Did you know Australia received 1.73 billion USD in remittances in 2024? With such a high volume of international transfers, it’s no surprise that the need for an affordable and secure money transfer solution has become a must.

Whether you want to send money to your loved ones, scale your business internationally, or pay your children’s education fees, you’ll find multiple payment options that may confuse you. But don’t worry, we are here to make it simple!

In this post, we’ll explain why DSGPay stands out as the most reliable, secure, and efficient global payment solution. Let’s get started.

Table of Contents

What Are the Key Considerations for Choosing the Best Service to Send Money to Australia?

Choosing the best global payment solution to send money to Australia depends on several factors, including speed, cost, and reliability. Here’s what to consider:

| Consideration | Description |

| 1. Purpose of Transfer | Before you send money to Australia, you should know the exact purpose of your transfer. Is it for helping out your family, paying suppliers, covering business expenses, or handling employee salaries? Knowing the purpose helps you pick the right service—whether you need a one-time payment, regular transfers, or bulk payments. |

| 2. Delivery Speed | Most bank transfers may have a longer time frame of 3-7 days. However, if speed is your priority, choose a provider that provides real-time payment options without any delays. |

| 3. Compare Fees and Exchange Rates | Transparency matters a lot when you’re choosing a service. Hidden fees can add up quickly for freelancers, businesses or individuals sending recurring payments. Pick a service that clearly states all charges and the final amount received by the recipient while offering competitive exchange rates. |

| 4. Security | Ensure that the provider offers secure, encrypted transactions to protect your financial information, especially when making business payments or supporting loved ones. |

| 5. Global Coverage | The payment provider should have global coverage. Double-check that the one you choose can actually send money to Australia. |

| 6. Payment Methods Available | Consider what payment methods the service accepts. Whether you prefer paying by bank transfer, credit card, or other online systems, choose a provider that offers flexible options for convenience and ease of use. |

| 7. Reliable Customer Support | Good customer support is essential. Choose a provider that offers responsive, helpful support to resolve any issues or questions, ensuring your transfer goes smoothly. |

What Are the Top Methods to Send Money to Australia?

Depending on rates, speed and reliability, we have curated the list of the 6 best ways to transfer money to Australia.

1. DSGPay

DSGPay is a trusted global payment solutions provider that makes it easy to handle payments around the world, including in Australia. With features like virtual accounts and multiple payout options, it helps businesses and individuals send and receive money quickly, securely, and without the high costs. DSGPay is all about great customer service, so they’ll help you with anything you need.

Plus, as your business grows, DSGPay can keep up with the increasing number of transactions, making it a reliable choice for businesses of all sizes.

Why Choose DSGPay

- DSGPay integrates with multiple local payment networks across Asia and leverages PayID on Australia’s NPP for real-time payments, providing broad access to Australian banks.

- It supports different currencies, like AUD, to make cross-border payments easier.

- DSGPay offers virtual accounts to help businesses handle payments without needing a physical bank.

- Multiple payout options, like real-time payments, batch file bulk settlement, and real-time gross settlement (RTGS), suit different business needs and payment sizes.

- API integration makes it easy to connect with your current financial systems, saving time and effort.

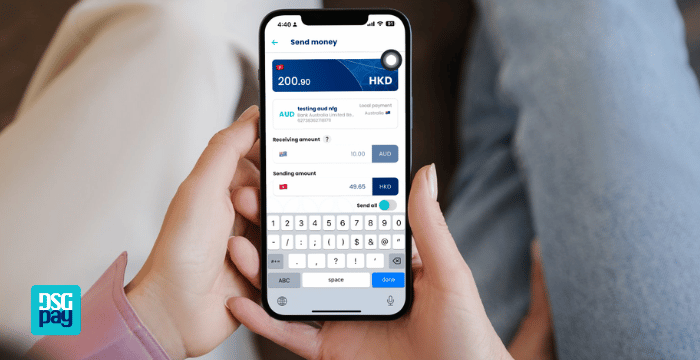

- The DSGPay mobile app allows instant, efficient transactions, helping you manage expenses and focus on growing your business.

How to Send Money to Australia Using DSGPay

To send money to Australia with DSGPay, follow these steps:

- Sign up for your DSGPay account

- Select the Currency: Open multi-currencies account, choose AUD (Australian Dollar) as the currency and create an AUD currency account.

