Payment Methods in Cambodia are undergoing a transformative shift, driven by technological innovation and economic growth. From traditional cash transactions to modern digital solutions, the landscape of financial services in Cambodia has expanded significantly. This evolution has not only bolstered economic development but also enhanced accessibility and efficiency, empowering businesses and individuals alike.

In this article, we explore the progression of international payment methods in Cambodia, highlighting their impact on the nation’s financial ecosystem.

Historical Overview of Payment Methods in Cambodia

Payment Methods in Cambodia have a rich historical backdrop, rooted in traditional practices like cash payments and basic bank transfers. These methods, while familiar and widely used, often presented obstacles such as processing delays, high transaction fees, and limited accessibility.

The emergence of international payment methods has marked a turning point, introducing digital solutions that enhance efficiency, reduce costs, and expand financial accessibility across the nation. This shift has been instrumental in reshaping Cambodia’s financial landscape and connecting it to the global economy.

The Advent of New International Payment Methods in Cambodia

The introduction of digital and mobile payment solutions has transformed payment methods in Cambodia, bringing a new era of convenience and efficiency. This evolution has been driven by progressive regulatory changes aimed at fostering financial inclusivity and technological innovation. Numerous players, including traditional banks and fintech companies, have played pivotal roles, launching cutting-edge international payment solutions that cater to diverse needs. These advancements have created a competitive and dynamic financial ecosystem, positioning Cambodia as a hub for modern payment technologies.

Influence of Technology on International Payment Methods

1. Increased Connectivity and Smartphone Adoption

- The rapid growth of internet connectivity and smartphone use has transformed payment methods in Cambodia.

- These advancements have made transactions more secure, efficient, and widely accessible.

2. Adoption of Digital Payment Platforms

- Platforms like Wing have successfully harnessed technology to offer seamless and reliable payment solutions, setting benchmarks for innovation in the sector.

3. Integration of Blockchain Technology and Implementation of AI Technologies

- Blockchain systems create immutable transaction records, reducing fraud risks.

- AI-powered chatbots and fraud detection systems analyze transaction patterns in real-time.

- These systems enhance security, detect suspicious activities, and improve user trust.

- The combination of blockchain and AI contributes to a secure, efficient, and inclusive financial system tailored to Cambodia’s needs.

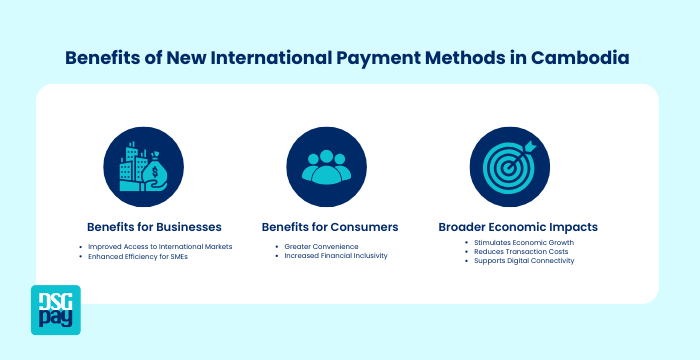

Benefits of New International Payment Methods in Cambodia

The introduction of new international payment methods has had a profound impact on Payment Methods in Cambodia, bringing several notable benefits.

1. For Businesses

Businesses now have improved access to international markets, enabling them to expand and engage in cross-border trade more efficiently. This has been particularly beneficial for small and medium-sized enterprises (SMEs), which can now tap into global opportunities with ease.

2. For Consumers

These advancements offer greater convenience, allowing for faster, more secure transactions both locally and internationally. The increased trust in digital payments has fostered a more inclusive financial environment, bridging the gap for the unbanked and underbanked populations.

3. Broader Economic Impacts

The adoption of modern payment methods stimulates Cambodia’s economic growth by driving increased trade, investment, and financial activity. The enhanced efficiency of these systems also reduces transaction costs, benefiting both businesses and consumers. Overall, the integration of these technologies supports Cambodia’s ongoing development into a more digitally connected and financially inclusive economy.

Conclusion

While challenges remain, the future of international payment methods in Cambodia holds promising developments, promising a more inclusive and efficient financial landscape. With DSGPay as your partner:

- You can effectively overcome hurdles and leverage the promise of a more inclusive and efficient financial system.

- We offer solutions tailored to this evolving landscape, ensuring your business stays ahead.

Contact DSGPay today, and together, let’s shape the future of international payments.