Nothing stays the same forever, and that’s a good thing—innovation aims to improve our lives. The world of finance is no exception. Traditional banking, with its reliance on physical branches, manual processes, and in-person services, is becoming a relic of the past.

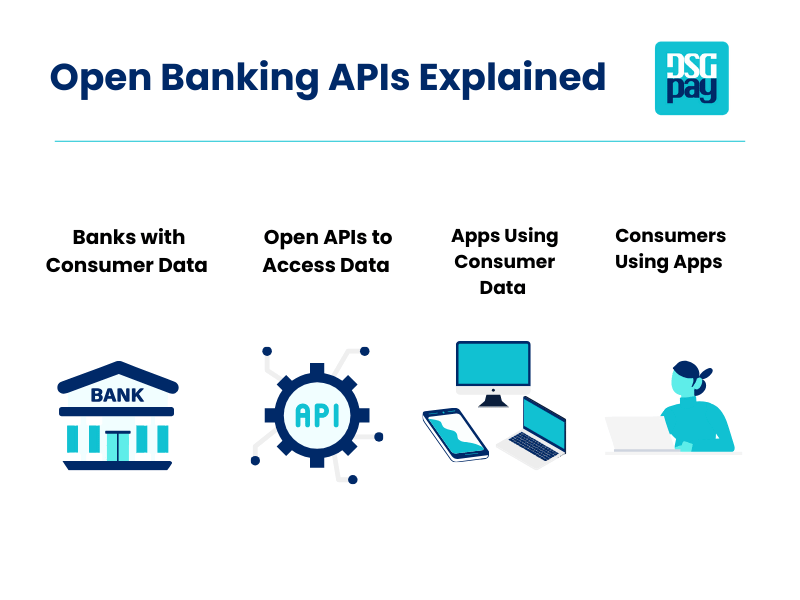

Open Banking APIs are coming to the scene and redefining how we interact with banking institutions. They knock down the barriers between financial institutions, offering consumers more power and flexibility than ever over their banking experience. Business owners or consumers constantly seek the best open banking API to provide them with seamless, secure, and innovative financial solutions. In this article, we’ll dive deeper into the world of open banking APIs and explore some of the best open banking API providers.

Quick Overview

What is An API?

If you work in the tech industry, chances are you’ve heard the term API before. But what exactly is an API?API stands for Application Programming Interface, which means that when different software systems are integrated and become compatible to work together seamlessly. Some common examples for personal use are connecting your Spotify account to your car dashboard or signing in to a website using your Google or Facebook account. Those are from APIs working behind the scenes, allowing those different applications to talk to each other and share data. This allows users to access various apps or systems without constantly switching between them.

What is An Open Banking API?

An Open Banking API is a way for banks or financial services to securely share their customers’ financial data with other authorized companies. Users can manage their accounts, transfer funds, collect payments, and access other financial services all in one place. Think of it as a hub that connects all your financial accounts and transactions, making it easier for you to keep track of your money.

Businesses in the 21st century are constantly seeking ways to streamline operations and increase efficiency. That’s when Open Banking API comes into play. It allows businesses to access real-time, accurate financial data from their customers’ bank accounts. This eliminates the need for manual data entry and reduces the risk of human error. By using an Open Banking API, businesses can automate processes, make more informed decisions, and provide better services to their customers.

Best Open Banking API Solutions of 2024

With so many options out there in the financial services landscape, finding the best open banking API that best suits your business needs can be overwhelming. We’ve done the legwork for you, diving into user reviews and industry insights to bring you our top picks for 2024.

GoCardless

GoCardless is a leading online direct debit provider that offers businesses a secure and fast way to collect customer payments. With its Open Banking API, businesses can easily set up direct debits and monitor real-time payments, giving them greater control over cash flow.

Plaid

Plaid’s open banking system specializes in democratizing financial services through technology, providing consumer-friendly experiences, developer-oriented infrastructure, and tools for creating financial products. Users often describe Plaid’s support as solid and reliable, making it a suitable option for companies needing dependable assistance with platform integration.

Stripe

Stripe is a leading online payment processing company for businesses of all sizes. One of its key strengths is its documentation and Open Banking API, making it a popular choice for companies looking for a seamless payment integration experience. Many users have praised Stripe’s documentation for being clear, easy to follow, and comprehensive. This makes it easy for developers to understand and integrate Stripe’s services into their own platforms.

Tink

Tink was founded in 2012 in Stockholm, Sweden, to improve financial services through technology. Today, Tink is a leading open banking platform offering various solutions for businesses of all sizes. Its platform is suitable for large companies, fintech startups, and banks alike, making it a versatile solution for organizations with varying needs.

Yapily

Yapily is a leading open banking platform in Europe, addressing the challenge of integrating with banks amid increasing digitization in financial services. Praised for simplifying bank integration, Yapily offers a robust API that ensures smooth and secure data access. Transparency in API visibility enhances client confidence, though some users note limitations in flexibility for unique business needs and scalability concerns as businesses expand.

How Open Banking APIs Work

Open banking APIs function by creating a secure and standardized way for banks to share data with authorized third parties. Several steps must be completed to connect a financial institution and a third-party financial service successfully.

Customer Consent

The process begins when customers consent to share their banking data with their chosen third party, typically through an online platform or mobile app.

API Integration

Banks and third parties use standardized APIs to ensure that data is consistent and secure.

Authentication

Customers will authenticate themselves using a secure multi-factor authentication to ensure the person providing consent is the account holder. This may include text messages, email, or the use of an authenticator application.

