You may have heard about it before when researching payment processing solutions, but what actually is a payment gateway? And why is it important to your business? A payment gateway is the key to providing customers with a fast, safe, and reliable way to complete transactions.

With the number of payment terminals worldwide expected to reach 555 million by 2026, the demand for secure and efficient payment gateways has never been higher.

This guide will explore why payment gateways are crucial for your business operations, how they safeguard sensitive data, and help you determine which one will best meet your needs.

Table of Contents

What is a Payment Gateway?

To put it simply, a payment gateway is like a middleman that securely transfers your customer’s payment information to the bank for processing. Whether your customer is paying with a credit card, debit card, or mobile payment, the payment gateway makes sure the transaction happens smoothly and securely.

In the mid-1990s, payment gateways first emerged alongside the rise of online shopping. Pioneer e-commerce websites like Amazon started to grow gradually and there was a need for secure systems to handle payments. Early payment gateways allowed businesses to process credit card payments over the Internet for the first time.

Over the years, these systems have evolved, incorporating stronger encryption, fraud detection tools, and faster processing times. Today, they handle billions of transactions globally, supporting a variety of payment methods beyond just credit cards, including digital wallets and mobile payments.

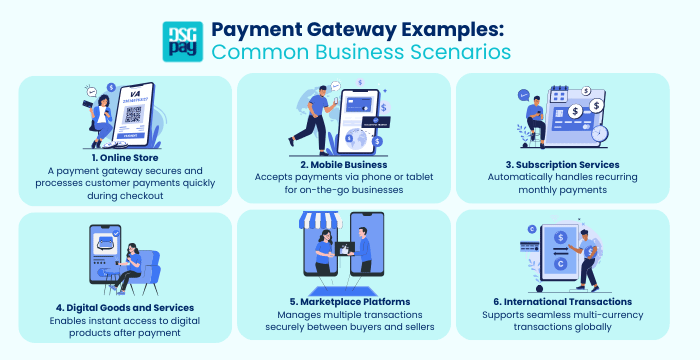

Payment Gateway Examples: Common Business Scenarios

Payment gateways are versatile tools used across various industries to streamline and secure transactions. From online stores to mobile businesses, payment gateways ensure that customers can easily and safely make payments, no matter the method. Here are some examples of how payment gateways are used in different business scenarios:

1. Online Store

If you run an online clothing shop, a payment gateway allows your customers to enter their payment details during checkout. It verifies their information and processes the payment quickly, making the buying process easy and secure.

2. Mobile Business

If you have a food truck or run a service-based business on the go, mobile payment gateways let you accept payments anywhere using your phone or tablet. These gateways allow for flexible, quick transactions, so you can cater to customers on the move.

3. Subscription Services

For businesses offering subscription services, such as streaming platforms or monthly product boxes, a payment gateway automatically handles recurring payments. It ensures your customers are billed every month without needing to re-enter their information, providing convenience for both parties.

4. Digital Goods and Services

If your business deals in digital goods like software, music, or online courses, a payment gateway facilitates instant access to these products after the payment is confirmed. Customers can receive their digital purchases right away, making the process frictionless.

5. Marketplace Platforms

For online marketplaces that connect buyers and sellers (such as eBay or Etsy), a payment gateway is crucial to securely handle multiple transactions between different parties. It ensures each transaction is processed separately, and the funds are correctly routed to the appropriate sellers.

6. International Transactions

If your business caters to customers from around the world, a payment gateway with multi-currency support enables smooth international transactions. It automatically converts payments into the correct currency, providing a hassle-free experience for both you and your customers.

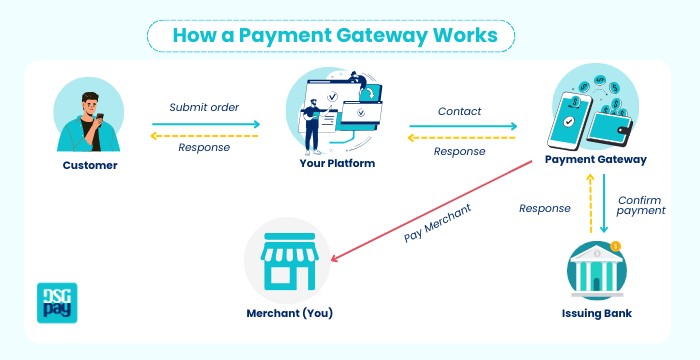

How Do Payment Gateways Work?

A payment gateway acts as the secure middleman between your business and the bank, ensuring sensitive payment information is safely transferred. Here’s a more detailed breakdown of how it works:

1. Customer Submits Order

The customer initiates a transaction by entering their payment details (credit card, debit card, or another payment method) on the platform, whether it’s an online store, app, or in-store system.

2. Platform Contacts Payment Gateway

Once the transaction is submitted, the platform (eCommerce site, app, or POS system) sends the payment details to the payment gateway. The gateway securely encrypts the customer’s data to ensure it remains protected during the transaction process.

3. Payment Gateway Contacts Issuing Bank

The payment gateway forwards the transaction request to the issuing bank (the customer’s bank). The issuing bank verifies whether the customer has sufficient funds or credit and checks for any potential fraud.

