Recent studies have shown that there has been a rise in the adoption of virtual accounts, particularly among eCommerce and online businesses.

If you’re new to this field, and you find yourself wondering, ‘What is a virtual account?’ well, read till the end and find out.

This article will explore everything you need to know about a virtual account, its features, benefits, and how it differs from the traditional banking system. As a tip, we’ll also throw in how to set up a virtual business account for your business.

Ready to explore this exhilarating dimension? Let’s dive right into it!

Table of Contents

Key Takeaways on ‘What is a Virtual Account?’

- Virtual accounts are digital sub-accounts that help businesses and individuals manage payments without opening multiple bank accounts.

- They simplify financial management by organizing transactions, tracking payments in real-time, and automating reconciliation.

- Virtual accounts allow businesses to receive and manage funds efficiently, especially for organizing multiple income streams and tracking payments from various sources.

- They support multi-currency transactions, making them useful for cross-border payments and reducing currency conversion fees.

- Compared to traditional bank accounts, virtual accounts offer lower costs, better scalability, and enhanced security by reducing the exposure of banking details.

What is a Virtual Account?

A virtual account is a digital payment solution that allows customers to complete transactions without relying on bank services. In other words, a virtual account is a unique identifier for each customer used to make payments, send items, or fulfil a purchase desire.

Unlike normal bank accounts, a virtual account includes unique and temporary digits that are used solely for that transaction. Sometimes, they are only valid for a limited time – 30 mins (more or less).

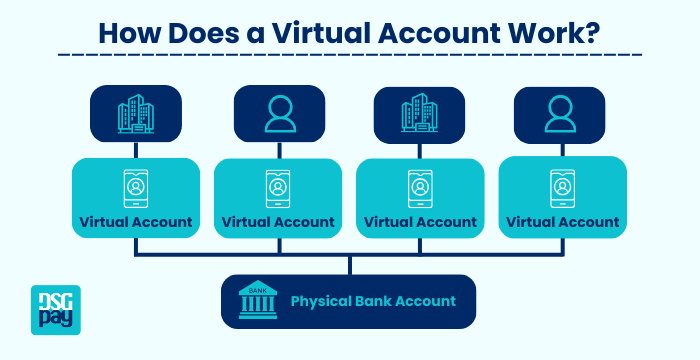

How Does a Virtual Account Work?

Virtual accounts are digital sub-accounts linked to a main bank account, allowing both businesses and individuals to manage payments, track transactions, and organize finances more efficiently. Each virtual account has a unique identifier, making it easier to separate income streams and allocate funds without the need for multiple physical bank accounts.

While businesses often use virtual accounts for payment collection and reconciliation, anyone who earns money online or handles multiple income sources can benefit from them. Virtual accounts provide a way to receive payments from different platforms, manage revenue streams in multiple currencies, and send funds with greater flexibility and control. Here are some common use cases

Common Use Cases for Virtual Accounts

1. App Developers & Software Creators

Developers who earn money from app stores (Google Play, Apple App Store) or software subscriptions can use virtual accounts to receive payouts in different currencies and manage income separately from personal finances.

2. Freelancers & Remote Workers

Freelancers working with global clients or through platforms like Upwork and Fiverr can open virtual accounts to receive payments in different currencies, reducing conversion fees and simplifying fund transfers.

3. Affiliate Marketers

Those earning commissions from affiliate programs (such as Amazon Associates, ClickBank, or ShareASale) can use virtual accounts to collect payouts in various currencies and transfer funds efficiently.

4. E-commerce Sellers

Online sellers on platforms like Amazon, Etsy, Shopify, and eBay can receive payments directly into virtual accounts, making it easier to separate business revenue, pay suppliers, and manage international transactions.

5. Subscription-Based Content Creators

Creators on platforms like Patreon, Substack, or YouTube Memberships can use virtual accounts to keep earnings organized, withdraw funds efficiently, and track income from multiple sources.

