Whether you’re a seasoned professional or new to global payments, understanding the key considerations for data security can be the difference between success and vulnerability. In today’s fast-paced global economy, businesses and financial institutions are processing massive volumes of cross-border payments daily.

With this transaction surge comes an equally significant responsibility: ensuring data security for mass global payments. As cyber threats become more sophisticated and regulations tighten, safeguarding payment data is not just a priority, and it’s a necessity.

This blog will explore the essential strategies and best practices for protecting your organisation’s most valuable asset, which is data.

Why is Data Security for Mass Global Payments Important?

Data security for mass global payments is a critical concern for businesses and financial institutions handling large volumes of cross-border transactions. The complexity and scale of these operations make them vulnerable to various threats, including cyberattacks, data breaches, and fraud. As the global payments landscape continues to evolve, so does the sophistication of potential threats, necessitating robust security measures.

With the increasing popularity of online transactions, which involve the electronic exchange of money between buyers and sellers, typically using credit/debit cards, digital wallets, or bank transfers. There is a growing need to protect sensitive information such as credit/debit card numbers and bank account information. It is crucial for businesses to take a proactive approach to data security for mass global payments by applying strong security measures.

1. Protect Sensitive Information through Encryption

One of the most important steps in protecting sensitive information is to encrypt it. Encryption is the process of converting plain text into code that can only be deciphered by someone with the correct key. The primary purpose of encryption is to protect sensitive information from being accessed, altered, or stolen by unauthorised parties. When sensitive information is encrypted, it is much more difficult for hackers to access it.

2. Protect Data with Secure Encryption Protocols

Secure Sockets Layer (SSL) and Transport Layer Security (TLS) are cryptographic protocols that are used to secure data as it is transmitted over a computer network, particularly the internet. Both protocols work by encrypting the data as it is sent between the user’s browser and a web server. This ensures that the data is protected from hackers who may try to intercept it in transit.

In practice, when you see HTTPS in your browser’s address bar, it means that your connection to the website is secured using either SSL or, more likely, TLS encryption. This ensures that any data you transmit, such as passwords or credit card information, is protected from eavesdroppers and attackers.

3. Ensure Secure Transactions with a Payment Gateway

Secure payment gateways are an important component of mass global payments. These gateways are used to process credit card transactions and other types of electronic payments. They provide an additional layer of security by encrypting the data as it is transmitted between the merchant and the payment processor.

4. Follow Payment Card Industry Data Security Standard

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards that must be met by organisations that accept credit card payments. PCI DSS compliance is a must for any organisation that handles sensitive payment information. It includes security measures such as firewalls, intrusion detection systems, and regular security audits.

5. Conduct Regular Security Audits

Regular security audits, which help identify vulnerabilities in the system and prevent data breaches, are an important aspect of data security for mass global payments.

To conduct a security audit, it’s important to start by identifying the areas of the system that are most at risk of a security breach. Then, assess the current security measures in place and evaluate access controls to ensure that only authorised users can access sensitive information.

Finally, a report of the findings and recommendations highlighting any necessary steps to address vulnerabilities and improve overall security will be created.

Concluding Thoughts

In conclusion, data security is of paramount importance when it comes to mass global payments.

By implementing encryption, SSL/TLS, secure payment gateways, PCI DSS compliance, and regular security audits, organisations can help protect sensitive information and ensure the security of their customer data.

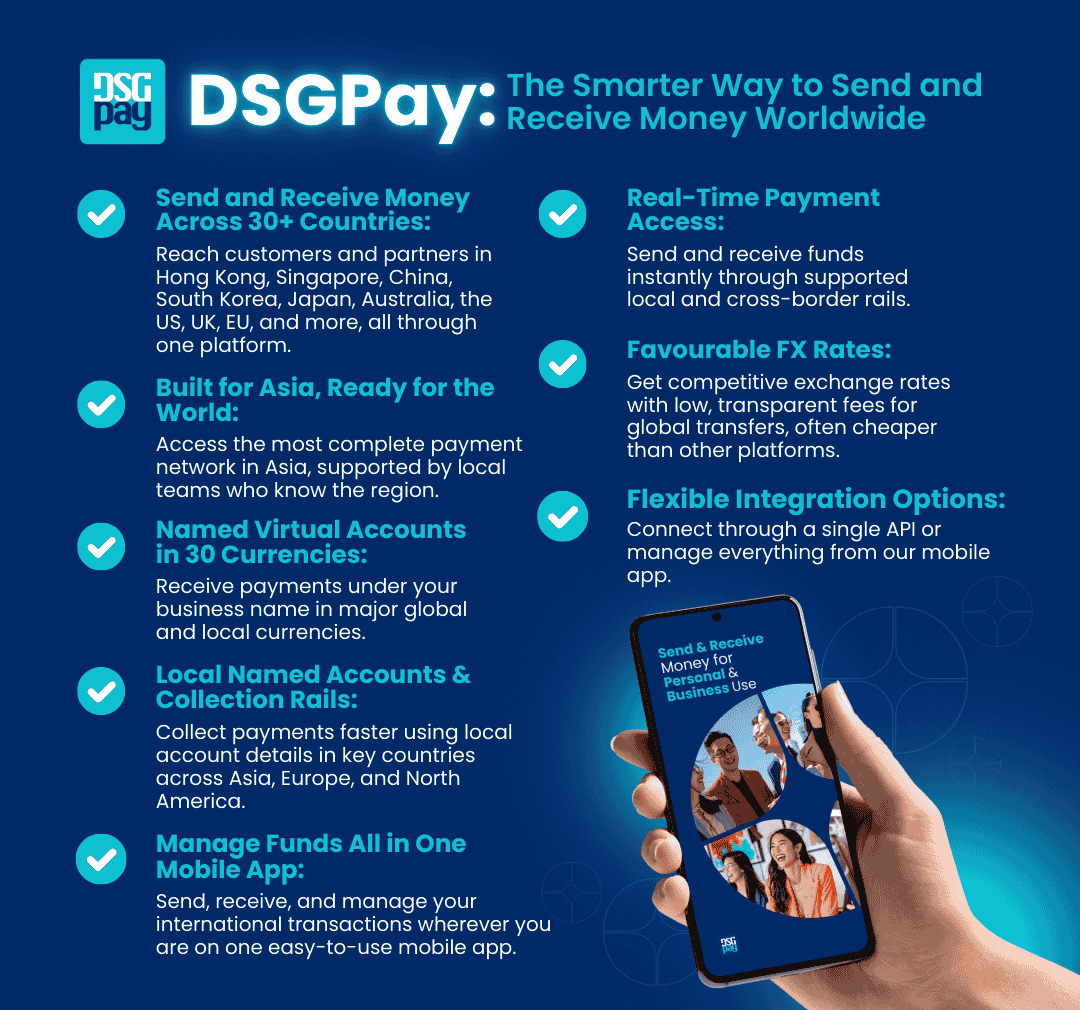

How DSGPay Ensures Data Security for Mass Global Payments

When handling mass global payments, data security is mission-critical.

At DSGPay, we take data security seriously because global payments demand it. Whether you’re handling collections or mass payouts, our platform is designed with security at its core.

- Uses encryption protocols to protect data in transit.

- Implements secure authentication methods to prevent unauthorised access.

- Conducts regular security audits to identify and mitigate vulnerabilities.

- Adheres to industry standards and compliance regulations.

- Designed to support secure, high-volume global transactions.

Ensure compliance and protect your payment data without slowing down your operations. DSGPay gives you enterprise-grade security for high-volume global transactions. Ready to secure your global payments with confidence?