With the increasing number of customers shopping online, it’s vital to partner with the right payment provider. Choosing a reliable payment provider can significantly impact your SME business’s success.

Table of Contents

Key Considerations for SME Payment Solutions

Late payments and an unreliable payment provider affect cash flow and the long-term growth of businesses. A survey of over 2000 mid-sized businesses by Quickbooks revealed that 65% of companies spent a staggering 144 hours on average weekly performing administrative tasks to collect payments.

Furthermore, 81% of businesses complained that they struggled to integrate a payment system. That’s why partnering with a robust and innovative payment provider is crucial for SME payment solutions.

1. Payment Providers’ Processing and Settlement Times

Processing and settlement can impact cash flow and customer payment experience. That’s why it’s crucial to know the service level agreement of any payment provider regarding processing and settlement.

Processing times refer to the duration for a transaction to be approved or declined. For example, when a customer makes a card payment with card payment providers, the issuing bank approves it after confirming the cardholder’s details and has sufficient funds in their account.

Settlement times refer to how long it takes for funds to settle. For example, credit and debit card payments process faster but take longer to settle, even days.

However, direct bank payments in countries with advanced payment systems typically settle almost instantly. Still, payment involving currency conversion usually takes a few days (2-5), depending on the payment provider and payment system.

2. Coverage of Cross-border Payment Providers

Coverage is essential when selecting reliable thirty-party payment providers for your SME business. Since most businesses have customers worldwide, partnering with cross-border payment providers that cover the geographical regions of their potential customers is crucial to avoid losing revenue.

Most top payment providers offer different payment methods and will recommend the most reliable and efficient method, such as local virtual payment accounts for any region, to enable customer payment experience.

3. Fees/Cost of Third-Party Payment Providers

Before choosing an online payment provider, it’s vital to understand their fees. Many P2P payment providers charge a fixed fee for every transaction. Some charge a percentage value of the transaction. This can range from 0.5% to 4% and depends on the volume of the transaction and payment method.

Most B2B payment providers typically add a markup to the exchange rate for transactions involving conversions from one currency to another. This markup is hidden and is usually covered by the customer at the point of transaction.

4. Ease of Implementation with Digital Payment Providers

Partnering with digital payment providers that offer ready-to-use and low-code implementation payment processors makes it easier for SME businesses to collect customer payments. The payment processor should be easy to deploy on a website and have undergone rigorous trials and errors to ensure its efficiency and reliability.

Some payment providers offer an API for easy and seamless website integration, allowing businesses to customize payers’ experience and gain control over their payments. The SME payment solutions should be compatible with different payment and financial software systems.

5. Ease of Use of Payment System

Problematic payment systems are a pain in the neck for businesses and customers. Complex and complicated payment systems drain resources and time and ultimately lead to a loss of revenue. However, automated/simplified payment processes save costs and time. Some payment providers incorporate AI to simplify their payment processes.

For customers, complicated payment systems will discourage them from completing a purchase. A study by Baymard Institute reveals that 22% of shoppers will abandon their cart because of the complicated and extremely long checkout process. Furthermore, 21% will abandon their cart if they can’t see/calculate the total order cost upfront. In addition, 26% will abandon their cart if the site requires them to create an account before making a payment. This implies that customers facing complicated and long checkout processes and non-transparent costs will not proceed with their transactions.

That’s why ease of use/operational simplicity is crucial when selecting a payment provider online.

6. Customer Support of Online Payment Provider

Customer support is the direct link between a firm and its customers. It can influence a business’s reputation and growth.

Multiple online payments can result in errors probably due to a bad network, especially when conversion between different currencies is involved in a single transaction.

Often, payment providers may adopt the latest technology trends to enhance their payment systems, and businesses will be eager to explore them.

Therefore, it is vital to choose a global payment provider with a robust customer support team to offer assistance should you encounter any problems. The best payment providers provide support through different channels, such as email, phone numbers, live chat, or even dedicated account managers. You can check online reviews of your intended payment provider to learn how they deal with issues, or you can run an experiment yourself.

7. Customer Payment Experience With P2P Payment Provider

Providing a seamless and convenient payment experience is crucial when selecting any payment provider. As online shopping is taking over commerce, customers are increasingly leaning towards fast, efficient, and reliable SME payment solutions.

