Payment Solutions in Malaysia have transformed the financial landscape in recent years, becoming a critical driver of economic growth and digital inclusivity. The rise of innovative digital payment solutions has profound implications not only for businesses and consumers but also for the entire Malaysian economy.

The Evolution of Payment Solutions in Malaysia

Historically, cash and cheques were the primary methods of payment in Malaysia. However, the advent of digital technology brought forth many electronic payment solutions, starting with card-based transactions and then transitioning to online banking and mobile wallets.

This shift towards digital payment solutions has been driven by increased internet penetration, the widespread use of smartphones, and the growth of e-commerce. Furthermore, regulatory support from Bank Negara Malaysia has also played a crucial role in fostering a digital economy and promoting the use of seamless digital payment solutions in Malaysia.

Impact of Digital Payment Solutions on Malaysia’s Economy

The economic benefits of the digital shift are substantial. Digital payment solutions can enhance efficiency, reduce transaction costs, and stimulate consumer spending. Payment solutions in Malaysia also play a vital role in financial inclusion efforts, providing access to financial services for the unbanked and underbanked populations with access to essential financial services.

Digital payment solutions in Malaysia have changed consumer behaviour, fostering a preference for seamless, cashless transactions. This shift has encouraged businesses to adapt and integrate digital payment solutions into their operations to meet consumer demand.

Current State of Payment Solutions in Malaysia

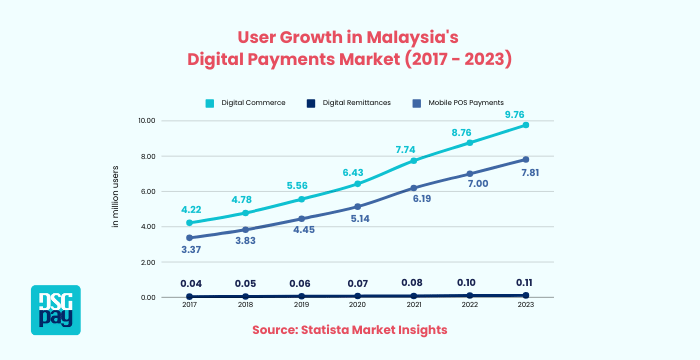

Today, digital payment solutions are popular in Malaysia. Digital wallets such as Touch ‘n Go eWallet, Boost, and GrabPay have become household names, revolutionizing the way Malaysians transact. The expansion of e-commerce has further propelled the use of online banking systems as essential payment solutions in Malaysia.

Leading financial institutions, including Maybank, have enhanced their offerings, with the Maybank2u platform becoming a benchmark for user-friendly and diverse digital payment solutions in Malaysia. The impact of these innovations is evident in the retail sector, where cashless payment solutions in Malaysia have streamlined transactions and improved the customer experience.

Challenges and Risks of Implementing Payment Solutions in Malaysia

Implementing digital payment solutions in Malaysia comes with a range of challenges and risks that businesses must address to ensure success. Despite the rapid growth of digital payments, issues such as security vulnerabilities, limited infrastructure, and consumer behavior pose significant barriers. Building trust, overcoming a cash-driven culture, and supporting smaller businesses in adopting robust systems are crucial steps toward fostering a seamless digital payment ecosystem. Below is an overview of these challenges and risks:

Challenges and Risks | Details |

User Trust | Many consumers still lack trust in digital payments. |

Cash Preference | A strong preference for cash needs to be overcome to boost digital adoption. |

Security Concerns | Online transactions are vulnerable to fraud and cyber-attacks. |

Technological Infrastructure | Robust systems are essential, posing challenges, especially for smaller businesses. |

The Future of Payment Solutions in Malaysia

Looking ahead, Malaysia’s digital payments landscape is set to evolve further. With advancements in technology paving the way for more sophisticated and secure systems. Emerging trends such as biometric authentication, blockchain integration, and real-time payment processing are set to redefine the landscape of payment solutions in Malaysia.

This evolution of payment solutions presents a multitude of opportunities for businesses, consumers, and the economy. By embracing these changes, Malaysia can enhance its economic growth, improve financial inclusion, and establish a more efficient and inclusive digital economy.

Conclusion

The rise of digital payment solutions in Malaysia is a testament to the country’s commitment to embracing the digital shift. While challenges exist, the benefits and future potential far outweigh these hurdles. As Malaysia continues to advance on its digital journey, the power of payment solutions remains a crucial driver of this exciting transformation.

DSGPay stands ready to support your business’s transition and help overcome any challenges. Our expertise in digital payment solutions addresses current needs and anticipates future trends, ensuring your business stays ahead in this evolving landscape. Harness the transformative power of digital payment solutions for your success. Contact DSGPay today and take a pivotal step in Malaysia’s exciting digital journey.