If you’ve hired a freelancer or are planning to, you’re probably wondering: What’s the best way to pay them?

With more businesses relying on remote talent, 25% of UK employees worked from home in 2022. Without a reliable payment process, you could face delays, high transaction costs, exchange rate fluctuations, and compliance headaches.

So, how do you navigate this? Let’s break down the best ways to pay freelancers efficiently and securely.

Table of Contents

Key Takeaways:

- Freelancers provide flexibility and expertise without the costs of full-time employees.

- Always classify freelancers correctly to avoid tax and legal issues.

- Choosing the right payment method depends on location, fees, processing time, and freelancer preferences.

- Clear contracts help prevent disputes over payments and project scope.

- A smooth onboarding process improves freelancer efficiency and collaboration.

- Balancing security, speed, and cost ensures hassle-free freelancer payments.

How to Pay Freelancers: 5 Popular Methods

Depending on the freelancer’s location, there are several methods you can use. However, in some cases, you have to rely on more than one method. Overall, these options are good for both domestic and international transfers.

1. Online Service Providers

Online payment platforms make it easy to pay freelancers, especially for international work. They offer fast transfers, support different currencies, and often include invoicing tools to simplify payments.

With mobile payment transactions hitting $7.39 trillion in 2023, A 14% increase from the previous year, more businesses and freelancers are relying on these digital solutions. While they’re convenient, transaction fees can add up, and security checks may sometimes cause delays.

How to Pay Freelancers Using Online Platforms

- Choose a payment platform that suits both you and the freelancer.

- Sign up, verify your account, and link a payment method (bank account or card).

- Get the freelancer’s payment details (email or account ID).

- Enter the amount, check fees and exchange rates, and confirm the payment.

- Follow up to ensure they’ve received the payment.

Pros:

- Fast payments are often processed instantly or within a few hours.

- Supports multiple currencies and handles exchange rates.

- User-friendly and widely accepted by freelancers worldwide.

Cons:

- Transaction fees (typically 3-5%) can be costly over time.

- Some platforms impose withdrawal limits or have country-specific restrictions.

- Security checks may occasionally result in temporary account freezes.

Best for: Businesses and individuals who need a reliable, easy-to-use payment method for both domestic and international freelancers.

2. Direct Bank Transfers

A direct bank transfer is a secure and straightforward way to pay freelancers by moving funds directly from your bank account to theirs. It eliminates the need for third-party platforms, reducing the risk of account holds or unexpected service disruptions.

This method is particularly useful for paying freelancers within the same country, as domestic bank transfers are often quick and cost-effective. However, when sending money internationally, transfers can take several days to process, and banks may charge high fees, especially for currency conversions.

How to Pay Freelancers Through Bank Transfers

- Get the freelancer’s bank details like account number, IBAN, and SWIFT/BIC code.

- Log in to your online banking or visit a bank branch.

- Add the freelancer as a new payee.

- Enter the payment amount and select the right currency.

- Check for any bank fees or exchange rate charges.

- Confirm and send the payment.

- Share the transaction details with the freelancer for tracking.

Pros:

- Secure and reliable, with direct deposits into bank accounts.

- No need for third-party services or additional accounts.

- Ideal for domestic transactions with lower or no fees.

Cons:

- International transfers can take 3–5 business days to process.

- Banks often charge high fees for cross-border payments.

- Currency exchange rates may not be as competitive as other payment platforms.

Best for: Businesses working with local freelancers who prefer direct deposits and want to avoid third-party payment services.

3. Checks

Checks used to be a common way to pay freelancers, but they’re not as popular now because they take longer to process and can be tricky to handle.

Still, some businesses and freelancers prefer them, especially for big payments or when they need a formal record. Since banks process checks, there are no online transaction fees, which can make them a cheaper option in some cases.

How to Pay Freelancers Through Checks

- Ask the freelancer for their full name and mailing address.

- Write a check with the correct amount and sign it.

- Double-check the details to avoid errors.

- Mail the check to the freelancer’s address.

- Inform the freelancer once it’s sent and provide tracking if available.

- Wait for them to deposit or cash the check.

- Keep a record of the transaction for reference.

Pros:

- No online fees or transaction charges.

- Provides a physical record for accounting and tax purposes.

Cons:

- Very slow processing, which can delay payments.

- Not practical for international transactions.

- Risk of checks getting lost or bounced, causing payment issues.

Best for: Freelancers and businesses that prefer traditional payment methods and need a formal paper trail.

4. Freelance Marketplaces

Freelance marketplaces are popular platforms where businesses can connect with freelancers for various projects. These platforms not only help with finding skilled professionals but also manage payments securely.

When you hire through a marketplace like Upwork, Fiverr, or Freelancer.com, you don’t have to worry about payment security. These platforms hold funds in escrow until the work is completed, protecting both parties from disputes.

How to Pay Freelancers Through Freelance Marketplaces

- Sign up on a freelance marketplace like Fiverr or Upwork.

- Post a job or hire a freelancer from the platform.

- Deposit funds into your account or set up a payment method.

