High transaction fees, fraud risks, complex approval processes, cash flow delays and above all customers abandoning carts due to lack of preferred method — ultimately, this can hinder your business’s growth and distract you from key goals like scaling your brand and driving conversions.

If you don’t have an Internet Merchant Account (IMA) in your online store, you’re leaving the money on the table for your competitors.

With global online shopping sales skyrocketing to $4.1 trillion in 2024, the need for an internet merchant account has become imperative. Customers are more inclined towards online shopping. The more payment methods your business provides, the higher the chances of reaching a broad customer base.

If you’re running an online store or planning to launch one, understanding how IMAs work is critical to smooth transactions, preventing chargebacks, and ensuring customers can pay however they want.

In this article, we’ll break down the fundamentals of internet merchant accounts, how they function, and how to choose the right one to maximize your revenue.

Table of Contents

Key Takeaways:

- An Internet Merchant Account (IMA) is essential for processing online payments.

- IMAs temporarily hold funds before transferring them to the business’s bank account.

- Obtaining an IMA requires a legitimate business, a secure website, and compliance with regulatory requirements.

- Different IMAs cater to various business types, including those in high-risk industries.

- The setup process involves selecting a provider, meeting application criteria, integrating a payment gateway, and ensuring compliance.

- Businesses should anticipate fees, chargebacks, and rolling reserves as part of account management.

- Benefits of IMA include faster transactions, broader market reach, and enhanced security against fraudulent activities.

What is an Internet Merchant Account

An internet merchant account (IMA) is a special type of bank account that enables businesses to accept online payments. You can consider it as a waiting room for payments. When a customer buys something online, the money first goes into this merchant account before moving to the business’s main bank account.

Unlike regular business bank accounts, merchant accounts don’t provide direct access to funds; instead, they ensure secure processing before transferring money to the business’s primary account.

An internet merchant account accepts credit/debit cards, digital wallets, bank transfers, BNPL services, cryptocurrencies, and country-specific alternative payment methods, depending on the service provider.

However, merchant accounts are not free. Businesses must pay processing fees for each transaction. These fees cover costs like payment authorization, fraud prevention, and fund transfers.

To operate, a merchant account must be set up with an acquiring bank (a financial institution that processes card transactions) and a payment gateway, which facilitates secure payment processing and handling.

In absence of a merchant account, businesses cannot process electronic payments, making it a vital component of e-commerce and digital transactions. Without it, businesses must rely on third-party platforms, which may have higher fees and limited control over payment flows.

Key Terms About Internet Merchant Account

- Payment Gateway: A service that securely processes online transactions by encrypting customer payment details and sending them to the acquiring bank for authorization. It acts as a bridge between the business’s website and financial institutions.

- Acquiring Bank: A financial institution that processes credit and debit card payments on behalf of a business. It works with payment networks (Visa, Mastercard) to authorize transactions and deposit funds into the merchant account.

- Issuing Bank: A financial institution that issues credit and debit cards to consumers. It is responsible for approving or declining transactions based on the cardholder’s available funds, credit limit, and fraud detection measures.

- Chargebacks: A reversal of a completed transaction initiated by the customer’s bank due to disputes, fraud claims, or processing errors. Excessive chargebacks can result in higher fees or account suspension for businesses.

- Rolling Reserve: A portion of a business’s transaction revenue held by the payment processor as a security measure to cover potential chargebacks or fraud risks. The funds are released after a set period if no disputes occur.