6. International Business Payments

Companies working with global suppliers, contractors, or remote teams can use virtual accounts to send and receive cross-border payments without the hassle of multiple traditional bank accounts.

7. Digital Wallet & Crypto Integrations

Some virtual account providers integrate with digital wallets and crypto exchanges, allowing users to receive payouts, withdraw funds, or manage fiat-to-crypto transactions more seamlessly.

Virtual accounts provide a flexible, efficient, and cost-effective way to handle money for both individuals and businesses, making them a valuable tool for the modern digital economy.

Differences Between Virtual Accounts and Traditional Payment Systems

There’s a huge difference between virtual accounts and normal bank accounts, typically used for traditional payment methods.

The normal accounts are the usual bank details used to complete a transaction.

For better analysis, let’s give a detailed breakdown of the differences between virtual and traditional payment methods.

| Features | Virtual Account Method | Traditional Payment Method |

| Account Structure | The system operates under a single master account. | It may require separate accounts for different locations. |

| Transaction Tracking | The system provides real-time tracking with unique markers or identifiers. | Limited tracking, often requires manual reconciliation. |

| Setup and Maintenance | It is quick to set up and requires minimal paperwork. | It has a lengthy setup process with extensive documentation. |

| Cost Efficiency | Lower maintenance fees and reduced banking costs. | There are higher fees for account maintenance and transactions. |

| Scalability | It is easily scalable for business growth. | It requires opening new or upgrading accounts for expansion. |

| Security | Reduces exposure of primary banking details in transactions. | The system is more vulnerable due to the account details shared across transactions. |

Although the traditional payment method is a familiar route to many people, the virtual account method makes payment tracking easier, reduces paperwork, and enhances cash flow management.

Virtual Accounts in Financial Management

You might be wondering, ‘What is a virtual account when it comes to financial management?‘

If you run an eCommerce store or have a website platform for your business, it’s easier and more efficient to use the virtual account method. This will allow your business to obtain greater accountability and oversight over its financial operations.

Additionally, they are commonly used for virtual payments, supplier transactions, and payroll processing, which simplifies balance and reporting. With this tool, you’ll also eliminate the need for traditional banking services.

Key Features of Virtual Accounts

• Unique Account Markers/Identifiers

This is a combination of specific numeric digits, referred to as the unique customer ID. These generated digits are unique to the customer for that specific transaction, and can not be used by another person. Although varies, it’s typically between 10 – 16 digits in numbers.

• Tracking of Real-Time Payments

Virtual accounts use real-time payment features to monitor and assess the transaction status of every purchase. It’s quick and easy to manage, thereby eliminating the delays typically derived from the traditional payment method.

• Seamless Payment System Integration

Virtual accounts were built to sync with payment gateways, account software, ERP systems, and other automated financial processes. This leads to easier and more efficient payment processing.

• Supports Multiple Currencies

In usual cases, virtual accounts support multiple currency transactions. In essence, you don’t need to open another account for international transactions. Particularly on DSGPay, they manage named virtual accounts for multiple countries. This makes them an ideal choice for businesses with global influence.

• Cheaper or Reduced Banking Costs

Virtual accounts equally eliminate the need to own and manage multiple bank accounts, since the virtual account can be linked to one primary account. On DSGPay, your virtual account can be designed to carry your business name, thereby increasing trust and credibility in your business.

• Automated and Recurring Transactions

You can design your virtual account to automatically sync payment invoices and schedule payments with payslips. This will reduce the manual workload and administrative errors.

What Benefits Does Virtual Account Bring to Your Business?

If you’re still unsure about opting for a virtual account, check out some of the benefits this modern strategy can bring to your business.

• Simplified Financial Management

Once you integrate a virtual account into your business, you’re automatically opting for simple and efficient financial management. This method allows businesses to manage multiple transactions under a single primary account, thereby promoting growth and control.

