Open banking in Thailand represents a significant shift in the nation’s financial landscape. As Thailand embraces the wave of financial digitisation, open banking has become a cornerstone of the country’s financial transformation. This innovative framework is not just about convenience, it’s reshaping how consumers, businesses, and institutions interact with financial services, paving the way for a more connected and competitive financial ecosystem.

The rise of open banking in Thailand is driven by a blend of technological advancements, regulatory support, and evolving customer demands. With APIs enabling seamless data sharing between banks, fintechs, and other financial institutions, open banking has unlocked a new era of personalised services.

Customers now enjoy enhanced transparency, streamlined financial management, and tailored product offerings, making banking more accessible and efficient than ever before.

What is Open Banking?

Open banking is a financial practice that allows third-party service providers, such as fintech companies, to access banking data securely with customer consent. It leverages APIs (Application Programming Interfaces) to enable the sharing of information between banks and other financial institutions. This approach not only enhances service offerings but also fosters competition and innovation in the financial industry.

For Thailand, where the financial sector is undergoing rapid modernisation, open banking provides opportunities to democratise financial services. It empowers customers to take control of their financial data, enabling them to explore better options for loans, investments, and savings. This shift aligns perfectly with the nation’s broader agenda of digital transformation and financial inclusion.

Regulatory Landscape and Support

The implementation of open banking in Thailand has been heavily influenced by global trends and local regulations. The Bank of Thailand (BOT), the nation’s central bank, plays a critical role in shaping policies and frameworks that govern this system. Recent regulatory efforts emphasise data security, transparency, and the importance of customer consent, ensuring that open banking operates within a robust and trustworthy framework.

Furthermore, Thailand’s alignment with international data protection laws, such as the General Data Protection Regulation (GDPR), enhances its credibility in the global financial ecosystem. These measures not only facilitate smoother adoption of open banking practices but also reassure customers about the safety of their data.

Benefits for Consumers and Businesses

The benefits of open banking in Thailand are multifaceted.

For consumers: It means access to better financial tools, improved personal finance management, and opportunities to secure more competitive financial products. For instance, a consumer looking for a loan can now use an open banking platform to compare offers from multiple banks and choose the one that best suits their needs.

For businesses: Particularly SMEs, open banking simplifies access to credit. By allowing lenders to assess real-time financial data, it enables faster loan approvals and tailored credit solutions. Additionally, open banking fosters innovation among fintech startups, which can build cutting-edge financial products and services that address specific market needs.

Challenges and the Way Forward

- Cybersecurity Concerns: Ensuring robust protection of sensitive customer data to prevent breaches remains a top priority.

- Building Trust: Gaining customer confidence in securely sharing financial information with third-party providers is a significant challenge.

- Interoperability Issues: Achieving seamless integration between financial institutions and third-party platforms requires standardised APIs and consistent regulations.

- Collaboration Needed: Effective solutions depend on partnerships between banks, fintechs, and regulators to address these challenges and build a reliable open banking ecosystem.

The Evolution of Open Banking in Thailand

Thailand has demonstrated a progressive stance towards digital banking, recognising its potential to spur economic growth and financial inclusion. Regulators have made significant strides, introducing changes that facilitate open banking.

Among crucial milestones, the introduction of PromptPay, a real-time payment platform, has paved the way for open banking, offering a glimpse of the sector’s future potential.

Open Banking and International Money Transfers

One of the ways open banking is revolutionising financial services is by making international money transfers more efficient. Open banking offers customers greater control over their international transactions by providing a more streamlined and transparent process.

Conclusion

In summary, the evolution of open banking in Thailand signifies an exciting phase in the nation’s financial history. While the journey is still in its early stages, the strides made thus far bode well for the future. As Thailand continues to embrace the potential of open banking, the nation stands on the precipice of a more inclusive, innovative, and customer-centric financial sector.