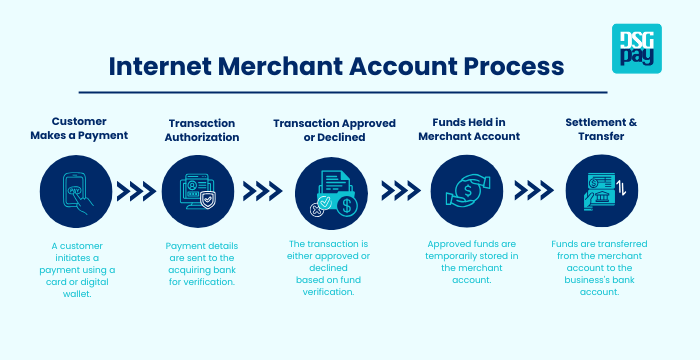

How Does an Internet Merchant Account Work

Integrating an internet merchant account in your business is not as complicated as it sounds. If you want to know how the process works, take a look at the steps below:

Step#1 Customer Makes a Purchase

Let’s say you own a clothing store. A customer buys a t-shirt from your website and heads towards the checkout. At the checkout page, he pays with his debit or credit card and provides the necessary details like billing address and security code to complete the transaction.

Step#2 Transaction Sent for Authorization

Customer details are encrypted and sent to the payment gateway, which acts as a middleman and sends the coded info to your merchant acquiring bank (the financial institution that provided your IMA).

Step#3 Card Network and Issuing Bank Review

The acquiring bank forwards the transaction request to the respective card network (Visa, MasterCard, American Express, etc.). The card network then contacts the customer’s bank to check whether the customer has enough funds or credit available to make the transaction. It also scans for potential frauds.

Step#4 Transaction Approved or Declined

- If approved, the issuing bank authorizes the transaction, and the payment process continues.

- If declined, the customer receives a notification, and the transaction is halted (due to insufficient funds, incorrect details, or suspected fraud).

Step#5 Funds Temporarily Held in Internet Merchant Account (IMA)

When the transaction is approved, the issuing bank releases the funds, but the funds are not sent directly to your business bank account. Instead, the money is held temporarily in your internet merchant account where the rest of the procedure is completed safely and securely.

Step#6 Funds Transferred to Business Account

After a short processing period (usually 1-3 business days), the funds are released from your IMA and deposited into your business bank account.

Types of Merchant Accounts

There are 4 different types of merchant accounts that are tailored to different business needs. Choosing the right one depends on factors like transaction volume, industry risk, and control over funds.

| Type of Merchant Account | What It is | Pros | Cons | Best for |

| Dedicated Merchant Account | A payment processing account set up specifically for one business, providing direct control over transactions. | – Lower fees for high-volume businesses – More control over transactions and disputes – Faster fund processing | – Lengthy approval process – Higher setup costs and monthly fees – Strict compliance requirements | Established businesses with high transaction volumes that need cost efficiency and control. |

| Aggregated Merchant Account | A shared account managed by a Payment Service Provider (PSP) like PayPal or Stripe, where multiple businesses process payments through the same account. | – Quick and easy setup – No dedicated account agreement required – Ideal for startups with low transaction volumes | – Higher per-transaction fees – Less control over disputes; PSPs may freeze funds – Limited customization options | Startups, small businesses, and freelancers looking for a simple payment solution. |

| High-Risk Merchant Account | A specialized account for businesses in industries with high chargeback rates or regulatory risks. | – Accepts payments for high-risk industries – Advanced fraud protection and chargeback prevention – Can handle higher transaction volumes | – Higher processing fees – Stricter approval requirements – May require a rolling reserve (holding part of funds as security) | Businesses flagged as high-risk by banks or payment processors. |

| Internet Merchant Account (IMA) | A merchant account designed specifically for online businesses to process digital transactions securely. | – Essential for e-commerce payments – Works with a payment gateway for secure transactions – Supports multiple payment methods (cards or digital wallets) | – Complex setup requiring integration with a payment gateway – Varying transaction fees depending on provider and region – Must comply with security standards (PCI DSS) | Any online business looking to accept payments securely and efficiently. |

How to Setup an Internet Merchant Account

1. Pick a Provider

First, choose a merchant account provider that fits your business. If you’re a small business or just starting out, choose a service provider that is easy to set up. If you have a bigger business and process lots of transactions, a dedicated account with a bank might save you money in the long run. Make sure the provider offers security features like fraud protection and PCI compliance to keep your transactions safe.

