Payment Service Providers (PSPs) have emerged as a critical element in the payment ecosystem in the ever-evolving digital landscape, powering seamless financial transactions for businesses globally. As the conduits that facilitate electronic transactions between merchants and customers, they enhance digital commerce’s speed, convenience, and security. This beginner’s guide aims to provide insights into Payment Service Providers, elucidating their significance, functionalities, and how they can boost your business’s growth.

What Are Payment Service Providers?

A PSP offers businesses many services critical for accepting electronic payments. These include payment processing for various channels like online, mobile, and point-of-sale systems. But a PSP’s role doesn’t end there. They offer integrations with other financial systems, ensuring transactions are conducted securely by employing fraud prevention measures and adhering to data security standards.

6 Benefits of a Payment Service Provider

Integrating a PSP into your business operations can unlock a host of advantages. As an essential element of the contemporary payment ecosystem, Payment Service Providers streamline your transaction processes and enhance customer satisfaction while providing a secure and scalable solution for businesses of all sizes.

Types of Payment Service Providers

The landscape of payment service providers is diverse, presenting a range of options, each equipped with unique features tailored to various business requirements.

1. Traditional Merchant Account Providers

These payment service providers create individual merchant accounts for businesses, bestowing greater control over their transactions. This tailored approach suits enterprises seeking a personalised touch in their payment processes.

2. Aggregators

This type of payment service provider bundles multiple businesses into a shared merchant account, simplifying the setup process significantly. For companies seeking rapid onboarding and ease of use, aggregators are an excellent choice.

3. Payment Gateways

Acting as the bridge between eCommerce platforms and traditional merchant accounts, payment gateways enable online transactions seamlessly. They are essential for businesses with an online presence looking to provide secure and reliable online payment options to their customers.

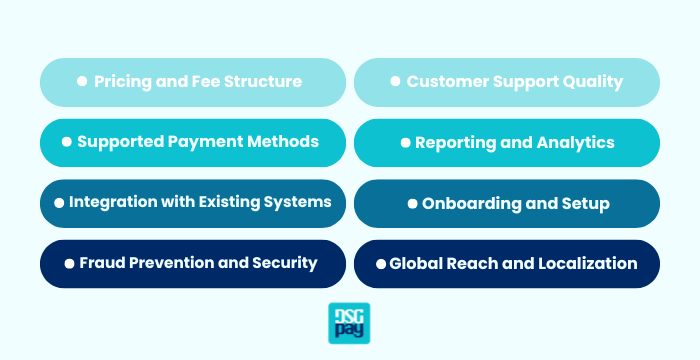

What to Look for When Selecting a Payment Service Provider

Choosing the right payment service provider (PSP) involves a thorough assessment of several critical factors to ensure it aligns with your business needs and customer expectations. Here’s a breakdown of key considerations:

- Pricing and Fee Structure: Look for transparency in pricing models. Understand any potential hidden fees, monthly fees, transaction fees, or setup costs, and consider how they impact your overall budget.

- Supported Payment Methods: Ensure the PSP supports a wide range of payment options (credit cards, digital wallets, etc.) to cater to customer preferences. Additionally, consider if the provider supports local payment options in your target markets.

- Integration with Existing Systems: Choose a PSP that integrates seamlessly with your current e-commerce platform or software. Some providers offer APIs or plugins for a smoother setup, reducing technical overhead.

- Fraud Prevention and Security: Confirm that the PSP has strong security measures, such as PCI DSS compliance, 3D Secure, and fraud prevention tools. These protect your business from fraudulent activities and reassure customers of secure transactions.

- Customer Support Quality: Reliable and accessible customer support is crucial for resolving issues quickly. Verify the support channels available (phone, email, live chat) and whether you’ll have access to a dedicated account manager.

- Reporting and Analytics: Effective reporting tools allow you to monitor transaction data and approval rates. Comprehensive analytics can help you optimize payments and troubleshoot failures.

- Onboarding and Setup: Consider the onboarding process, including documentation, timelines, and training support. A streamlined setup process can get your payment systems running with minimal delay.

- Global Reach and Localization: If your business operates internationally, look for payment service providers with high approval rates across different regions and those that support local currencies, which can increase customer conversions globally.

DSGPay: Your Reliable Payment Service Provider

DSGPay stands as a beacon of trust and efficiency in the dynamic world of digital payments, enabling businesses to streamline their transaction processes. As an established PSP, we offer a range of tailored solutions designed to facilitate and secure digital transactions, enhancing your customer’s buying experience.

DSGPay is a dependable partner that prioritises your business’s growth and success. As we navigate the future of digital payments together, our goal remains to offer solutions that improve your bottom line.

Conclusion

As we’ve explored, understanding the world of payment service providers is fundamental for any business looking to enhance Its digital payment processes. The right payment service provider simplifies and secures transactions and contributes significantly to your business growth by providing a superior customer experience. Therefore, selecting a PSP should be based on your business needs and the value they can deliver.

At DSGPay, we pride ourselves on being a trusted PSP that businesses can rely on. If you’re interested in exploring how a PSP can revolutionise your business operations or have any queries, our team at DSGPay is here to help. Reach out to us today and leverage our expertise to navigate your journey in digital payments.