As the way we shop online changes, businesses need to keep up with how consumers prefer to pay. According to Statista, in 2023, the global value of open banking payments reached $57 billion, with projections indicating significant growth in the coming years. This shift shows that offering more than just traditional payment options is no longer just a nice-to-have feature. Whether you’re looking to cut down on fees, make payments easier for customers, or grow your business internationally, finding the right card payment alternatives can play a big role in your success.

We’ve done the research to help you find the card payment alternatives that work best for your business. With these insights, you’ll be able to provide your customers with more payment options, enhance convenience, and optimize your operations, whether you’re managing a small business or a large organization.

Table of Contents

What to Look for When Choosing Card Payment Alternatives

Before diving into the card payment alternatives, it’s essential to first understand what factors to consider when choosing the right options for your business. Taking the following considerations into account will help you make informed decisions and set your business up for success.

- Understand Your Needs: Assess your transaction volume, frequency, and whether you need domestic or international payments.

- Check Security: Opt for solutions with encryption, tokenization, and regulatory compliance.

- Compare Costs: Analyze transaction and conversion fees to find the most cost-effective option.

- Consider Speed: Choose a system that processes payments in real time or within your preferred timeframe.

- Look for Integration: Ensure the payment option integrates seamlessly with your financial systems.

- Check Support: Select a provider with reliable customer service.

1. Digital Wallets

Digital wallets or virtual wallets are the fastest-growing payment method globally. They accounted for 50% of the global e-commerce spend and 30% of the global point of sale spend in 2023. This popularity of digital wallets as a card payment alternative is not surprising as they are easy to use.

Users who use digital wallets are able to store their payment information on their phones. You usually need to simply tap your phone to a terminal to initiate a transaction using near-field communication (NFC) technology. Some popular digital wallets are PayPal, Apple Pay and Google Pay.

DSGPay’s multi-currency virtual accounts offer your business the ability to receive funds from local payment and SWIFT networks and settle funds back to your home country’s main bank accounts via SWIFT.

2. Buy Now Pay Later

Buy Now Pay Later (BNPL) has seen significant growth as a card payment alternative in recent years. It allows you to purchase something without paying the full amount upfront. With BNPL, customers usually make the payment in small instalments over a fixed period. It’s becoming a popular payment method as it allows even customers without credit cards to enjoy a credit-like option.

3. Bank Transfer

Bank transfers, including Automated Clearing House (ACH) payments, involve customers transferring money directly from their bank account to your business. Bank transfers work as card payment alternatives, as customers don’t need a physical card to move the funds.

4. Gift Cards or Prepaid Vouchers

Gift cards or prepaid vouchers available in-store or online can allow your customers to make purchases without credit or debit cards. According to Worldpay, prepaid cards are on the rise and will exceed $1 trillion in global transaction value.

However, a problem with gift cards as card payment alternatives is that they’re usually only available in standardised amounts. This can make using up the whole amount difficult, resulting in either having to top up the funds or leaving funds on the card.

Along with gift cards, prepaid cards can also be used for payroll and business-to-consumer payments.

5. Cash-based Payments and Pay on Delivery

Cash-based payments are great as they allow customers who don’t have bank accounts or cards to shop online.

When making a purchase online, you can select the cash-based payment option on checkout. You can then head to a participating store to pay with cash. The participating store will transfer the funds to the merchant, and your product will be shipped upon receipt of payment.

Alternatively, you might find the option of paying for goods on delivery when ordering online. This is a common practice for food deliveries.

6. Cryptocurrency

While cryptocurrency has become increasingly popular, it’s not necessarily a common card payment alternative. But some businesses do accept it as payment. Cryptocurrency transfers can be complicated and involve high fees, so you should thoroughly assess this method before integrating it into your business.