- Choose the Payment Method:

- Select the payment method that suits your needs:

- One-Time Payment Link: Enter the recipient’s details and payment amount in AUD. Review the payment details, authorize the transaction, and share the payment link with your business partner.

- Fixed Account: Share the account information with your partner or copy the account details to transfer funds directly from your bank account.

- Select the payment method that suits your needs:

- Track Your Payment: Monitor the progress of your transaction in real-time through your phone or receive updates via push notifications.

2. SWIFT Transfer

When you want to send money to Australia, the first option that might come to your mind would be a bank transfer. You can visit your local bank and inquire about SWIFT transfers. While bank transfers are done on a national level, the SWIFT network works globally allowing international transactions between banks using unique BIC codes.

Banks that provide SWIFT services such as HSBC, ANZ, CitiBank, Chase, Well Fargo, PNC Bank and Bank of America. They have different SWIFT transfer charges that usually range between $15 to $50. For SWIFT transfers, you’ll need information like the recipient’s bank details including account number and special SWIFT code.

Why Choose SWIFT Transfers

- Secure and reliable.

- Ideal for sending large, one-time payments.

- Speed isn’t your top priority.

Though this is the most secure option, they are expensive, slow, and provide poor exchange rates compared to others on the list.

How to Send Money to Australia Through SWIFT Transfers

- Log into your bank account or visit in person to request a SWIFT transfer.

- Check for any fees and limits before sending money abroad.

- Provide details like the country and currency you’re sending.

- You may be asked to verify your identity with a passport scan and a recent bill.

- Agree on the exchange rate with your bank or transfer service.

- Your bank will receive your money.

- The funds will be converted to the destination currency and sent through the SWIFT network.

3. Forex Providers

Forex Providers or Foreign Exchange Providers are another good option if you want to send money to Australia. They help you convert currency at a competitive exchange rate making it a cheaper alternative to SWIFT transfer.

You can transfer funds via forex providers like TorFX, Xe, OFX and Currencies Direct. They are best suited for businesses or individuals looking to transfer large sums of money at the most favourable exchange rate.

Why Choose Forex Providers

- To send large sums of money.

- To get the most competitive exchange rates.

- For quick transfers.

However, transaction fees may be higher than expected, making it a less cost-effective choice. Also, the technical complexities involved may make it less convenient.

How to Send Money to Australia Using Forex Providers

- Pick a trusted forex provider like OFX, Xe, or WorldFirst. Check their rates and fees.

- Sign up by providing your details and ID.

- Add the recipient’s info, like their name, bank account number, and bank details (e.g., BSB if they’re in Australia).

- Enter the amount you want to send and confirm. You’ll see the exchange rate and fees.

- Pay for the transfer with your bank, credit/debit card, or another option.

- Track your transfer online or via their app for updates.

- The money will reach the recipient’s bank account, usually in 1–5 business days.

4. CryptoCurrency

If you’re already aware of the crypto industry, you must know how easy it is to transfer funds internationally using cryptocurrencies like Bitcoin and Ethereum. They are faster and cheaper than bank transfers. The good part is that you can transfer funds even if your recipient doesn’t have a bank account.

While there are some challenges, like adoption and rules still being worked out, the use of cryptocurrencies, especially stablecoins, is expected to grow and become a bigger part of global money transfers.

Why Choose CryptoCurrency

- Lower transaction fees compared to traditional methods.

- Faster transfers, often completed in minutes.

- Accessible to anyone with an internet connection, even without a bank account.

- Secure transactions through blockchain technology.

- No need for currency conversion fees.

- Available 24/7, unlike bank transfers.

- Stablecoins offer reduced volatility for safer transfers.

While cryptocurrency offers advantages like lower fees, faster transfers, and accessibility, it also comes with challenges. The high volatility of many cryptocurrencies presents a risk to users, even though stablecoins have been introduced to help reduce this instability.

How to Send Money to Australia Using CryptoCurrency

- Choose a cryptocurrency (like Bitcoin).

- Get a digital wallet to store it.

- Ask the person for their wallet address.

- Type in their address and the amount you want to send.

- Check everything is correct.

- Hit send and wait a few minutes.

- Let the person know it’s on its way!

5. Online Money Transfer Service

Online money transfer services like Paypal, Wise, and Remitly are quite popular among businesses and individuals for performing international transactions and offering competitive exchange rates.

