Digital payment in Bangladesh is more than a trend. It’s a fast-moving revolution transforming how individuals and businesses transact. As more people turn to mobile wallets, QR code payments, and online platforms for daily financial activities, the country is rapidly shifting away from cash-based transactions.

With the market projected to reach $48.40 billion in transaction value by 2025, this shift is driving financial inclusion, convenience, and economic growth across the country.

In this article, we’ll break down what digital payments are, the main players, and how this revolution is shaping Bangladesh’s financial future. Let’s get into it!

Table of Contents

Bangladesh’s Digital Transformation

Bangladesh is undergoing a transformative digital revolution, and digital payment in Bangladesh is at the heart of this transformation. The government’s “Digital Bangladesh” vision has laid the foundation for a more inclusive and connected society, and the country’s digital payment ecosystem is evolving rapidly.

With a combination of supportive regulations, increased mobile penetration, and advancements in technology, Bangladesh has created a fertile ground for digital financial services to thrive. The increasing use of smartphones, coupled with improved internet connectivity, is making digital financial solutions more accessible, even in remote and underserved areas.

The Rise of Mobile Financial Services (MFS)

One of the key success stories of digital payment in Bangladesh is the rise of Mobile Financial Services (MFS), which have revolutionized the way Bangladeshis handle their finances. Platforms like bKash, Nagad, and Rocket have become household names, with bKash leading the charge. These platforms offer a wide range of services, including money transfers, bill payments, mobile top-ups, and even receiving remittances from abroad.

Digital payment in Bangladesh has become synonymous with MFS, as millions of people have adopted these services for everyday financial activities. bKash, for instance, boasts millions of active users who rely on it for both personal and business transactions. This widespread adoption has made digital payment in Bangladesh a crucial part of daily life and economic activity, enabling people from all walks of life to participate in the formal economy.

Key Players in Digital Payment in Bangladesh

The success of digital payment in Bangladesh can be attributed to several key players that have made significant contributions to the ecosystem.

Below are the leading platforms powering this digital shift:

1. bKash

As the largest mobile financial service provider in Bangladesh, bKash has revolutionized the way people send and receive money. With millions of active users, bKash has become the go-to platform for mobile banking and payments.

Best Use For: Individuals seeking a platform for everyday transactions.

Pros

- Offers a wide range of services.

- Nationwide agents ensure easy cash-in and cash-out.

Cons

- Higher transaction fees compared to other platforms.

2. Nagad

A mobile wallet launched by Bangladesh Post, Nagad is another major player in the digital payment in Bangladesh space. It provides similar services to bKash, including money transfers, bill payments, and mobile top-ups.

Best Use For: Individuals seeking a platform for everyday transactions.

Pros

- Competitive fees

- User-friendly app interface

Cons

- Limited support for international transactions.

3. Rocket

Owned by Dutch-Bangla Bank, Rocket is one of the pioneers in digital payment in Bangladesh. It allows users to perform a range of financial transactions, including money transfers and utility bill payments.

Best Use For: Customers who prefer a bank-backed service with a range of financial offerings, including savings and loan products.

Pros

- Offers a range of banking services.

- Access to extensive ATM network.

- Reliable service backed by a reputable bank.

Cons

- Does not support international money transfers through its mobile banking service.

- Cannot deposit foreign currency in rocket account.

4. Upay

A mobile financial service developed by Ucash, a subsidiary of United Commercial Bank (UCB). Upay provides services such as money transfers, bill payments, and mobile top-ups, gaining popularity for its strong bank backing.

Best Use For: Freelancers, young professionals, urban users, people using UCB services.

Pros

- User-Friendly Interface.

- Providing a variety of financial services.

Cons

- Does not support sending money abroad.

5. SureCash

SureCash is a prominent platform offering money transfers, utility payments, and loan disbursements. It is known for catering to both urban and rural users, helping to drive financial inclusion across the country.

Best Use For: Individuals in both urban and rural areas looking for a platform that supports a variety of financial transactions.

Pros

- Specialized services in educational payments.

- User-friendly platform.

Cons

- Smaller agent network.

Uncovering Digital Financial Services in Bangladesh

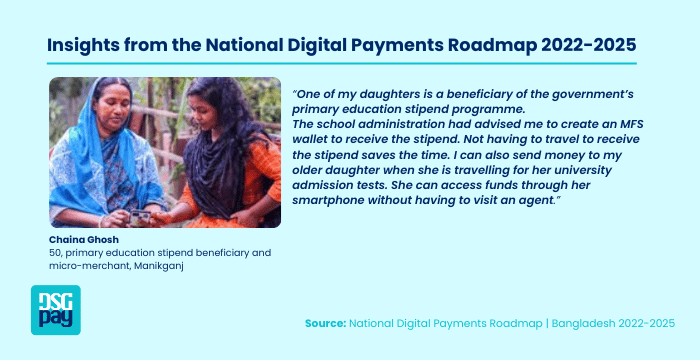

Digital payment in Bangladesh is part of a broader digital financial services ecosystem that includes mobile banking, online payments, digital insurance, and investment platforms. These services offer alternatives to traditional banking, expanding access to the unbanked population, especially in rural areas where physical bank branches are limited. For example, mobile wallets allow people to transfer money, pay bills, and make purchases without needing to visit a bank.

The growth of digital payment in Bangladesh has been significant, with the government’s push to digitize payments and transactions driving much of the progress. By leveraging digital technology, financial institutions and startups are creating user-friendly platforms that cater to a variety of needs, making it easier for individuals to participate in the economy and manage their finances.

Concluding Thoughts on Digital Payment in Bangladesh

Digital payment in Bangladesh is doing more than just replacing cash. It’s unlocking economic potential at every level. By expanding access to financial services, especially in rural and underserved areas, it empowers individuals to save, invest, and fully participate in the economy. This financial inclusion is not only improving lives but also fueling broader economic development.

As digital tools become more accessible, demand is rising, jobs are being created, and small businesses are thriving. The result is a more resilient, connected, and dynamic economy.

Bangladesh’s digital financial journey is still unfolding but one thing is clear: digital payments are at the heart of a more inclusive and prosperous future.

DSGPay: Simplifying Cross-Border Finance for Bangladesh

While local platforms have made digital payments a part of daily life in Bangladesh, cross-border transactions remain a challenge for individuals and businesses needing international reach. That’s where DSGPay steps in, offering a smarter, more flexible way to manage global payments.

Why Choose DSGPay?

- Global Virtual Accounts: Hold, send, and receive payments in over 30+ currencies, including BDT, USD, GBP, EUR, and AUD all from one platform.

- Fast Settlements: Benefit from quicker turnaround times for receiving and sending international funds without the delays of traditional banks.

- Lower Fees, Better Rates: Enjoy competitive FX rates and transparent pricing, helping you keep more of what you earn.

- Regulated & Trusted: Licensed under Hong Kong’s Money Service Operator (MSO) framework, DSGPay offers enterprise-grade security and compliance.

- Global Compatibility: Easily link your DSGPay account with platforms like Upwork, Freelancer.com, and more.

By simplifying cross-border finance, DSGPay is helping individuals and businesses connect with the world, faster, easier, and more securely. Start your global payment journey with DSGPay today.