When it comes to choosing a mass payment provider that best suits your needs whether to employees, vendors, or customers, it’s important to choose a reliable provider. The choice of payment provider can have a significant impact on the efficiency, security, and overall success of mass global payment transactions.

By choosing a reliable provider, businesses can rest assured that their payments will be processed accurately and securely and that their financial information and sensitive data will be protected.

This can be a critical factor for businesses looking to expand globally, as it helps to ensure a seamless payment experience for all parties involved.

Table of Contents

What Is a Mass Payment Provider?

A mass payment provider is a financial service that enables businesses to send bulk payments to multiple recipients simultaneously. These providers streamline the payment process, reducing the administrative burden and ensuring transactions are completed efficiently. Mass payment providers are essential for businesses that need to pay employees, suppliers, freelancers, or customers quickly and securely across different regions or currencies.

What Are the Key Factors for Choosing a Mass Payment Provider?

1. Security

When choosing a mass payment provider, make sure they use secure methods for processing payments, such as encryption and fraud detection. In addition, it’s essential to verify that the provider adheres to all relevant regulations and industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR). This will ensure that businesses and their customers’ financial information and sensitive data are protected and that the payment process is secure and compliant with all applicable laws and standards.

2. Fees

When considering different mass payment providers for global payments, compare their fees and pricing structures for mass global payments, it is important to compare their fees and pricing structures. Different providers may offer different pricing models, such as flat fees, percentage-based fees, or a combination of both. It is important to carefully review these fees and compare them to other providers to ensure that you are getting the best deal.

3. Payment Methods

When choosing a mass provider, it’s important to consider what payment methods they support and whether they align with your business needs and the needs of your recipients.

Some providers may only support bank transfers, which can be slow and may require additional steps. Other providers may also support credit and debit cards, e-wallets, and other forms of electronic payments, which can be more convenient and faster for your recipients.

4. Processing Times

When selecting a mass payment provider, it is important to consider the processing speed of mass global payments when choosing a provider. A fast processing time can be crucial for businesses that need to make timely payments to employees, vendors, or customers. Mass payment providers that offer real-time processing can help businesses avoid any delays or disruptions in their payment operations.

5. Global Coverage

If your business needs to make mass global payments to people in different countries, look for a provider with global coverage. This will ensure that you can make fast and secure payments to anyone, anywhere in the world.

6. Customer Support

For mass global payments, look for providers that offer excellent customer support. This is especially important if you have any questions or concerns about the payment process.

Whether you are looking for guidance on a particular aspect of the payment process or need assistance with a technical issue, having a provider with a responsive and knowledgeable support team can be a valuable asset.

7. Integration

Check to see if the provider can integrate with your current accounting or payroll software. This can help streamline the payment process and reduce the risk of errors. Additionally, having an integrated solution can save you time by eliminating the need to manually enter payment information into multiple systems. This can be especially important if you have a large number of vendors or employees who need to be paid regularly.

When it comes to making mass global payments, it’s important to choose a provider that can meet your specific needs. By considering these key factors, you can ensure that you select a provider that is both reliable and cost-effective.