A recent statistic by Baymard Institute shows that 13% of online shoppers have abandoned their carts because of insufficient payment methods. In addition, 9% abandoned their cart because their credit card was declined. Customers value convenience and will always want to pay using their preferred payment method. Therefore, any payment solution or provider that doesn’t meet these criteria should be avoided.

8. Transparency of Global Payment Provider

Transparency is a vital factor when choosing a payment provider. It helps to build trust and commitment. A transparent provider will reveal details about their pricing, transaction costs and any extra charges. This will help businesses analyse their finances and make an informed decision.

Also, the best online payment provider will reveal information regarding compliance and data security measures to give businesses and customers assurance that their sensitive data is secured.

9. Compliance with International Payment Regulations

Payment regulation is changing worldwide. While regulations such as KYC and AML are slightly the same across different geographical regions, some countries have a separate, unique regulatory framework. Therefore, it’s crucial to partner with an international payment provider that complies with worldwide payment regulations and regulations around the locations of your target customers.

10. Security Measures by Payment Providers

A study by Baymard Institute shows that 25% of online shoppers abandoned their cart because they didn’t trust the site with their credit information. This illustrates the importance of security.

Therefore, it’s vital to partner with the best payment providers that follow industry standards and security protocols such as level-1 PCI DSS Compliant. Some payment providers incorporate fraud detection and other measures to safeguard transactions from malicious entities.

11. Hosted vs Non-Hosted Payment Systems

Hosting a payment system off-site (the customer is redirected to the payment processor site to process the payment) and on-site (the customer processes payments on your site) has pros and cons. The advantage of a hosted system is that it reduces the need to store sensitive data on your site. The disadvantage is that it makes the payment process longer and lengthy, which can discourage customers.

Therefore, choosing a payment provider that provides any of these options is crucial.

12. Mobile Payment Provider Support

Most online shoppers use their tablets and mobile phones. Therefore, it’s vital to partner with a mobile payment provider that supports mobile payment. This allows your customers to shop with any device of their choice.

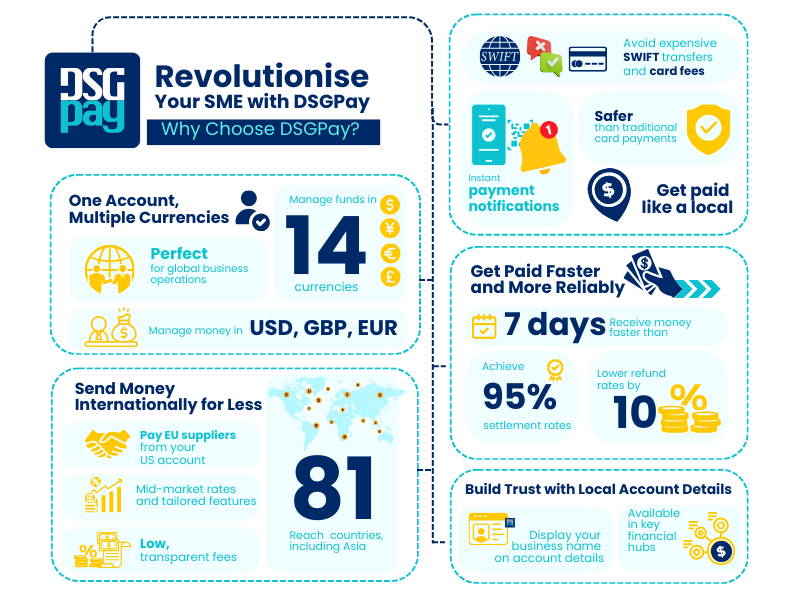

DSGPay Simplifies Cross-Border Payments Across Asia

Choosing the right payment provider will enhance your SME business operations and customer payment experience, increasing revenue and growth. Conversely, the wrong payment provider can ruin your business and drive away your customers.

DSGPay is a leading cross-border payment provider in Asia. By offering multi-currency, multi-channel, and virtual accounts, DSGPay streamlines payments and enhances customer payment experience.

As a fully regulated and licensed provider, DSGPay leverages cutting-edge technologies to offer transparent, secure and reliable SME payment solutions.