2. Apply for an Account

Once you’ve picked a provider, you’ll need to apply. This means giving details about your business, like your company registration, bank info, and estimated sales. Some businesses are considered high-risk and might need to provide extra paperwork or pay higher fees. Some services approve accounts instantly, while banks may take a few days.

3. Wait for Approval

After applying, your provider will review your information. If you’re in a high-risk industry, you may have to provide extra security, like a rolling reserve, where they hold back a small portion of your money as protection against chargebacks.

4. Set Up a Payment Gateway

A payment gateway connects your website to your merchant account, making sure money gets from your customer’s bank to yours. Make sure your gateway works smoothly with your website and checkout system.

5. Test It Out

Before going live, run a few test transactions to make sure everything works correctly. This helps spot any issues before real customers start making payments. Check that payments go through smoothly and that fraud detection tools are working.

6. Start Accepting Payments

Once you’ve tested everything, you’re good to go! Customers can now pay you online through your website, or e-commerce store. Keep an eye on transactions to prevent fraud, handle chargebacks, and make sure your payment process runs smoothly.

Requirements of a Merchant Account

These are some of the must-haves for creating an internet merchant account.

- Proof of business registration to verify legitimacy.

- A business bank account to receive payments.

- A secure website with SSL encryption and a functional checkout page.

- Tax identification and financial statements for risk assessment.

- Industry classification, as high-risk industries, may need extra approval.

- Estimated processing volume, including expected monthly sales.

- Fraud prevention measures, such as chargeback policies and verification tools.

- Compliance with PCI DSS standards for secure payment handling.

Fees and Cost of Internet Merchant Account

The cost of setting up and using an internet merchant account can differ a lot depending on:

- The company you choose to handle your payments.

- The type of business you run.

- How many transactions do you process?

- How risky your business is considered.

- Pricing model of the service provider (flat-rate, interchange-plus, or tiered pricing).

Here is a general overview of the fee structure you may find:

| Fee Type | Details | Typical Cost Range |

| Transaction Fees | Charged per sale, usually a percentage plus a fixed fee. | 1.49% – 2.9% + $0.10 – $0.30 per transaction |

| Monthly Service Fees | Flat fee for account maintenance. | $8 – $35 per month |

| Setup Fees | One-time cost for opening an account. | Varies; sometimes waived |

| Chargeback Fees | Applied when a customer disputes a charge. | Varies by provider |

| International Surcharges | Extra fees for cross-border transactions. | Varies |

| Statement Fees | Charged for paper or digital statements. | Less common, varies |

| Rolling Reserve | A percentage of funds held temporarily for risk management. | Typically 5% – 10% of sales |

Benefits of Internet Merchant Account

Having an internet merchant account can have lots of benefits for your business:

- Accept more payment methods like credit/debit cards and digital wallets (Apple Pay, Google Pay).

- Receive funds faster, typically within 1-3 days.

- Improve security and reduce fraud with transaction verification.

- Expand globally by accepting online payments from international customers.

Potential Challenges and How to Overcome Them

While an internet merchant account has lots of benefits to offer, they do come with certain challenges that may affect your overall profit.

• High Transaction Fees

Merchant accounts often come with processing fees that can add up. To minimize costs, compare multiple providers, look for volume-based discounts, and negotiate lower rates based on your sales volume.

• Chargebacks & Fraud Risks

Online transactions are prone to fraud and chargebacks, which can hurt your business. Implement fraud detection tools, use strong customer verification methods, and set clear refund policies to reduce disputes.

• Complex Approval Process

Some merchant accounts require extensive documentation and a lengthy approval process. If you need a quicker setup, consider Payment Service Providers (PSPs), which offer simpler registration with fewer requirements.