- Approve milestones or completed work before releasing payment.

- The platform processes the payment and deducts any fees.

- The freelancer receives the payment in their account.

- Keep track of invoices and transaction details for future reference.

Pros:

- Built-in payment protection and escrow system.

- Supports milestone payments for structured project management.

- Dispute resolution services in case something goes wrong.

- Easy to track and manage payments through the platform.

Cons:

- High service fees, often ranging from 10-20%.

- Funds may take time to become available for withdrawal.

- Limited flexibility for direct freelancer-client transactions outside the platform.

Best for: Businesses and freelancers who prefer a secure, structured payment process and built-in dispute resolution.

5. Western Union

Western Union is a widely available money transfer service, ideal for freelancers without bank accounts or access to online payment platforms. Its cash pickup option is useful in regions with limited banking infrastructure.

How to Pay Freelancers Through Western Union

- Collect the freelancer’s full name and location details.

- Visit a Western Union branch or use their online service.

- Choose the send money option and enter the payment amount.

- Select cash pickup or bank transfer as the delivery method.

- Pay using cash, debit/credit card, or a linked bank account.

- Get the tracking number (MTCN) and share it with the freelancer.

- The freelancer picks up the payment using their ID and MTCN.

- Keep the receipt for reference.

Pros:

- Available in many countries, making it accessible for global freelancers.

- Suitable for freelancers who don’t use bank accounts.

- A cash pickup option is available for convenience.

Cons:

- High transaction and currency conversion fees.

- Slower than online payment services.

- May require physical visits for sending or receiving money.

Best for: Freelancers in remote or underbanked areas who need an alternative to online payments.

Who is a Freelancer

Freelancing is a form of self-employment where individuals offer their skills and services to clients on a project-by-project basis rather than working for a single employer. It provides flexibility in choosing clients, setting work schedules, and determining rates.

Freelancers can work in various fields, such as writing, graphic design, programming, marketing, and consulting.

One of the biggest advantages of freelancing is independence. Professionals can work from anywhere and select projects that align with their expertise.

However, it also comes with challenges, including inconsistent income, client management, and tax handling. Success in freelancing requires strong self-discipline, networking, and the ability to market oneself effectively.

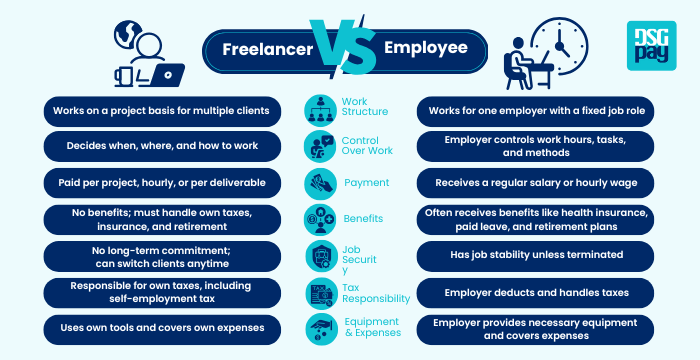

Worker Classification: Difference Between a Freelancer and an Employee

Here’s a simple breakdown of the key differences between a freelancer and an employee, so you can see how they compare in terms of work structure, control, payment, and benefits.

This structured comparison makes it easier to assess whether hiring a freelancer or an employee aligns better with business needs.

Key Points to Remember When Paying Freelancers

From onboarding to figuring out how to pay freelancers, keep these key points in mind.

1. Choosing the Right Payment Method for Your Freelancer

When choosing a payment method, consider where the freelancer is located, their preferred way to get paid, and any extra fees.

Global payment solution providers work well for international payments, while bank transfers are better for local ones.

Always check what the freelancer prefers to avoid delays. Also, be aware of fees; some platforms charge a percentage, bank transfers can be costly for international payments, and freelance sites take a cut. Picking the right method ensures a smooth and cost-effective payment process.

2. Setting the Right Terms

Before hiring a freelancer, having a clear contract in place is essential. It protects both parties and ensures everyone is on the same page. Here is what your contract should include:

- Scope of Work: Clearly define the tasks, deliverables, deadlines, and any project milestones. This prevents confusion and sets expectations from the start.

- Payment Terms: Specify whether the freelancer will be paid per hour or project. Include details on invoicing schedules and payment deadlines to avoid disputes.

- Revisions Policy: Outline how many revisions are included before additional charges apply. This keeps the process efficient and prevents endless edits.

- Confidentiality Clause: If sensitive business information is involved, consider adding a non-disclosure agreement to protect your data.

- Termination Clause: State the conditions under which either party can end the contract. This ensures a clear exit strategy if the collaboration does not work out.

A well-structured contract helps build a smooth and professional working relationship from the beginning.

3. Onboarding Process

Once the contract is set, the next step is onboarding. This process helps the freelancer get up to speed quickly and work efficiently within your workflow. Here is how to do it effectively:

- Provide Clear Project Briefs: Give detailed instructions on the work required, including brand guidelines, deadlines, and expectations. A well-prepared brief prevents misunderstandings and keeps the project on track.