7. Open Banking Payments

Open Banking allows third-party providers to access bank data in real-time, enabling customers to make secure payments directly from their bank accounts without needing a physical card. This method offers businesses a low-cost, secure alternative to card payments, with the added benefit of reducing chargebacks and improving cash flow. Open Banking also provides consumers with more control over their financial data and faster transaction times, making it an appealing choice for both businesses and customers looking for a modern, seamless payment experience.

DSGPay is at the forefront of harnessing the power of open banking, offering businesses the benefits of higher conversion rates, reduced fraud risks, secure transactions, faster settlements, and mobile-ready payment experiences.

Benefits of Offering Card Payment Alternative Methods

In today’s rapidly evolving digital economy, businesses need to stay ahead of customer preferences, and one major area of change is how people choose to pay. While credit and debit cards remain popular, the rise of alternative payment methods, such as mobile wallets, direct bank transfers, and cryptocurrencies, has opened up new opportunities for businesses to cater to a broader audience. As more consumers seek out options that align with their convenience, security, and lifestyle needs, offering card payment alternatives has become a critical strategy for businesses aiming to stay competitive.

Drive More Sales

If your business accepts a variety of payment methods, it will cater to the needs of a larger customer base. More customers will be willing to make purchases and complete transactions if they see their preferred method of payment on checkout.

Market Expansion

Accepting card payment alternative methods popular in different regions around the world will help your market reach new regions.

Seamless Checkout

Some card payment alternative solutions, such as Buy Now Pay Later, allow customers with little to no credit history to make purchases. This results in a fast and seamless checkout.

Save on Fees

Your business can save money and avoid expensive credit card transaction fees by accepting alternative payment methods. When a customer sees other easier transaction options, they might opt for a method with fewer fees.

Fraud Protection

Many card payment alternatives provide enhanced security during transactions by requiring customers to confirm their identity before using digital wallets. For example, Apple Pay generates a virtual card that conceals real card details from merchants, reducing the risk of fraud in the event of a security breach. This extra layer of protection gives users more confidence when making payments.

Common Reasons Why Users Prefer Cross-Border Payment Over Card Payments

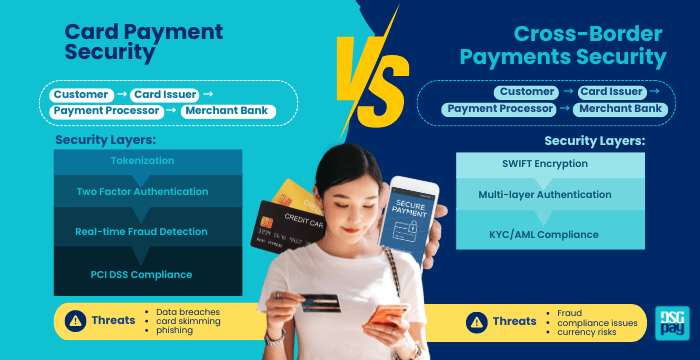

- Lower Fraud Risk: Cross-border payments have fewer vulnerabilities, such as card skimming or phishing, which are common with card payments, reducing the risk of fraud.

- Stronger Authentication: Cross-border payments often require multi-factor authentication (MFA) and other advanced security protocols, providing an extra layer of protection compared to traditional card transactions.

- No Exposure of Card Details: Users don’t have to share sensitive card information, minimizing the risk of data theft in case of merchant breaches or online fraud.

- Regulatory Compliance: Cross-border payments are regulated under strict KYC and AML laws, offering more confidence in the security and transparency of transactions.

DSGPay as a Card Payment Alternative

Having reviewed the different alternative options available, it’s clear that having the right payment partner is crucial to your business success. DSGPay is another trusted method, especially for businesses looking to expand their reach into the Asian market. With deep expertise in the region, DSGPay offers tailored cross-border payment solutions that simplify transactions and support seamless international growth.

Whether you’re targeting customers, suppliers, or partners, DSGPay provides the reliability, speed, and flexibility needed to thrive in a competitive global market. Let us help you unlock new opportunities and optimize your payment strategy.