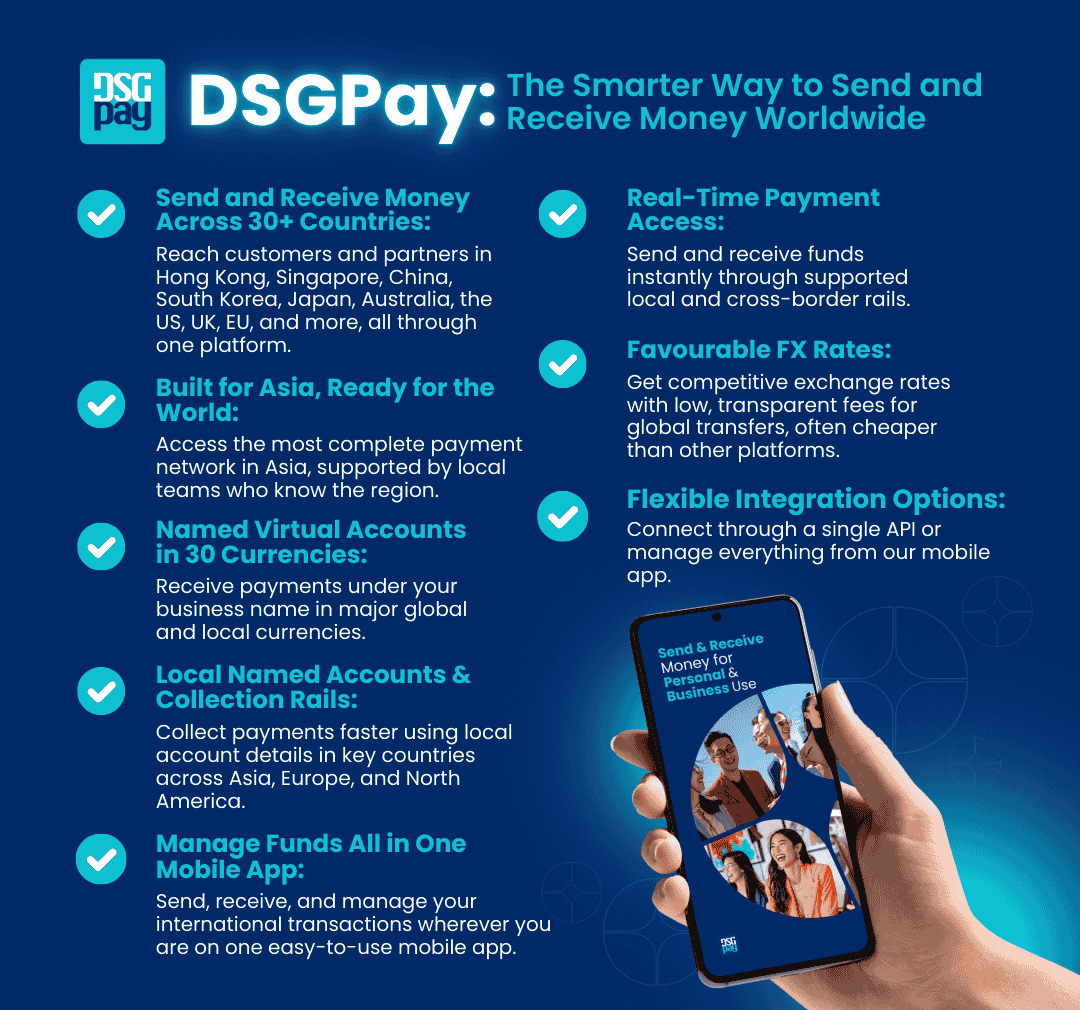

As Thailand embarks on this exciting journey towards an innovative and customer-centric financial sector, it is important that businesses stay ahead with DSGPay. With a deep understanding of open banking, our team can help you harness this potential and navigate the changes effectively. Keep the future of finance from passing you by – reach out to DSGPay today, and together, let’s shape a more inclusive and innovative financial landscape in Thailand.