Open banking in Singapore has been gaining momentum as a promising solution to drive financial innovation and improved customer experience. This concept involves opening up access to customer financial data, with their consent, to third-party providers. By doing so, it enables the sharing of information and services among different banks and financial institutions, ultimately creating a more open and integrated financial ecosystem.

Open banking holds immense potential to transform how Singaporeans manage their money and conduct financial transactions. With increased collaboration and competition among banks, customers are expected to have more personalized and efficient financial services at their disposal. This shift towards open banking has the potential to create a deeper level of trust and engagement between customers and financial institutions in Singapore.

Understanding Open Banking

Open banking is a system where banks and other financial institutions provide access to their data via Application Programming Interfaces (APIs). This sharing enables third-party developers to build new financial products and services.

At its core, open banking encompasses three primary principles: transparency, customer-centricity, and innovation. It paves the way for improved consumer choice, fosters competition, and stimulates creative technological developments.

Globally, open banking has seen a surge of interest, with many regions implementing related legislation and numerous fintech companies leveraging this data-rich environment to develop innovative solutions.

The Emergence of Open Banking in Singapore

Singapore has embraced digital banking proactively, recognising its potential to spur financial innovation and efficiency. The Monetary Authority of Singapore (MAS) has paved the way for open banking by fostering a conducive regulatory environment and encouraging collaboration between traditional banks and fintech firms.

Notable milestones in Singapore’s open banking journey include the launch of various API initiatives by significant banks, MAS’s establishment of data-sharing standards, and the introduction of digital bank licenses.

The Impact of Open Banking on Singapore’s Financial Sector

Disruption and Innovation in Traditional Banking

Customer expectations are evolving rapidly, demanding more personalised and convenient banking services. Open banking facilitates the creation of tailored financial products that meet these needs. Simultaneously, it empowers customers to control their financial data, thus transforming the way banking is conducted.

The Rise of Fintech and Non-banking Players

Fintech companies drive open banking, providing fresh perspectives and solutions that challenge traditional banking norms. While this has resulted in increased competition, it has also led to numerous collaborations, creating a symbiotic relationship that benefits the financial ecosystem.

Economic Implications

The economic prospects of open banking are promising, with the potential to contribute significantly to Singapore’s economic growth. However, it also brings compliance and security concerns that must be managed.

The Future of Open Banking in Singapore

Open banking in Singapore is on an upward trajectory, with predictions of increasing adoption and continuous evolution. While numerous opportunities exist, such as creating new business models and enhanced customer experiences, challenges like data security and legacy system integration need to be addressed. However given Singapore’s adaptability to technological advancements, the potential for open banking to revolutionize the financial sector in the country is immense.

What Does This Mean to The Singaporean Citizen?

In a nutshell, open banking is about putting consumers at the centre of their financial journey by providing access to a diversified range of innovative financial services. With open banking, Singaporeans can look forward to personalizing their banking experiences, lower costs, and faster, safer transactions. This simply means the people of Singapore can have more control over their finances and enjoy a more transparent and secure financial ecosystem while ensuring fair competition among financial institutions.

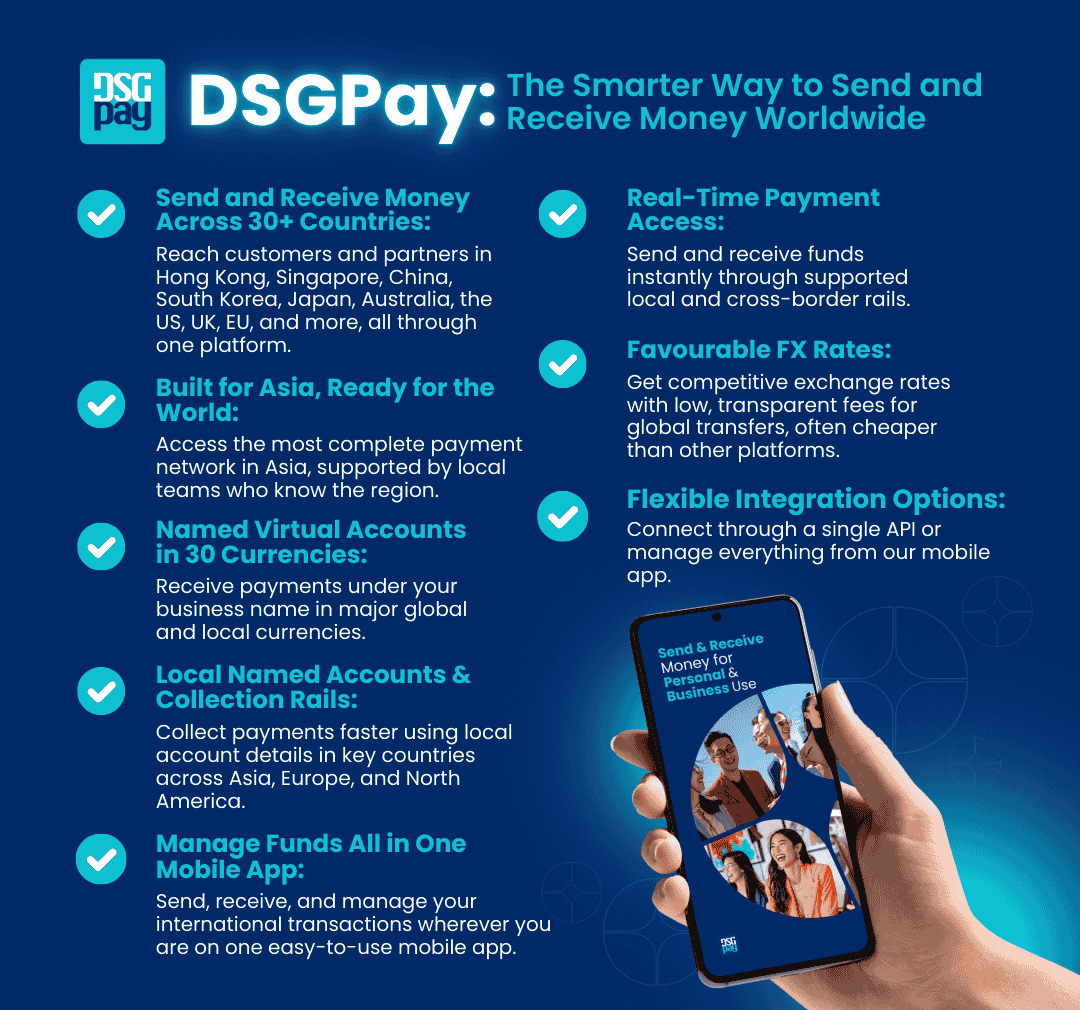

How DSGPay Contributes to Open Banking in Singapore

As a fintech company committed to driving innovation in the financial sector, DSGPay recognizes the importance of open banking and its potential to enhance the banking experience for Singaporeans. At DSGPay, we are continually leveraging this data-rich environment to develop cutting-edge payment solutions for our customers. With our innovative payment system seamlessly integrated into the open banking ecosystem, we are committed to providing our customers with a secure, fast, and personalised payment experience. If you’re looking for a reliable and customer-centric payment solution, contact us now!