• Enhanced Cash Flow Control

With a virtual account, you’ll gain better control over your business inflows. Additionally, you can track payment transactions in real-time, make better financial decisions, and allocate resources effectively.

• Improved Payment Bookkeeping

One of the jobs of a bookkeeper is to match payment invoices and receipts to their transactions. However, using a virtual account can make this job easier and reduce any chances of errors in the financial records.

• Greater Scalability

Virtual accounts can be created and assigned as needed, allowing businesses to scale their financial operations without opening multiple physical bank accounts.

• Cost Savings

By reducing the need for multiple bank accounts, you can cut down expenses on maintenance and administrative fees.

Concluding Thought on “What is a Virtual Account?”

If you’re still puzzled by the question – ‘What is a virtual account?’ Here is a quick recap to refresh your memory.

In this article, we explained that virtual accounts are smart and efficient means to streamline payment processing with real-time transaction tracking, simplified cash flow control, and cost savings strategies.

Unlike traditional bank accounts, virtual accounts allow companies to organize payments efficiently without maintaining multiple physical accounts.

By adopting virtual accounts, businesses can automate reconciliation, enhance security, and scale financial operations with ease.

If you’re looking for a reliable virtual account provider, DSGPay offers a seamless and feature-rich solution to meet your business needs.

DSGPay Provides Virtual Accounts for Businesses and Freelancers

If you’re looking for a reputable virtual account provider, DSGPay’s virtual account feature is an excellent choice. It caters to businesses of all sizes, kinds, and forms.

They empower businesses to manage and process payments effectively without the need to open a bank account for every location. In other words, they simplify cross-border transactions and financial management for businesses in multiple countries.

They have numerous types of virtual accounts including:

- Named Virtual Accounts: This account type is designed in the name of the account holder or merchant. For example, if your business name is – TYWELL Enterprises, you can open a virtual account on DSGPay with your business name. This virtual account can be shared and used to complete payment transactions in a regional presence without the need to open local bank accounts.

- Dynamic Virtual Accounts: Ideal for large businesses, this account type allows users to create and manage a virtual account based on business needs. It includes several features such as real-time payment tracking, flexible payment solutions, customer groups, and more.

- Static Virtual Accounts: This account is recommendable for subscription and utility-based businesses with static account details for continuous business operations. In other words, businesses that use a regular business account for their services, and in most cases, unchanged for a very long time.

How to Set Up a Virtual Account with DSGPay

Setting up a Virtual Account with DSGPay is simple and allows freelancers and businesses to receive USD payments without needing a U.S. bank account. Follow these steps to get started:

- Sign Up for DSGPay: Create an account on DSGPay’s platform and complete the verification process. This ensures secure and compliant transactions.

- Access Your Virtual Account Details: Once approved, log into your DSGPay dashboard to view your Virtual Account information, including:

- Account Holder Name

- ACH Routing Number

- Wire Routing Number

- Account Number

- Bank Name

- Enter Your Virtual Account Details in Your Payment Platform: If you receive payments from platforms like Upwork, go to the payment settings and choose “Direct to U.S. Bank (ACH)” as your withdrawal method. Enter your DSGPay Virtual Account details just as you would a traditional U.S. bank account.

- Receive Your Payments: Once your platform processes the payment, funds will be deposited into your DSGPay account within 2–3 business days.

- Manage Your Earnings: You can now:

- Hold USD in your account and withdraw when exchange rates are favourable.

- Convert USD to your local currency (PHP, EUR, GBP, etc.) and transfer it to your bank at lower fees than PayPal or wire transfers.

- Use DSGPay’s multi-currency options to send money internationally or pay suppliers.

By choosing DSGPay, your business has access to over 30 countries including the USA, UK, Australia, South Africa, and numerous Asian countries. Their named virtual account feature is a powerful financial tool that simplifies transactions and enhances overall efficiency.

Looking for the best out of all? Get in line now and be a part of the journey to financial success.