Data Sharing

Once authenticated, the bank shares the requested financial data with the third party using the API

Open APIs can communicate real-time ongoing data such as account balances, transaction history, payment information, and more, which allows third-party integrators to offer more sophisticated use cases in their product offerings.

Benefits of Open Banking APIs

Open banking promises a myriad of innovations in a stagnant banking industry. These benefits improve the banking experience for consumers and the value of financial institutions while allowing third-party developers to take banking into the 21st century.

Benefits of Open Banking APIs for Business Use

- Increased convenience and efficiency for businesses managing their customers’ payment processing operations. Businesses can seamlessly collect customer payments securely, saving time and money compared to traditional payment methods.

- Integrating Open Banking APIs improves user experience, allowing businesses to offer responsive and reliable payment options to customers and ultimately generate more revenue.

- Open Banking promotes cost reduction and margins for small and medium enterprises by eliminating third-party payment gateways. Businesses can access real-time account information, which provides accurate data necessary for financial planning.

- New market and business opportunities are directly tied to open banking, increased data visibility, and cross-border capabilities, ultimately opening up new markets.

Benefits of Open Banking APIs for Personal Use

- Improved financial management with integrations like budgeting tools, financial planning applications, and other services that collect, analyze and report financial data in real-time.

- With enhanced financial transparency through APIs, consumers can access a more wholesome and comprehensive view of their economic situation, providing them with the information they need to make informed decisions.

- Increased payment options allow consumers to make payments directly from their bank accounts and bypass credit and debit card processes. They can also link certain accounts for future or recurring use.

Is Open Banking Safe?

Security in open banking is paramount, and because these networks are built for the modern-day consumer, are more secure with added technology than traditional banking ever could be.

Strong Authentication Process

The cornerstone of financial security, Multi-factor authenticators ensure that steps are taken in every process to ensure that the person making changes to their financial data is who they say they are. Biometric verification is also beginning to be used as an added level of security.

Data Encryption

Data exchanged between banks and fintech services is encrypted, ensuring all information remains confidential and never falls into the wrong hands.

Regulatory Management

Compliance processes are strict with banking APIs, and many different country-specific and global regulations ensure that the authentication, encryption, and consent processes are followed step by step.

What are some common open banking API use cases?

| Use Case | Description | Example |

| Banking Integration | Integrating multiple banking services into a unified platform. | Open banking allows combining payment, transfer, and savings services into a single app for seamless financial management, enhancing user convenience and control over their finances. |

| Personalized Insurance | Customizing insurance premiums based on customer financial profiles. | With open banking, insurance rates and coverage can be adjusted based on individual financial data, better meeting customer needs and offering more competitive pricing. |

| Customer Rewards | Tailoring rewards based on customer spending habits. | Using open banking transaction data, personalized rewards can be offered through loyalty programs, increasing customer loyalty and satisfaction. |

| Transaction Processing | Automating payment matching with invoices. | Open banking enables automatic reconciliation of payments and invoices, streamlining accounting processes and reducing errors. |

| Identity Verification | Securely verifying customer identities. | Verifying customer identities using secure open banking methods before processing transactions helps prevent fraud and enhances security. |

| Income Verification | Speeding up loan approvals with accurate income checks. | Open banking allows quick verification of borrower income through digital channels, expediting loan approvals and decisions. |

| Financial Management | Aggregating transaction data for budgeting purposes. | Open banking provides users with a consolidated view of their finances across accounts and cards, aiding in better financial planning and budgeting. |

| Credit Assessment | Evaluating creditworthiness using detailed financial data. | Open banking insights offer lenders comprehensive credit reports and risk assessments, improving the accuracy of credit evaluations. |

| Overdraft Management | Analyzing transaction patterns for personalized overdraft solutions. | Open banking can analyze spending patterns to offer tailored overdraft protection options, minimizing customer fees and financial stress. |

| Debt Collection | Streamlining recovery efforts with debtor financial data. | Open banking enhances debt recovery processes by analyzing the debtor’s financial status and negotiating effective repayment plans. |

| P2P Transfers | Facilitating fast and secure fund transfers. | Open banking enables quick and secure peer-to-peer money transfers, leveraging advanced digital banking technologies for efficient transactions. |

The Future of Open Banking APIs

With the rapid emergence of new Open Banking API use cases, it’s exciting to witness their impact on consumers’ lives. One significant aspect of mobile and online banking for consumers is making payments, a process that has become increasingly complex as technology has advanced.

Today, there are more payment options than ever, such as direct bank transfers, digital wallets, and peer-to-peer payment platforms. However, not all methods are equally efficient and secure, and it can take some effort to sift through the available options to find the best open banking API.

DSGPay’s Open Banking Solutions

DSGpay is a payment platform revolutionizing online transactions in Asia with cross-border payments, collections, and virtual accounts connecting billions of consumers and businesses. As a payment platform built for the future of banking, DSGpay delivers the following:

- Real-time efficiency with integrated real-time transactions for collections and payments across numerous local Asian payment networks.

- Industry-leading technology with a state-of-the-art API embedded across mobile and web-based applications

- Resilience and drive, with a commitment to operational and technological excellence.

- Open to a broad range of fintech uses for payment providers/digital wallets, e-commerce checkout, and mobile/online gaming.

As the future of banking continues to evolve, businesses and consumers must embrace the opportunities presented by open banking APIs or get lost in the past.

With over ten years of experience, 10 billion transactions, 81 countries growing, and 25,000+ global partners and payout agents, DSGpay is in a position to redefine payments and collections.