- Grant Access to Necessary Tools: If the freelancer needs specific software, platforms, or files to complete the work, make sure they have access from the start. Delays often happen when freelancers are waiting for permissions.

- Establish Communication Methods: Decide how you will stay in touch, whether through email, Slack, Zoom, or another platform. Clear communication helps avoid confusion and keeps everyone aligned.

- Set Up Regular Check-ins: Agree on when and how progress updates will be shared. This helps catch potential issues early and ensures the freelancer stays on the right track.

A smooth onboarding process saves time, reduces frustration, and ensures that your freelancer can begin contributing effectively from day one.

4. Send Invoice

Invoices help keep payments clear and organized by outlining the work completed and the amount due. A well-structured invoice ensures transparency, prevents misunderstandings, and serves as a record for both you and the freelancer.

Key Elements of an Invoice:

- Freelancer’s Details: Name, contact information, and payment details.

- Your Details: Business name, address, and contact information.

- Invoice Number & Date: Helps track payments and keep records.

- Description of Work: Clearly list tasks completed, project details, or hours worked.

- Amount Due & Payment Terms: State the total cost, currency, and payment deadline.

5. Consider International Payment Options

When working with international freelancers, choosing the right payment method is key to avoiding delays and high fees. It’s also important to check if the freelancer’s country has any restrictions on receiving international payments. Consider using platforms designed for international payments, which often offer lower fees and better exchange rates.

Understanding how to pay freelancers across different countries can feel tricky, but a little planning goes a long way. To keep things smooth and hassle-free, here are some simple tips to avoid delays and unnecessary costs.

- Use Multi-Currency Accounts: Money exchange services and digital apps let you send and receive money in different currencies, which can cut down on conversion fees and make payments easier.

- Check Local Rules: Some countries have strict rules about receiving international payments. It is always a good idea to check so you do not run into any surprises.

- Be Upfront About Fees: Bank transfers and payment platforms often charge fees. Make sure both you and the freelancer know who is covering those costs so there are no misunderstandings.

- Time Payments Smartly: Exchange rates change all the time. If possible, try to schedule payments when the rates are better to save a little money.

A little preparation goes a long way in making sure your freelancers get paid on time without any headaches.

Concluding Thoughts on How to Pay Freelancers Without the Hassle

Knowing how to pay freelancers doesn’t have to be complicated. Hidden fees, slow transactions, and complex bank transfers can be frustrating, but there are simple solutions. Secure online platforms, direct bank transfers, or freelancer-friendly services make payments quick and super-easy.

The key is to keep things simple, set clear contracts, agree on payment terms upfront, and make sure invoices are easy to understand.

Whether your freelancer is in the same city or halfway across the world, picking a payment method that’s secure, affordable, and hassle-free will save you a lot of headaches. Get this right, and paying freelancers will feel like just another routine (and painless) part of running your business.

FAQs: How to Pay Freelancers

Q: How often should I pay freelancers?

Payment frequency depends on your agreement. Some freelancers prefer weekly or bi-weekly payments, while others invoice monthly or per project milestone.

Q: What happens if a freelancer does not deliver the work?

A well-drafted contract should include a dispute resolution clause. If using a freelance platform, leverage their dispute resolution services.

Q: Can I pay freelancers with a credit card?

Yes, many payment gateways like PayPal and Stripe allow credit card payments. However, ensure your freelancer accepts this method.

Q: Are freelancer payments tax-deductible?

Yes, freelancer payments are usually deductible as business expenses. Keep records and issue tax forms like a 1099-NEC for U.S.-based freelancers.

Q: What is the best way to avoid payment disputes?

Clear contracts, milestone-based payments, and detailed invoices help prevent disputes.

How DSGPay Makes It Easy to Pay Freelancers

Paying freelancers, especially those in different countries, can be a headache. DSGPay takes the hassle out of the process with simple, fast, and secure payment options. Here’s how:

- Pay in Different Currencies: No need to worry about exchange rates. DSGPay lets you send money in multiple currencies, so freelancers get the right amount without extra conversion fees.

- Virtual Accounts for Easy Payments: Assign unique virtual accounts to each freelancer, making it easy to manage, track, and organize payments without opening multiple bank accounts.

- Save Money on Fees: Instead of managing multiple bank accounts, use DSGPay to handle all freelancer payments in one place, cutting down on unnecessary costs.

- Manage Payments Anytime with the Mobile App: Send, track, and manage freelancer payments effortlessly from your phone using our mobile app, ensuring full control wherever you are.

- Fast and Flexible Payments: Choose from real-time transfers, bulk payments, or instant payouts to get money to your freelancers quickly and conveniently.

- Automatic Payments & Tracking: Set up scheduled payments, track transactions in real-time, and get instant updates, so you always know where your money is.

- Safe and Compliant: DSGPay ensures all transactions meet legal requirements and includes fraud prevention measures, so your money stays secure.

With DSGPay, paying freelancers is quick, easy, and stress-free. No delays and no hidden fees. Just smooth transactions every time.