| Issues | Solutions |

|---|---|

| Incorrect Details Entering the wrong account number or routing code can cause delays or lost funds. | Always double-check before confirming. |

| Delays Delays can occur due to processing times, weekends, or public holidays. | Plan transfers ahead to avoid disruptions. |

| High Fees Unexpected fees can surprise you, especially with international transfers. | Compare banks and money transfer services to find the most cost-effective option. |

| Fraud Fraudsters may attempt to intercept sensitive information. | Avoid sharing personal banking details through insecure channels and enable two-factor authentication where possible. |

Tips and Tricks for Hassle-Free Bank Transfers

1. Use Mobile Banking Apps

Mobile banking apps simplify the transfer process and offer features like recurring payments, instant transfers, and notifications.

2. Leverage Free Transfer Options

Some banks offer fee-free transfers for certain accounts or platforms. Explore these to save on costs.

3. Optimize International Transfers

Use services like Wise or PayPal for better exchange rates and lower fees, and consider sending funds in batches to reduce per-transfer costs.

4. Schedule Transfers

Plan ahead and schedule payments for recurring expenses, such as rent or utility bills. This ensures you never miss a deadline.

5. Keep a Record

Always save transaction receipts or screenshots of your transfers for future reference.

Understanding Bank Account Transfer Innovations

1. Real-Time Payments (RTP)

RTP systems are gaining popularity for their speed and convenience. Unlike ACH, RTP operates 24/7 and processes transfers instantly.

2. Blockchain Technology

Blockchain-based transfers, like those using cryptocurrencies, offer fast and secure alternatives for international payments. Platforms like RippleNet are gaining traction for cross-border banking.

3. Open Banking APIs

Open banking allows third-party services to integrate with banks, providing more personalized and efficient transfer solutions.

Bank Account Transfer Etiquette for Businesses

Businesses often rely on bank transfers for payroll, supplier payments, and customer refunds. Here’s how to ensure smooth operations:

1. Automate Payments

Use payroll and accounting software to automate recurring payments, reducing errors and saving time.

2. Communicate with Recipients

Always inform recipients when payments are initiated, including expected delivery times and amounts.

3. Track Large Bank Account Transfers

For high-value transactions, use tracking tools and maintain direct communication with your bank to prevent delays.

FAQs About Bank Account Transfers

| Q: Can I cancel a bank transfer? It depends on the transfer type. ACH transfers can often be cancelled if caught early, but wire transfers are harder to reverse once processed. |

| Q: What happens if I send money to the wrong account? Contact your bank immediately. They may be able to recover the funds, but success depends on the recipient’s cooperation. |

| Q: Are bank account transfers safe? Yes, when conducted through secure platforms and trusted financial institutions. Always use strong passwords and avoid sharing sensitive information. |

| Q: How do I minimize international transfer costs? Compare fees and exchange rates across bank account transfers and services. Opt for services with transparent pricing, like Wise or Revolut. |

The Future of Bank Account Transfers

As technology advances, bank account transfers will become even faster, cheaper, and more secure. Emerging trends like blockchain, AI-powered fraud detection, and open banking are set to revolutionize the way we send money.

For now, staying informed about transfer options, fees, and security measures is your best bet for smooth transactions. Whether you’re sending money to a loved one or making international payments, understanding the nuances of bank transfers can save you time, money, and unnecessary stress.

Bank account transfers are essential, but with the right knowledge and tools, you can navigate the process like a pro. Use these tips and tricks to make your transactions efficient and secure.

Why Businesses Are Choosing Virtual Accounts Over Bank Transfers

Businesses are increasingly turning to virtual accounts for their payment needs due to their convenience and adaptability. Unlike traditional bank transfers, virtual accounts offer modern solutions that make financial management simpler and more efficient:

- Quick and Easy Setup: Setting up a virtual account is faster and more straightforward than opening multiple bank accounts, often requiring just a few steps online.

- Hassle-Free Verification: Virtual accounts simplify KYC processes, enabling businesses to verify their details securely and quickly without extensive paperwork.

- Simplified Payment Management: Manage multiple currencies and transactions effortlessly without the need for numerous bank accounts.

- Cost Savings: Lower transaction fees make virtual accounts a cost-effective choice, especially for international and frequent payments.

- Real-Time Updates: Instant payment notifications and automated reconciliation provide better visibility and control over finances.

- Faster Cross-Border Transactions: Virtual accounts ensure quicker processing times, making them ideal for global business operations.

Ready to Transform the Way Your Business Handles Payments With DSGPay?

DSGPay revolutionizes the way businesses handle transactions, offering a streamlined platform that makes managing payments effortless. With competitive fees and transparent pricing, DSGPay ensures you can plan your transfers with confidence, free from hidden fees. Whether you’re sending payments locally or managing global transactions, DSGPay empowers your business with secure, efficient solutions.

Why Choose DSGPay?

- Licensed and Regulated: DSGPay offers a secure and trustworthy payment solution that complies with the highest regulatory standards.

- Dedicated Virtual Accounts: Benefit from personalized banking experiences with virtual accounts held at prestigious institutions

- Local Collection and Payout Solutions Across Asia: With local payment solutions for both B2B and C2B transactions across Asia, DSGPay helps you penetrate diverse markets with ease.

- Reliable SWIFT Payment Rail: For international transactions, DSGPay uses the trusted SWIFT network to ensure fast, secure, and efficient cross-border payments.

- Support for Global and Exotic Currencies: DSGPay offers extensive currency support, including major global currencies and exotic Asian currencies, giving your business the flexibility to operate efficiently across regions.