Did you know that in 2024, Hong Kong became Asia’s top financial hub again, ranking third in the world after New York and London? With 151 banks and transactions in over 100 currencies every day, it’s a gateway to global markets.

If you’re moving to Hong Kong, starting a business, or handling international finances, you likely want to open a bank account in Hong Kong to benefit from the city’s globally connected financial system.

In this guide, we’ll break down exactly how to open a bank account in Hong Kong step by step so you can get started with confidence.

Table of Contents

The 5 Steps to Open a Bank Account in Hong Kong

If you’re ready to open a bank account in Hong Kong, following a clear step-by-step process will help you avoid delays and ensure a smooth experience. Below are the four essential steps you need to follow:

Step 1: Choose and Compare the Banks in Hong Kong

Hong Kong offers a wide range of banking options to cater to diverse needs, whether you’re looking for personal banking, business accounts, or multi-currency solutions. Each bank has its own unique features, so it’s important to compare them based on what matters most to you.

Below is a table highlighting key features of some of the top Hong Kong banks to help you make an informed decision.

Step 2: Prepare Your Documents

Before heading to the bank, ensure you have all the required documents to avoid delays in your application process. Hong Kong banks have specific requirements for both personal and business accounts.

Required Documents for Personal Accounts

- Passport: A valid, unexpired passport for identification.

- Proof of Address: Recent utility bills, rental agreements, or official bank statements showing your residential address.

- Employment Documents: Employment contract, salary slip, or tax return as proof of income.

- Hong Kong ID or Visa: Non-residents may need a valid visa, work permit, or other proof of legal stay.

- Initial Deposit: Banks may require a minimum initial deposit ranging from HKD 1,000 to HKD 50,000, depending on the account type.

Required Documents for Business Accounts

- Business Registration Certificate: Official proof of the company’s registration in Hong Kong.

- Articles of Association: Documentation outlining the company’s structure and objectives.

- Director’s Identity Proof: Passport and proof of address for all directors.

- Company Proof of Address: A recent utility bill or lease agreement for the company’s office.

- Proof of Business Activities: Invoices, contracts, or other documents showing the nature of the business.

- Shareholder Information: List of shareholders and their respective ownership stakes.

- Initial Deposit: Similar to personal accounts, business accounts often require an initial deposit.

Pro Tip: Always carry multiple copies of your documents, as banks may need to retain them for verification purposes.

Step 3: Schedule an Appointment

Scheduling an appointment is a smart way to ensure your banking experience is smooth and efficient. While some Hong Kong banks accept walk-ins, securing an appointment either online or over the phone can help you save time and avoid unnecessary delays.

Below is a table with contact details for major Hong Kong banks to help you schedule your appointment easily:

Step 4: Submit Your Application at the Bank

On the day of your appointment, ensure you bring all the required documents and an initial deposit (if applicable). A bank representative will guide you step-by-step through the application process to ensure a smooth experience.

What to Expect:

- Application Forms: Fill out forms detailing your personal information, financial background, and any additional requirements specific to the type of account you are opening.

- Account Features: Select features like online banking, debit/credit cards, and multi-currency options tailored to your needs.

- Verification Process: The bank will verify your documents and may ask questions about your financial activities, such as the source of funds, expected transactions, and the purpose of the account.

- Initial Deposit: Submit your initial deposit, if required, to activate the account.

Step 5: Activate Your Account and Start Banking

Once your application is approved, you will receive your account details, debit/credit card, and online banking access. Depending on the bank and account type, approval timelines can range from a few days to a couple of weeks. Activation involves several critical steps to ensure you can utilize all account features effectively.

Steps to Activation:

- Set Up Online Banking: Register for the bank’s online platform and mobile app to manage your account conveniently. Most banks provide detailed guides or customer support to assist you.

- Activate Debit/Credit Cards: Follow the instructions provided to activate your card, which may include setting up a PIN for ATM withdrawals and transactions.

- Link to Payment Platforms: Connect your account to platforms like PayPal, Alipay, or WeChat Pay if needed. This step is crucial for seamless international and local payments.

- Understand Fees and Limits: Familiarize yourself with the bank’s fee structure, including transaction fees, currency conversion charges, and withdrawal limits. This helps avoid unexpected charges.

- Enable Multi-Currency Features: If applicable, activate multi-currency support to manage funds across different currencies effortlessly.

- Set Notifications: Enable alerts for account activities such as withdrawals, deposits, and low balances for better financial control.

When to Choose a Traditional Bank?

- Physical Branch Access: Ideal for those who need in-person assistance or access to branch-exclusive services.

- Personalized Financial Advice: Offers tailored consultations for investments, loans, and financial planning.

