Embedded Finance Trends are reshaping the global financial landscape, seamlessly integrating financial services into non-financial platforms. For Thailand, a country experiencing a rapid digital transformation, this trend offers immense opportunities for shaping the future of its financial services sector.

Understanding Embedded Finance

At its core, embedded finance refers to the integration of financial services like payments, lending, or insurance directly into a non-financial platform, such as retail apps, ride-hailing services, or social media platforms that offer seamless financial transactions without redirecting users to external banking or payment apps. It enhances user experience by providing seamless, convenient, and personalised financial services.

Global and Thailand’s Embedded Finance Trends

Globally, embedded finance trends have surged as companies recognize the value of integrated financial solutions. The move towards embedded finance is fueled by consumers’ desire for easier, faster, and more personalized services.

Thailand’s fintech landscape has been dynamic, bolstered by high smartphone penetration, a robust digital infrastructure, and progressive regulatory policies. Embedded finance in Thailand has taken root with the rise of digital platforms offering integrated financial services. Regulatory support has been instrumental in this journey, with the Bank of Thailand fostering an ecosystem conducive to fintech innovation and the growth of embedded finance.

Key Players in Thailand’s Embedded Finance Ecosystem

Thailand’s fintech scene is vibrant, with key players driving the adoption of embedded finance trends. Leading the way are companies like Grab and LINE, which have successfully integrated financial services into their non-financial platforms. Grab has expanded its offerings beyond ride-hailing to include digital payments, micro-lending, and insurance—all accessible within its app. Similarly, LINE, a popular messaging app, has expanded into the financial realm through LINE Pay, enabling seamless transactions within its platform.

These embedded finance trends showcase how businesses are capitalizing on integrated services to enhance customer experience and foster loyalty. The ability to provide financial services within a familiar app interface significantly boosts user engagement, demonstrating the power of embedded finance.

The Impact of Embedded Finance on Thailand’s Economy and Consumers

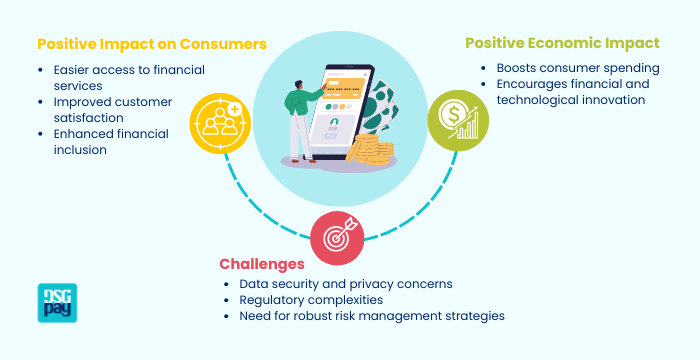

Positive Impact on Consumers

- Easier access to financial services: Embedded finance integrates services directly into everyday platforms, allowing users to make payments, secure loans, and more with minimal friction.

- Improved customer satisfaction: The convenience and speed of accessing financial services within familiar apps enhance user experiences, leading to higher satisfaction.

- Enhanced financial inclusion: By embedding finance into widely used digital platforms, more people, including underserved populations, gain access to financial services that were previously difficult to reach.

Positive Economic Impact

- Boosts consumer spending: Easier access to credit and payment options encourages more frequent transactions, stimulating economic growth.

- Encourages financial and technological innovation: The integration of finance into non-financial services drives new business models and innovations in product offerings.

Challenges

- Data security and privacy concerns: The increase in financial data being shared across various platforms heightens the risk of data breaches and misuse.

- Regulatory complexities: Embedded finance must navigate evolving regulations, creating challenges for companies aiming to stay compliant while expanding their services.

- Need for robust risk management strategies: As embedded finance grows, ensuring strong risk management practices becomes essential to mitigate potential issues related to fraud and systemic financial risks.

Future Opportunities in Thailand’s Embedded Finance Landscape

The future of embedded finance trends in Thailand looks promising, marked by continued innovation and technological advancements. Personalisation and contextual relevance are likely to drive the next phase of growth, offering users even more tailored financial experiences. The incorporation of AI and machine learning into embedded finance trends could revolutionize the way services are delivered, enhancing security, personalisation, and efficiency.

Businesses and investors can leverage these opportunities by developing strategic partnerships and staying ahead of market demands. As embedded finance continues to grow, it is crucial to align business strategies with emerging embedded finance trends to remain competitive.

Conclusion

Embedded finance trends are transforming Thailand’s financial landscape, integrating financial services into everyday platforms and enhancing user experiences. For businesses looking to capitalize on this wave of innovation, now is the time to act. DSGPay stands ready to assist in navigating this evolving market, providing expertise that ensures your business stays at the forefront of the embedded finance trends revolution.

Reach out to DSGPay today and harness the power of embedded finance for sustainable success.