Why Choose Online Money Transfer Service

- Quick and easy transfers via app or website.

- Instant transfers for smaller amounts.

- Lower fees and better exchange rates than banks.

- Support for multiple currencies and countries.

- Simple interfaces for easy use.

- Various payment options, including bank accounts and cards.

As compared to SWIFT transfers, they are fast providing instant money transfer options. But keep in mind that certain platforms have transfer limits, which can restrict how much you can send at once, especially when using credit or debit cards.

How to Send Money to Australia Using Online Money Transfer Service

- Sign up for PayPal, Wise, or another online money transfer service.

- Link your bank account or card to your account.

- Enter the recipient’s details like their email, phone number or bank details as required.

- Type in how much you want to send and check the fees.

- Double-check that everything is correct before you send.

- Confirm the payment, usually by verifying with a code.

- Track your transfer to see when it reaches the recipient.

6. Western Union

Western Union is one of the oldest and most trusted names in money transfers and financial services. They make it easy to transfer online, through their app or in person at one of their many agent locations. You can send money to over 200 countries and they make sure that transfer is secure and reliable.

To send money to Australia through Western Union, you need to provide some basic information that includes your full name, address, valid ID, source of funds (for larger transactions) and receiver details like his name and bank details. They offer a range of payment options like paying with cash, debit or credit card or even through your bank.

Why Choose Western Union

- Available in 200+ countries and territories.

- Serving millions of customers daily.

- Billions of bank accounts and wallets worldwide are accessible for payouts.

- Hundreds of thousands of agent locations globally.

Compared to other options Western Union has high fees and less favourable exchange rates. This means the transfer may end up costing you more, and the recipient might not get the exact amount you intended to send.

How to Send Money to Australia Using Western Union

- Sign in or register for a free account.

- Click ‘Send now’ to start the transfer process.

- Enter Australia as the destination and choose the receiver’s preferred method (cash pickup or bank account).

- Review the fees, delivery times, and total amount to ensure everything is correct.

- Pay using cash, card, or bank transfer, depending on your choice.

- Keep your tracking number (MTCN) from the receipt and share it with the recipient for tracking.

FAQS: Sending Money to Australia

Q: What is the best way to send money to Australia?

The best way to transfer money depends on your priorities. For speed, flexibility and cost-efficiency, DSGPay is a standout choice.

Q: How long does it take to send money to Australia?

Delivery times vary. DSGPay and online services like Wise offer near-instant transfers, while SWIFT and Forex providers may take 1–5 business days.

Q: Are there any hidden fees when sending money?

Always check for hidden fees, especially with banks and SWIFT transfers. Services like DSGPay are transparent with their charges.

Q: Are there transfer limits?

Yes, limits depend on the service. For example, online platforms may cap transfers, while DSGPay supports both small and large transactions.

Q: How do I start using DSGPay for international transfers?

Getting started is simple! Sign up for a DSGPay account, open an AUD currency account, and choose your preferred payment method. You can send payments via one-time payment links or fixed accounts, making the process easy and convenient.

Q: Can I track my transfers with DSGPay?

Yes, DSGPay provides real-time tracking and notifications, so you’re always updated on the status of your transactions.

Why DSGPay is the Best Option to Send Money to Australia

Now you know the 6 best ways to send money to Australia, each offering unique benefits tailored to different needs. Among them, DSGPay truly stands out as an all-in-one solution. Here’s why:

- Multi-Currency Accounts: Easily manage and send money in different currencies with DSGPay’s flexible account options.

- Global Connectivity: DSGPay connects with local payment networks across Asia and uses PayID on Australia’s NPP for real-time payments, ensuring wide access to Australian banks.

- Competitive Pricing: Enjoy low exchange rates and minimal transaction charges, saving you money on every transfer.

- High Scalability: As your business grows, DSGPay can handle high transaction volumes without requiring you to switch providers.

- Robust Security: DSGPay ensures your transactions are safe and secure with advanced encryption technology.

- Exceptional Customer Service: Benefit from reliable support tailored to your needs.

- DSGPay Mobile App: The DSGPay mobile app enables quick and seamless transfers, helping you manage expenses and focus on expanding your business.

Ready to experience the ultimate solution for your money transfers? DSGPay is here to make sending money to Australia easier, faster, and more secure.