DSGPay: A Reliable Mass Payment Provider

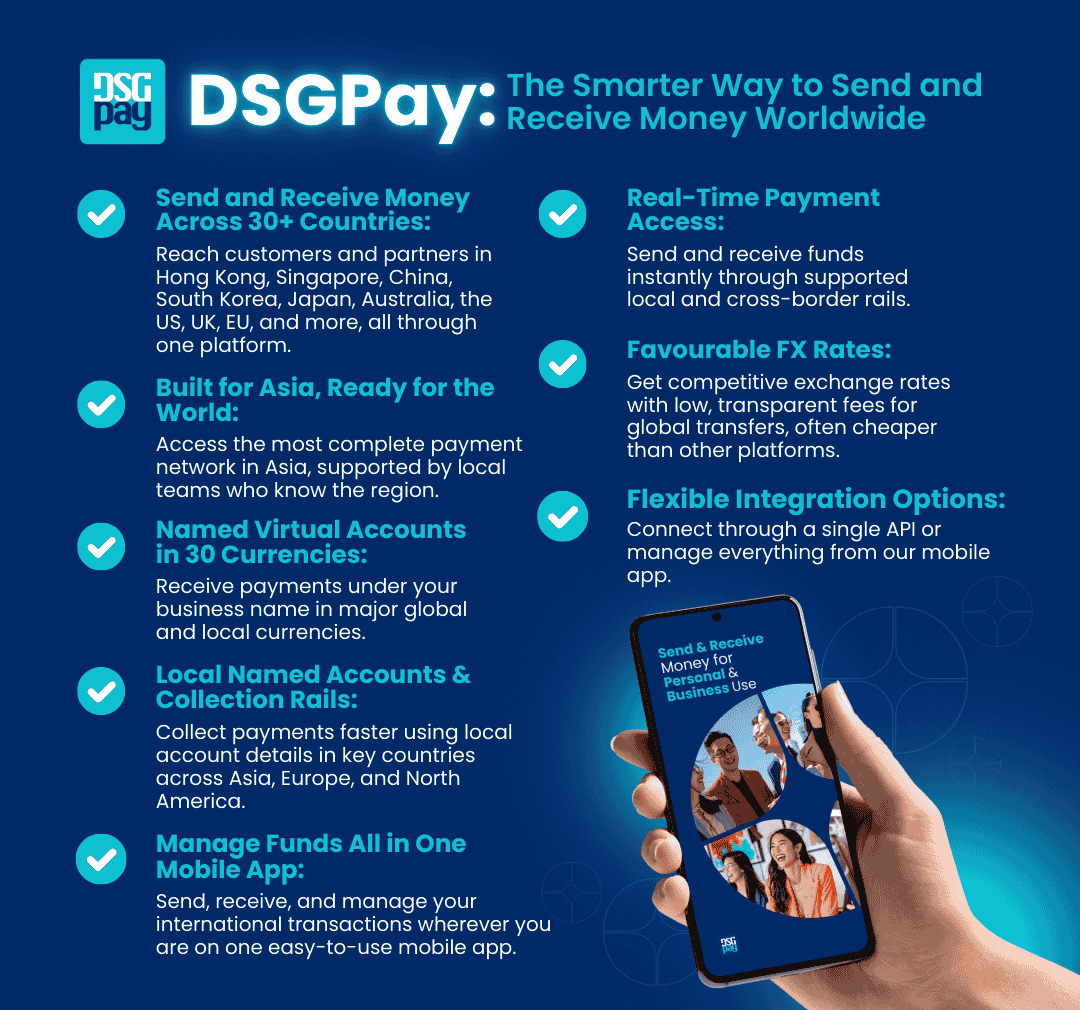

DSGPay is a trusted mass payment provider offering secure and efficient payment solutions for businesses of all sizes. With support for over 30 currencies and a suite of payment services, including Virtual Accounts, Collections, and Payouts, DSGPay ensures seamless global transactions.

Key features of DSGPay include:

- Support for over 30 currencies: DSGPay enables transactions in multiple currencies, making global payments seamless.

- A Suite of Payment Services: Virtual Accounts, Collections, and Payouts to cater to diverse business payment needs.

- Competitive Pricing: Transparent fee structures with cost-effective pricing models.

- Fast Processing Times: Real-time and same-day processing options for timely transactions.

- Global Coverage: Make payments across different regions without geographical restrictions.

- Seamless Integration: Easy API integration with existing accounting and payroll systems for streamlined operations.

- Dedicated Customer Support: A responsive team ready to assist businesses with their payment needs.

When it comes to making mass global payments, choosing the right provider is essential. By considering these key factors and exploring solutions like DSGPay, businesses can ensure secure, efficient, and cost-effective payment processing for their global operations.