• Long-term Contracts

Shop around for providers with transparent pricing and no hidden fees. Look for providers that don’t require long-term contracts or charge early termination fees.

Merchant Accounts vs. Payment Gateways: What’s the Difference?

Many people confuse merchant accounts with payment gateways, but they serve different roles. A merchant account is like a temporary wallet where funds sit before reaching your business bank account, while a payment gateway acts as the secure bridge that transfers payment data between customers, merchants, and banks.

| Feature | Merchant Account | Payment Gateway |

| Function | Holds funds temporarily | Facilitates transaction processing |

| Security | Offers fraud protection | Encrypts payment data |

| Example Providers | Chase, Bank of America | PayPal, Stripe, Authorize.net |

In most cases, you need both a merchant account and a payment gateway to process online payments smoothly.

Does a Merchant Account Need a Payment Gateway?

A merchant account let’s your business accept different types of online payments, but to actually process those payments , you need a payment gateway.

Here’s why a merchant account must have a payment gateway:

- It Makes Payments Happen: When a customer reaches the checkout page and enters their payment details (such as credit card information or digital wallet credentials), the payment gateway securely captures this data.

- Security & Fraud Protection: It encrypts customer details, keeping transactions safe from fraud and hackers.

- Fast & Smooth Transactions: It ensures quick payment approvals, reducing delays in receiving funds.

- Supports Multiple Payment Methods: Credit cards, debit cards, PayPal, Apple Pay—payment gateways let you accept all of them.

- Enables Online Business Growth: If you want to sell to customers worldwide, a payment gateway is a must.

Without a payment gateway, transactions can’t be processed, and without a merchant account, you won’t have a place to receive funds. Both work together to enable smooth and secure online payments.

Need a Secure and Reliable Payment Gateway for Your Business?

If you don’t want to get in all the complexities of setting up a merchant account, you can choose a more quick and secure service provider like DSGPay. It ensures seamless payment processing while adhering to local financial regulations.

With features such as Named Virtual Accounts, businesses can easily collect payments from customers, offering a more structured and automated way to manage transactions.

Here’s why DSGPay is the right choice for your business:

- Seamless Transaction Processing – Manage digital payments efficiently with a secure and reliable system.

- Virtual Accounts for Easy Payments – Businesses can receive payments from customers through dedicated virtual accounts, making transaction tracking and reconciliation hassle-free.

- Customisable Payment Solutions – Adapt payment gateway features to suit your business needs, including QR code payments, virtual accounts, and open banking integration.

- Security and Compliance – Stay ahead with a fully compliant and secure payment gateway that meets regional financial regulations and protects customer data.

- Scalability for Growth – Expand your business confidently with a payment system that supports multiple currencies and international transactions.

- Enhanced Customer Experience – A smooth and quick checkout process means happier customers and fewer abandoned carts.

Get started with DSGPay today and simplify your payment processing with secure, efficient, and scalable solutions tailored to your business needs.

FAQS

Q: What is an internet merchant account?

An internet merchant account is a special type of bank account that allows businesses to accept online payments securely.

Q: Do I need an internet merchant account to accept online payments?

Yes, without an IMA, you can’t accept card payments online. It ensures transactions are processed securely.

Q: What’s the difference between a merchant account and a payment gateway?

A merchant account holds funds temporarily, while a payment gateway processes transactions and encrypts payment data for security.

Q: What are the fees associated with an internet merchant account?

Fees vary but typically include transaction fees (1.5%-3.5%), monthly maintenance fees ($10-$50), and chargeback fees ($20-$100).

Q: Can a small business use an internet merchant account?

Yes, small businesses can use an IMA. Many providers offer easy setup options like PayPal or Stripe.

Q: How long does it take to receive payments through an internet merchant account?

Funds are usually transferred to your business bank account within 1-3 days after processing.

Q: Is an internet merchant account secure?

Yes, IMAs follow security standards like PCI DSS to protect customer payment data and prevent fraud.