4. Bank Confirms Payment

If the transaction is approved, the issuing bank sends a confirmation message back to the payment gateway. The bank may also decline the transaction if there are insufficient funds or any fraud is detected.

5. Payment Gateway Sends Response

The payment gateway receives the confirmation from the bank and relays this information back to the platform, indicating whether the payment was successful or declined.

6. Merchant Receives Payment

If the payment is approved, the funds are transferred from the issuing bank to the merchant’s account. At this point, the merchant can confirm the order and proceed with fulfilment.

Difference Between Payment Gateway and Payment Processor

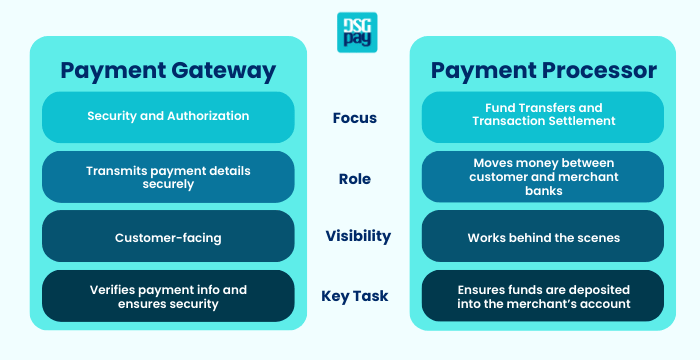

Although payment gateways and payment processors often work hand in hand, they serve distinct roles in the payment ecosystem. Both are essential for completing a transaction, but they manage different parts of the payment process.

Payment Gateway

The payment gateway is responsible for capturing and authorizing the payment. It collects the customer’s payment details, such as credit card or digital wallet information, and verifies whether the transaction can proceed. Think of the gateway as the security checkpoint—it checks the payment credentials, encrypts the data, and communicates with the customer’s bank to confirm the payment is valid.

Payment Processor

The payment processor, however, is in charge of the actual movement of funds. Once the payment is authorized by the gateway, the processor steps in to complete the transaction. It ensures that the money is transferred from the customer’s bank account to the merchant’s account. The processor communicates with both banks to ensure the funds are deposited where they need to be.

Best 7 International Payment Gateways

How Much Does a Payment Gateway Cost?

When evaluating the cost of a payment gateway, pricing can vary depending on the provider and the services offered. Most gateways charge a percentage of each transaction along with a flat fee.

For example, transaction fees typically range from 2.5% to 3.5% per transaction, with additional fees of around $0.30 to $0.50 per charge. Some providers, like PayPal or Stripe, may offer more competitive rates for higher transaction volumes or specific payment methods, while others, like Payoneer, offer free transfers between their accounts but charge additional fees for non-Payoneer credit card payments.

There may also be additional fees for certain services, like cross-border payments or using Buy Now Pay Later (BNPL) options. Generally, it’s important to consider both the transaction fee percentage and any fixed fees when choosing the right payment gateway for your business.

How to Choose a Payment Gateway?

Choosing the right payment gateway for your business is a crucial decision that can impact your bottom line, customer satisfaction, and overall security. With a variety of payment gateway providers offering different features, it’s important to evaluate key factors to ensure the gateway fits your specific business needs. Whether you need an online payment gateway or a secure payment gateway for in-person transactions, these considerations will help you make an informed decision.

1. Cost and Pricing Structure

When choosing a payment gateway, start by evaluating the pricing structure. Look at transaction fees, setup costs, and any additional charges for features like international payments or high-volume transactions. Make sure the cost aligns with your business needs and expected transaction volumes.

2. Compatibility with Your Business Model

It’s essential to choose a gateway that works well with your business model. Whether you run an eCommerce store, a mobile business, or a global operation, the gateway should support the payment methods and platforms you need, such as credit cards, mobile wallets, or multi-currency transactions.

3. Security Features

Security is a top priority when selecting a payment gateway. Ensure the gateway offers features like encryption, fraud detection, and is PCI-compliant to protect your business and customer data from potential threats.

4. Customer Experience

A seamless, easy-to-use checkout process is key to reducing cart abandonment. Look for a gateway that provides a smooth customer experience, with quick transaction times and a user-friendly interface to ensure customers can complete their payments without frustration.

Choose the Payment Gateway That’s Right for You

It all comes down to your business needs! By evaluating factors like cost, security features, and compatibility with your business model, you can confidently select the payment gateway that best supports your operations. Whether you’re managing an online store, a mobile business, or international transactions, the right payment gateway will streamline payments, enhance customer experience, and keep your transactions secure.

If you’re looking for a solution that combines reliability, security, and flexibility, consider DSGPay. Our payment platform offers seamless integration for both small and large businesses, with multi-currency support, competitive transaction fees, and robust security features. Whether you’re accepting payments locally or handling cross-border transactions, DSGPay ensures that your payments are processed quickly and securely, so you can focus on growing your business.

Take the time to assess your options, and you’ll be well on your way to improving efficiency and driving business growth. With DSGPay, you get a payment gateway that not only meets your business needs but also positions you for success in today’s competitive market. The decision you make today can have a lasting impact on your business’s success.