- Specialized Services: Includes options like safety deposit boxes, complex loans, and wealth management tools.

- Extensive ATM Network: Provides easy cash withdrawal and deposit options across wide locations.

- Security and Reliability: Trusted for long-term savings and investment accounts due to established stability.

How to Open a Hong Kong Bank Account Online

Opening an online bank account in Hong Kong is a convenient option, especially for expats, remote workers, and businesses managing cross-border transactions.

Steps to Open an Online Hong Kong Bank Account:

- Check Eligibility: Some banks require a Hong Kong ID or proof of residence, while others allow non-resident accounts with additional documentation. Confirm deposit and activity requirements.

- Prepare Documents: Gather your passport, proof of address, and income proof. For business accounts, also prepare a registration certificate and business contracts.

- Apply Online: Visit the bank’s website or app, fill out your details, and upload the required documents.

- Verify Identity: Complete verification via video call or an in-branch visit, depending on the bank’s requirements.

- Deposit Funds: Transfer the initial deposit to activate your account.

- Set Up Online Banking: Register for internet banking to access multi-currency transactions, payments, and other account tools.

While not all banks offer full online account setup, many provide hybrid processes that combine digital and in-person steps. Here’s what you need to know:

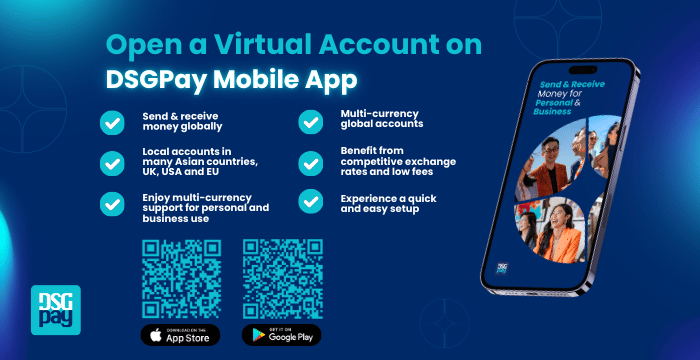

The Convenient Alternative: Online Virtual Accounts

Online virtual accounts provide an efficient and flexible way to manage finances without the need for traditional banking visits. These accounts are ideal for individuals and businesses managing multiple currencies or handling cross-border transactions.

With features like real-time transfers, low fees, and seamless integration with digital wallets, online virtual accounts are becoming the preferred choice for modern banking needs.

Why More Users Prefer Online Virtual Accounts

- Anywhere, Anytime Access: Online virtual accounts let you manage finances from anywhere in the world, eliminating the need for physical trips to the bank.

- Easy Setup: Quick and hassle-free account opening processes tailored for all users.

- Streamlined for All Users: Ideal for individuals and businesses, simplifying global financial operations.

- Affordable Fees: Enjoy lower transaction costs and minimal maintenance fees compared to traditional accounts.

- Multi-Currency Support: Manage funds in multiple currencies seamlessly, perfect for cross-border transactions.

- Accessibility for Non-Residents: Designed to accommodate users from anywhere, offering easy account setup without requiring local residency.

Concluding Thoughts on How to Open a Bank Account in Hong Kong

Having learned about how to open a bank account in Hong Kong, are you now ready to take the next step? Whether you’re navigating the requirements to open an account with the local banks or exploring online virtual accounts, choose the best option to meet your financial needs.

- Compare account types and fees.

- Prepare the right documents.

- Explore virtual alternatives for speed and flexibility.

- Prioritize security, accessibility, and currency support.

Hong Kong remains one of the world’s most powerful financial centers and opening a bank account here can unlock global opportunities for you or your business.

Why Choose DSGPay for Your Banking Needs in Hong Kong

Managing cross-border transactions in Hong Kong can be complex, especially for non-residents, startups, and SMEs. But DSGPay simplifies the process with innovative solutions tailored to modern needs. As a trusted alternative to traditional banks, DSGPay delivers unparalleled convenience and efficiency for both individuals and businesses.

What You Can Do with a DSGPay’s Virtual Account:

- Hold and Manage 30+ Currencies: Operate in HKD, USD, EUR, GBP, AUD, CNY, and more. All from one account.

- Open a Named Account for Your Business: Get a virtual global account under your company’s name to enhance trust and simplify business transactions.

- Skip the Bank Visit: Seamless onboarding experience without in-person visits.

- Competitive Exchange Rates: Enjoy favourable rates that help you save on every transaction.

- Fast Payments: Experience fast and secure transfers, enhancing effectiveness.

If you’re exploring alternatives to traditional banks in Hong Kong, DSGPay offers a practical and efficient solution. Ready to simplify your global payments?