Malaysia’s Digital Economy is undergoing a remarkable transformation, reshaping the nation’s financial landscape. Beneath the modern skyline of Kuala Lumpur and beyond the lush landscapes of Malaysia, a financial renaissance is taking root. The financial sector is swiftly gravitating towards the digital realm, spurred by increased digital payment solutions and the rise of e-wallets.

Join us as we delve into this transformative journey and decode Malaysia’s rapidly evolving payments landscape.

Table of Contents

The Rise of Malaysia’s Digital Economy

In recent years, Malaysia has emerged as a hub of innovation in Southeast Asia, with its digital economy playing a pivotal role in driving growth. Defined by the integration of digital technologies into every facet of life, Malaysia’s digital economy spans industries, from e-commerce and fintech to health tech and education. At the forefront of this revolution is the payments industry, where e-wallets are reshaping how Malaysians manage their money and complete transactions.

Understanding E-Wallets in Malaysia

E-wallets, or digital wallets, are mobile applications that allow users to store funds, pay bills, transfer money, and even access rewards seamlessly. These tools have gained immense popularity due to their convenience, security, and ability to integrate with other digital services. For Malaysia, where smartphone penetration exceeds 90%, e-wallets provide an ideal solution to meet the demands of a tech-savvy population.

The COVID-19 pandemic further accelerated the adoption of e-wallets in Malaysia’s digital economy, as consumers and businesses alike sought safer, contactless payment methods. The result? A surge in e-wallet transactions, which have now become a staple in everyday life, from buying groceries to paying for public transport.

What are the Top E-Wallets in Malaysia?

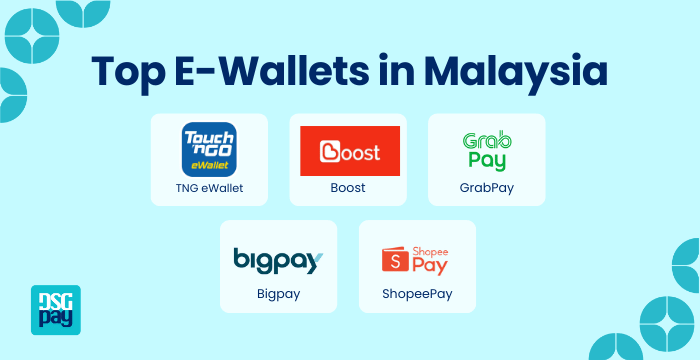

Malaysia boasts a competitive e-wallet market, with several players contributing to the expansion of Malaysia’s digital economy.

Here are five prominent companies leading the way:

1. Touch ‘n Go eWallet

Born out of a transportation payment solution, the Touch ‘n Go e-wallet has rapidly expanded its services to cover a multitude of payment options.

2. Boost

As an early entrant in the market, the Boost e-wallet has grown its user base with innovative services and customer-focused marketing.

3. GrabPay

Leveraging its successful ride-hailing platform, Grab ventured into the financial sector, and GrabPay is now one of Malaysia’s leading e-wallets.

4. BigPay

An offering by AirAsia, BigPay is more than just an e-wallet. It functions as a financial management tool, offering international remittance, expense tracking, and a prepaid card linked to its app.

5. ShopeePay

ShopeePay enhances the e-commerce experience by enabling quick and easy payments for online shopping. It has also expanded into offline retail, making it a versatile option for users.

The Benefits of E-Wallet Adoption

The growing popularity of e-wallets is a testament to the benefits they offer, not just for individuals but also for businesses and the economy.

- For consumers: E-wallets provide unmatched convenience, security, and access to exclusive rewards and promotions.

- For businesses: They open new opportunities to engage customers through personalized marketing and loyalty programs.

- On a larger scale: E-wallets contribute to Malaysia’s digital economy by promoting financial inclusion and reducing dependency on cash. This shift supports government initiatives like the MyDIGITAL blueprint, which aims to position Malaysia as a regional leader in the digital economy by 2030.

Challenges and the Road Ahead

Despite their success, e-wallets face challenges such as cybersecurity concerns, fragmented adoption among older generations, and competition in a saturated market. Addressing these issues will require collaboration between private companies, regulators, and consumers to build trust and ensure seamless interoperability.

Looking ahead, e-wallets are positioned to become a vital element of Malaysia’s digital economy. With ongoing innovation, strategic collaborations, and government initiatives, these digital payment tools are not only enhancing financial accessibility but also stimulating economic growth. By fostering financial inclusion, creating job opportunities, and driving digital transformation, e-wallets are paving the way for a more dynamic and interconnected financial landscape in Malaysia.

Looking to the Future: Malaysia’s Cashless Vision

Malaysia’s journey towards a cashless society is far from over. The future holds promising prospects, with emerging trends such as biometric payments, blockchain technology, and AI-driven services expected to revolutionise the payment landscape further.

Conclusion

The rise of e-wallets marks a significant milestone in Malaysia’s digital financial renaissance. As the nation continues to embrace this transformation, it’s poised to unlock unprecedented opportunities for economic growth and financial inclusion.

Ready to simplify your financial transactions?

With DSGPay, you can experience seamless remittances to Malaysia with unmatched efficiency and convenience. Whether for personal remittances or business transactions, DSGPay offers real-time disbursement, extensive bank coverage across Malaysia, and a secure platform with no hidden fees. Benefit from API integration and flexible transaction options to suit your needs.

Choose DSGPay today to ensure your funds reach their destination efficiently and hassle-free.